I was having an interesting chat with a Locks Heath buy to let Landlord the other day when the subject of size of households came up in conversation. For those of you who read my Brexit article published on the morning after the referendum, one of the reasons on why I thought the Locks Heath property market would, in the medium to long term, be OK, was the fact that the size of households in the 21st Century was getting smaller – which would create demand for Locks Heath Property and therefore keep property prices from dropping.

I was having an interesting chat with a Locks Heath buy to let Landlord the other day when the subject of size of households came up in conversation. For those of you who read my Brexit article published on the morning after the referendum, one of the reasons on why I thought the Locks Heath property market would, in the medium to long term, be OK, was the fact that the size of households in the 21st Century was getting smaller – which would create demand for Locks Heath Property and therefore keep property prices from dropping.

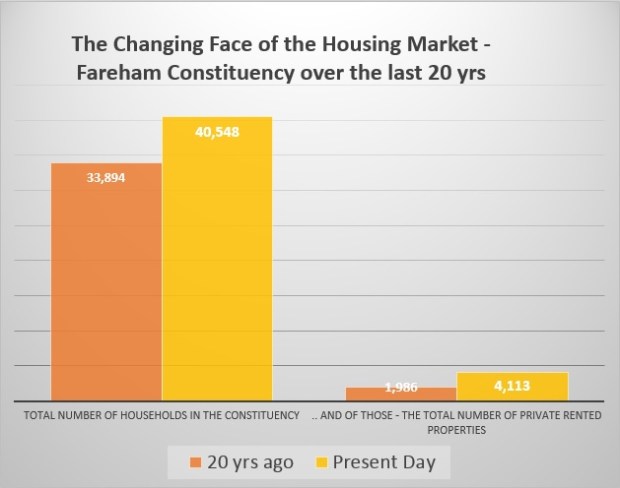

Looking at the stats going back to the early 1960’s, when the average number of people in a home was exactly 3, it has steadily over the years dropped by a fifth to today’s figure of 2.4 people per household. Doesn’t sound a lot, but if the population remained at the same level for the next 50 years and the we had the same 20% drop in household size, the UK would need to build an additional 5.28 million properties ( or 105,769 per year). When you consider the Country is only building 139,800 properties a year it doesn’t leave much for people living longer and immigration. Looking closer to home…

In the Fareham Borough Council area, the average number of occupants per household is 2.4 people

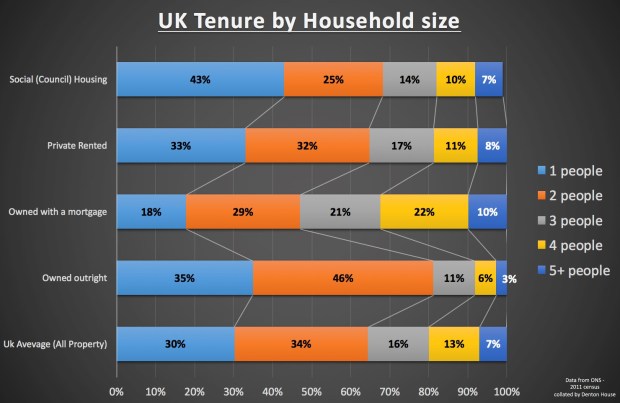

When we look at the current picture nationally and split it down into tenure types (i.e. owned, council houses and private renting, a fascinating picture appears.

The vast majority of homeowners who don’t have a mortgage are occupied by one or two people (81% in fact), although this can be explained as residents being older, with some members of the family having moved out, or a pensioner living alone. People living on their own are more likely to live in a Council house (43%) and the largest households (those with 4 or more people living in them are homeowners with a mortgage – but again, that can be explained as homeowners with families tend to need a mortgage to buy. What surprised me was the even spread of private rented households and how that sector of population are so evenly spread across the occupant range – in fact that sector is the closest to the national average, even though they only represent a sixth of the population.

When we look at the Fareham Borough Council figures for all tenures (Owned, Council and Private Rented) a slightly different picture appears…

| 1 person households in Locks Heath | 2 person households in Locks Heath | 3 person households In Locks Heath | 4 person households in Locks Heath | 5+ person households in Locks Heath |

| 25.36% | 39.33% | 16.02% | 13.97% | 5.32% |

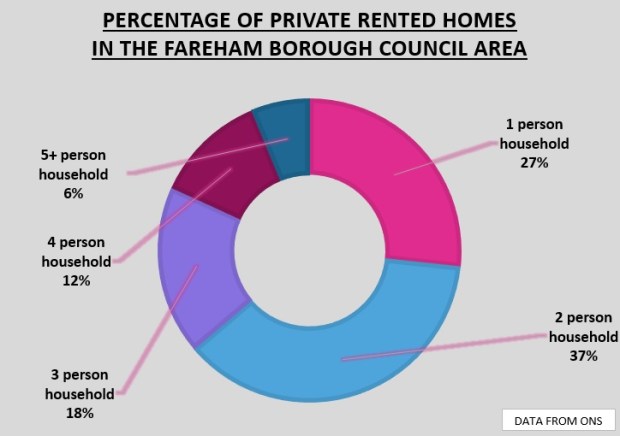

But it gets even more interesting when we focus on just private rental properties in Locks Heath, as it is the rental market in Locks Heath that really fascinates me. When I analysed those Fareham Borough Council private rental household composition figures, a slightly different picture appears. Of the 3,906 Private rental properties in the Fareham Borough Council area:

- 26.6% of Private Rental Properties are 1 person Households

- 36.9% of Private Rental Properties are 2 person Households

- 18% of Private Rental Properties are 3 person Households

- 11.9% of Private Rental Properties are 4 person Households

- 6.2% of Private Rental Properties are 5+ person Households

As you can see, Locks Heath is not too dissimilar from the national picture but there is story to tell. If you are considering future buy to let purchases in the coming 12 to 18 months, I would seriously consider looking at two and three bedroom houses. Even with the numbers stated, there are simply not enough two and three bedroom houses to meet the demand. They have to be in the right part of Locks Heath and priced realistically, but they will always let and when you need to sell, irrespective of market conditions at the time, will always be the target of buyers. To read more articles on the Locks Heath Property Market and where I consider best buy to let deals are in Locks Heath and the rest of the local area, please visit the Locks Heath Property Blog http://www.thelocksheathpropertyblog.co.uk.

Well it’s been four weeks since the Referendum vote and we have had a chance to reflect on the momentous decision that the British public took. Many of you read the article I wrote on the morning of the results. I had gone to bed the night before with a draft of my Remain article nicely all but finished, to be presented, first thing in the morning, with the declaration by the BBC saying we were leaving the EU. I don’t think any of us were expecting that.

Well it’s been four weeks since the Referendum vote and we have had a chance to reflect on the momentous decision that the British public took. Many of you read the article I wrote on the morning of the results. I had gone to bed the night before with a draft of my Remain article nicely all but finished, to be presented, first thing in the morning, with the declaration by the BBC saying we were leaving the EU. I don’t think any of us were expecting that.

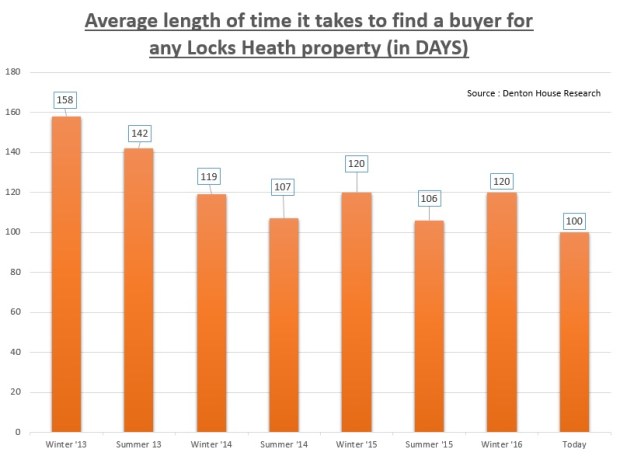

I had a Landlord from Park Gate email me the other day. She said she had been following my blog (the Locks Heath Property Blog) for a while and wanted to pick my brain on when is the best time of the year to sell a property. Trying to calculate the best time to put your Locks Heath property on the market can often seem something akin to witchcraft and, whilst I would agree that there are particular times of the year that can prove more productive than others, there are plenty of factors that need to be taken into consideration.

I had a Landlord from Park Gate email me the other day. She said she had been following my blog (the Locks Heath Property Blog) for a while and wanted to pick my brain on when is the best time of the year to sell a property. Trying to calculate the best time to put your Locks Heath property on the market can often seem something akin to witchcraft and, whilst I would agree that there are particular times of the year that can prove more productive than others, there are plenty of factors that need to be taken into consideration.