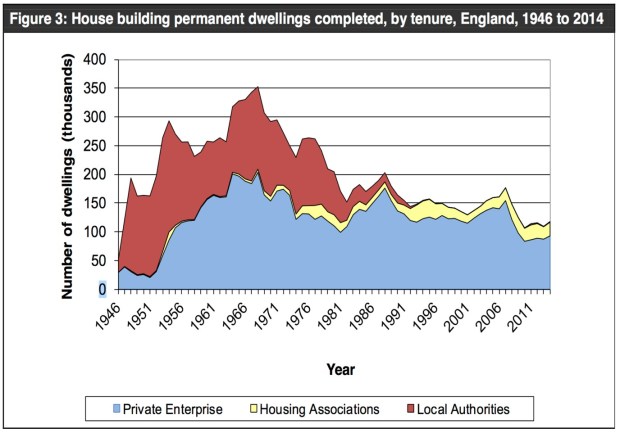

The ‘Right to Buy’ scheme was a policy introduced by Maggie Thatcher in 1980 which gave secure council tenants the legal right to buy the Council home they were living in with huge discounts. The heyday of Council ‘Right To Buys’ was in the 80’s and 90’s, when 1,719,368 homes in the country were sold in this manner between October 1980 and April 1998. However, in 1997, Tony Blair reduced the discount available to Tenants of council houses and the numbers of properties being bought under the Right to Buy declined.

So what does this mean for Locks Heath homeowners and Landlords? Well quite a lot actually!

Looking at the figures for our local authority, whilst the number of ‘Right to Buys’ have dwindled over the last few years to an average of only 29 ‘Right to Buy’ sales per year, one must look further back in time. Looking at the overall figures, 2,049 Council properties were bought by council Tenants in the Fareham Borough Council area between 1980 and 1998. Big numbers by any measure and even more important to the whole Locks Heath property market (i.e. every Locks Heath homeowner, Locks Heath Landlord and even Locks Heath aspiring first time buyers) when you consider these 2,049 properties make up a colossal 14.8% of all the privately owned properties in our area (because in the local authority area, there are only 13,808 privately owned properties).

Locks Heath first time buyers and Landlords can now buy these ex-council properties second hand (or the PC brigade like to call them ‘pre-loved ex–local authority dwellings’) as those original 80’s and 90’s Tenants (now homeowners) have more than passed the time of any claw back of the discount they received (council discount was repayable if the first owner sold within a stipulated time period – usually 5 years).

Now let us all be honest, some (not all), but some ex-council properties lack the vital KSA (Kerb-Side-Appeal) that some Landlords crave. The new homes builders know all about KSA as they dress up the exteriors of their new homes to make them more appealing to buyers.

Yes, the modern stuff being built in Locks Heath is lovely, but too many Landlords purchase buy to let property solely based on where they would choose to live themselves, instead of choosing with a business head and choosing where a tenant would want to live. As I have mentioned in a previous article, a property attractive to you as a purchaser is likely to be attractive to a potential Tenant but you should always remember the first rule of buy to let property – you aren’t going to live in the property yourself. What an ex-council property lacks in terms of KSA, they more than make up for in other ways. Tenants more worried about how close the property is to a particular school or family members for child care matter to them far more than the look of a property.

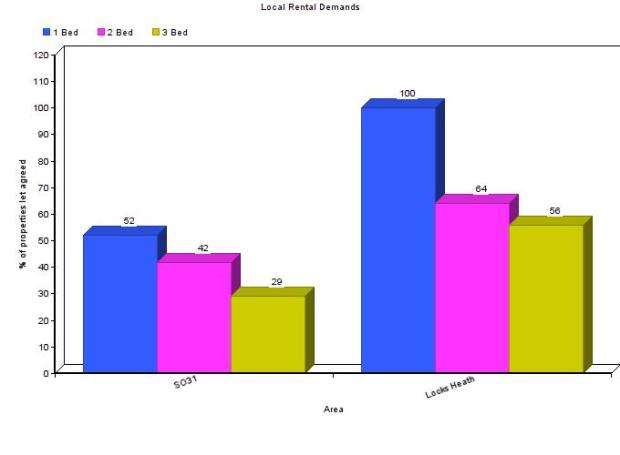

Whilst ex-council properties tend to increase in value at a slower rate than more modern properties, that is more than made up for in the much higher yields – and those built between the wars or just after are really well built. Tenant demand for such properties is good since Locks Heath property values are so expensive. A lot of people can’t get mortgages to buy, so they will settle on renting, meaning there is a good demand for that sort of property to rent. Also, the very fact the council were forced to sell these Locks Heath properties in the 80’s and 90’s, means that today’s younger generation who would have normally got a council house to live in themselves, now can’t as many were sold ten or twenty years ago.

So to Locks Heath Landlords I say this… don’t dismiss ex-council houses and apartments – but remember the first rule of buy to let (see above). However, those very same Locks Heath Landlords should go in with their eyes open and take lots of advice. Not all ex-council properties are the same and even though they have good demand and high yields, they can also give you other headaches and issues when it comes to the running of the rental property. One source of advice is the Locks Heath Property Blog http://www.thelocksheathpropertyblog.co.uk

… That just leaves the 1,186 council houses still owned by the local authority to be sold to their tenants in the coming years!

My parents bought their first house in the late 1970’s, they were in their late 20’s. Interestingly, looking at some research by the Post Office from a few years ago, in the 1960’s the average age people bought their first house was 23. By the early 1970s, it had reached 27, rising to 28 in the early 1980’s.

My parents bought their first house in the late 1970’s, they were in their late 20’s. Interestingly, looking at some research by the Post Office from a few years ago, in the 1960’s the average age people bought their first house was 23. By the early 1970s, it had reached 27, rising to 28 in the early 1980’s.