Rent increases can be a tricky subject to tackle but it is something I am discussing with increasing regularity with Landlords so this week I thought I would break from my usual articles and share my thoughts with my lovely readers.

Rent increases can be a tricky subject to tackle but it is something I am discussing with increasing regularity with Landlords so this week I thought I would break from my usual articles and share my thoughts with my lovely readers.

So should you rock the boat and increase your Tenant’s rent or not? Let’s have a look at some points to help you make your mind up…

Potential problems

Before you make a decision you should take time to consider whether an increase is really needed. A hasty decision could damage your relationship with your Tenant and in extreme cases could lead to them leaving the property altogether. This can leave you with an empty property and some costs involved with finding a new Tenant.

Why am I thinking about an increase?

Ask yourself why you feel an increase is necessary – Are you increasing it because your costs or mortgage rates have risen or are you doing it out of greed?

From my experience, if you have a good Tenant (i.e. one that pays the rent on time and looks after the property) and treat them fairly, that usually equates to the most profitable experience – even without increasing rent.

Good reasons Vs Bad reasons

Some valid reasons for an increase can be a mortgage rate increase, changes in taxation, changes in market conditions or simply that the property is costing more to maintain.

However if you are increasing the rent out of greed or just because you can then I would recommend leaving it alone.

If you think that your property is worth more rent than you are currently getting then you should speak to a local lettings expert who can advise you on the current market conditions and give you an accurate up-to-date valuation of your property.

Am I able to increase my Tenant’s rent?

Before making any other considerations you need to know if you are actually able to increase your Tenant’s rent.

If you are currently within a fixed term tenancy then you cannot make an increase unless there is a clause in the tenancy agreement that specifically states that the Landlord can review the rent during the fixed term or it is specifically stated that the rent will increase to a set amount after a period of time (ie. After the first six months). Of course any such clause would need to be deemed fair, and too much of a dramatic increase may spur your Tenant to contest the new rent amount at a tribunal.

How do I increase the rent?

Ok, so you’ve finally made up your mind and are looking to increase the rent. Before you take the plunge there are strict procedures to follow. Failure to follow the correct procedure could lead to your request for more rent being invalid.

- Negotiate the rent increase when renewing the Tenant’s contract.

If your tenancy has recently come to an end you may want to renew it on to another fixed term tenancy. If this is the case the easiest way to enforce a new rent can be to agree it as part of the renewal process. Just ensure that the new rent is detailed in the new tenancy agreement.

- Agree an increase mid-tenancy and document it

As I briefly mentioned earlier in this article you can agree a review of the rent or a set increase to take place during a tenancy before the tenancy agreements are signed. Any clause must be fair and detailed within the tenancy agreement. You should also write to the Tenant when the time comes to notify them that you would like to enforce the clause giving adequate notice.

- Serve the Tenant with a Rent Increase Notice

If nothing is done to renew the tenancy agreement after the fixed term ends it will roll on to a Statutory Periodic tenancy. In this instance you should issue your Tenant with a Rent Increase Notice if you wish to increase the rent.

A Section 13(2) Notice of the Housing Act 1988 must be served proposing the new rent and the date at which you would like it to commence. For a monthly, weekly or fortnightly tenancy, you should provide at least one month’s notice to your Tenant of the increase.

What if the Tenant refuses the rent increase?

If the Tenant feels that the rent increase that you are trying to enforce via a Section 13(2) notice is excessive and they do not wish to discuss it with you, they can refer the rent increase to the Tribunal. They must do this before the starting date of the proposed new rent. In this instance they should notify you that they are doing so.

The tribunal will consider the Tenant’s application and decide what the maximum rent for the property should be. In setting a rent, the tribunal must decide what rent the landlord could reasonably expect for the property if it were let on the open market under a new tenancy on the same terms. The tribunal may therefore set a rent that is higher, lower or the same as the proposed new rent.

A note to remember…

If you have a good Tenant paying the rent on time and looking after your property then think before increasing the rent. A good Tenant can be hard to find so if you already have one then take into consideration how much time and money it will cost you to find a new Tenant should they not want to pay your increase.

Keep an eye on the market and comparative rental prices. If you are charging less and the market is buoyant then it may be a good time to bargain with your Tenant. If they can see that an alternative property will cost them more a month and that they will incur more fees and moving costs they will be more inclined to accept your increase.

For more articles on the local property market please visit www.thelocksheathpropertyblog.co.uk.

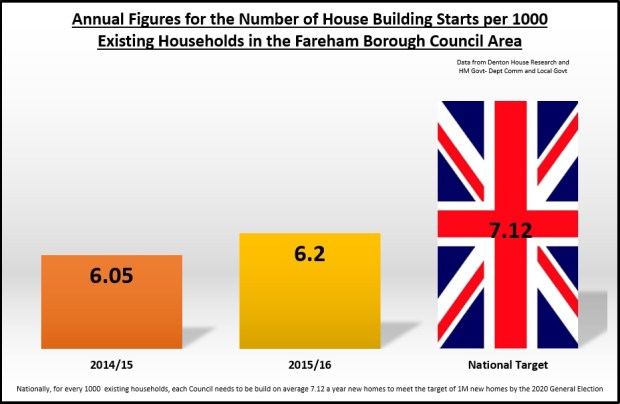

Let me speak frankly, even with Brexit and the fact immigration numbers will now be reduced in the coming years, there is an unending and severe shortage of new housing being built in the Locks Heath area (and the UK as a whole). Even if there are short term confidence trembles fueled by newspapers hungry for bad news, the ever growing population of Locks Heath with its high demand for property versus curtailed supply of properties being built, this imbalance of supply/demand and the possibility of even lower interest rates will underpin the property market.

Let me speak frankly, even with Brexit and the fact immigration numbers will now be reduced in the coming years, there is an unending and severe shortage of new housing being built in the Locks Heath area (and the UK as a whole). Even if there are short term confidence trembles fueled by newspapers hungry for bad news, the ever growing population of Locks Heath with its high demand for property versus curtailed supply of properties being built, this imbalance of supply/demand and the possibility of even lower interest rates will underpin the property market.

Even the most sane person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market. Excluding central London which is another world, most commentators are saying prices will be affected by around 10%. So looking at the commentators’ thoughts in more detail, property values in Locks Heath will be 10% lower than they would have been if we hadn’t voted to leave the EU.

Even the most sane person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market. Excluding central London which is another world, most commentators are saying prices will be affected by around 10%. So looking at the commentators’ thoughts in more detail, property values in Locks Heath will be 10% lower than they would have been if we hadn’t voted to leave the EU. A few weeks ago I was asked a fascinating question by a local Councillor who, after reading the Locks Heath Property Blog, emailed me and asked me –

A few weeks ago I was asked a fascinating question by a local Councillor who, after reading the Locks Heath Property Blog, emailed me and asked me –