I had an interesting question the other day from a homeowner in Park Gate who asked me the difference between asking prices and values and why it mattered. When it comes to selling property, there must be agreement between the purchaser (buyer) and seller (vendor) for a property sale to take place. The value a buyer applies to a property can massively differ from the value a seller or mortgage company places upon it. The seller, the buyer and the mortgage company must find an agreeable value to assign to a property so the sale can proceed.

I had an interesting question the other day from a homeowner in Park Gate who asked me the difference between asking prices and values and why it mattered. When it comes to selling property, there must be agreement between the purchaser (buyer) and seller (vendor) for a property sale to take place. The value a buyer applies to a property can massively differ from the value a seller or mortgage company places upon it. The seller, the buyer and the mortgage company must find an agreeable value to assign to a property so the sale can proceed.

In many of my articles about the Locks Heath property market, I talk about values, i.e. what property in Locks Heath actually sells for, but I haven’t spoken about asking prices for a while. Now asking prices are important as they are one of the four key matters a potential buyer will judge your property on (the others being location, bedrooms and type). Price yourself too high and you will put off buyers. So let’s take a look at the Locks Heath numbers.

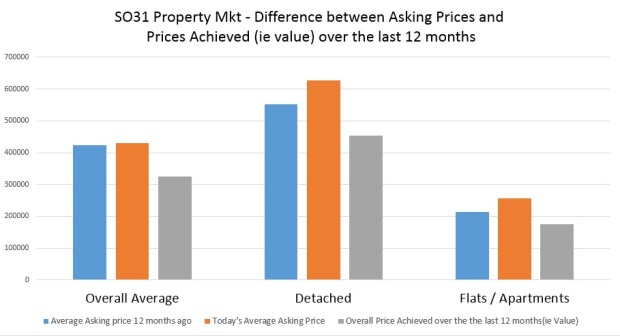

Over the last 12 months asking prices (i.e. the price advertised in the paper and on Rightmove) in the SO31 area have increased by 19%, taking the average asking price in Locks Heath to £429,000 (up from £423,000 twelve months ago).

Interestingly though, when we look at, say detached property and flat/apartments, a slightly different picture appears. Twelve months ago, the average asking price for a detached house in the Locks Heath area was £551,400 and today its £626,100 (a rise of 14%); whilst over the same 12-month period, the average asking price of a flat/apartment was £213,500 a year ago, and today its £257,600 (a rise of 21%).

However, my research shows that the supply of property for sale in Locks Heath is beginning to increase. In December 2015, there were 255 on the market in Locks Heath today there are 276 properties on the market (up 8%). This will mean homeowners looking to sell will need to be conscious of how their property compares against others on the Locks Heath property market. The Locks Heath property market still has substantial momentum and sufficient demand remains to provoke more modest asking price rises. This noteworthy increase in supply since Christmas is currently providing more choice for buyers and is tempering asking price rises – and here is the devil in the detail – only 1% of the overall 19% annual figure (mentioned in para 3) has appeared since December.

… And here is the second point to make. Asking prices are one thing, but what a property sells for (i.e. value) is a completely different matter. These are the average prices achieved (i.e. what they sold for or the average value) for property in Locks Heath over the last 12 months…

- Overall Average £325,700

- Detached £453,300

- Flat/Apartment £175,900

You can quite clearly see, there is a difference between what people are asking for property and what it is selling for. The underlying fundamentals of low interest mortgages and tight supply remain prevalent in the Locks Heath property market however, the number one lesson has to be this … if you want to sell, be realistic with your pricing.

For more articles like this please visit the Locks Heath Property Blog www.thelocksheathpropertyblog.co.uk.

With Locks Heath youngsters not able to buy their own property, my research would suggest the progressively important role the private rented sector has been playing in housing people in need of a roof over their head. Especially at a time of increasing affordability problems for first time buyers and growing difficulties faced by social housing providers (local authorities and housing associations) in their ability to secure funding from Westminster and then compete against the likes of the Taylor Wimpey’s and Miller’s of this world to buy highly priced building land.

With Locks Heath youngsters not able to buy their own property, my research would suggest the progressively important role the private rented sector has been playing in housing people in need of a roof over their head. Especially at a time of increasing affordability problems for first time buyers and growing difficulties faced by social housing providers (local authorities and housing associations) in their ability to secure funding from Westminster and then compete against the likes of the Taylor Wimpey’s and Miller’s of this world to buy highly priced building land.

With the Referendum on EU membership on the horizon our households now also have something European to concentrate on that doesn’t involve party political broadcasts or politician’s treating us all like children – the Euro 2016 Football Tournament. Locks Heath is home to all different backgrounds and nationalities so if you’re not lucky enough to be jetting off to France for the UEFA Euro 2016 football tournament, have no fear! For a bit of fun I have taken a look at which European people live in Locks Heath so you know who to soak up the best atmosphere with!

With the Referendum on EU membership on the horizon our households now also have something European to concentrate on that doesn’t involve party political broadcasts or politician’s treating us all like children – the Euro 2016 Football Tournament. Locks Heath is home to all different backgrounds and nationalities so if you’re not lucky enough to be jetting off to France for the UEFA Euro 2016 football tournament, have no fear! For a bit of fun I have taken a look at which European people live in Locks Heath so you know who to soak up the best atmosphere with! As my readers will know I normally only post properties that I feel have good buy-to-let potential that are on the market with other agents. This week, however, Brook Estate Agents have taken on a property with such good potential I knew I had to share it with you all.

As my readers will know I normally only post properties that I feel have good buy-to-let potential that are on the market with other agents. This week, however, Brook Estate Agents have taken on a property with such good potential I knew I had to share it with you all.

In this post credit crunch world of sub terrain low interest and annuity rates so low a limbo dancer would smart, the growth of buy to let since 2009 has been phenomenal. So much so, there has been an evolution in purchase of property in the UK from that of just buying the roof over one’s head to that of a buy to let investment where it is seen as a standalone financial asset to fund current and future (ie pensions) investment. So recently, a few days before the release of latest Land Registry data of property transactions, quite a few market commentators were anticipating a huge increase in the number of properties sold in January as the 1st of April 2016 stamp duty deadline got closer.

In this post credit crunch world of sub terrain low interest and annuity rates so low a limbo dancer would smart, the growth of buy to let since 2009 has been phenomenal. So much so, there has been an evolution in purchase of property in the UK from that of just buying the roof over one’s head to that of a buy to let investment where it is seen as a standalone financial asset to fund current and future (ie pensions) investment. So recently, a few days before the release of latest Land Registry data of property transactions, quite a few market commentators were anticipating a huge increase in the number of properties sold in January as the 1st of April 2016 stamp duty deadline got closer.