I had an interesting chat with a Warsash landlord who owns a few properties in the area this week – He popped his head in to my office whilst he was in Park Gate on some errands. We had never spoken before (because he uses another agent in the suburb to manage his Locks Heath properties) yet, after reading my blog on the Locks Heath Property Market for a while, the landlord wanted to know my thoughts on how the recent interest rate cut would affect the Locks Heath property market. I would also like to share these thoughts with you…

I had an interesting chat with a Warsash landlord who owns a few properties in the area this week – He popped his head in to my office whilst he was in Park Gate on some errands. We had never spoken before (because he uses another agent in the suburb to manage his Locks Heath properties) yet, after reading my blog on the Locks Heath Property Market for a while, the landlord wanted to know my thoughts on how the recent interest rate cut would affect the Locks Heath property market. I would also like to share these thoughts with you…

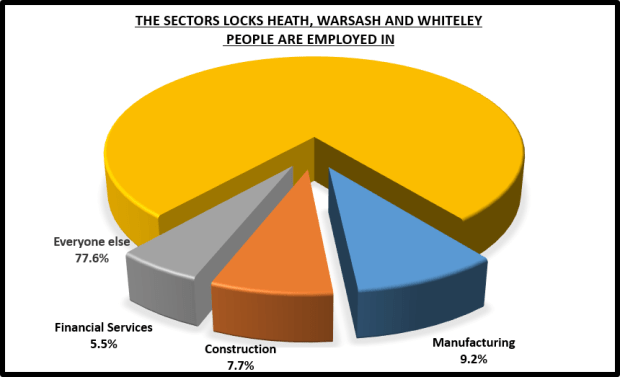

Well it’s been a few weeks now since interest rates were cut to 0.25% by the Bank of England as the Bank believed Brexit could lead to a materially lower path of growth for the UK, especially for the manufacturing and construction industries. You see for the country as a whole, the manufacturing and construction industries are still performing well below the pre credit crunch levels of 2008/09, so the British economy remains highly susceptible to an economic shock. This is especially important in Locks Heath, because even though we have had a number of local success stories in manufacturing and construction, a large number of people are employed in these sectors. In Locks Heath, Warsash and Whiteley, of the 23,360 people who have a job, 2,145 are in the manufacturing industry and 1,803 in Construction meaning…

9.2% of Locks Heath, Warsash and Whiteley workers are employed in the Manufacturing sector and 7.7% of workers are in Construction.

The other sector of the economy the Bank is worried about, and an equally important one to the Locks Heath economy, is the Financial Services industry. Financial Services in Locks Heath, Warsash and Whiteley employ 1,289 people, making up 5.5% of the working population.

Together with a cut in interest rates, the Bank also announced an increase in the quantity of money via a new programme of Quantitative Easing to buy £70bn of Government and Private bonds. Now that won’t do much to the Locks Heath property market directly, but another measure also included in the recent announcement was £100bn of new funding to banks. This extra £100bn will help the High St banks pass on the base rate cut to people and businesses, meaning the banks will have lots of cheap money to lend for mortgages. This should have a huge effect on the Locks Heath property market (as that £100bn would be enough to buy half a million homes in the UK).

It will take until early in the New Year to find out the real direction of the Locks Heath property market and the effects of Brexit on the economy as a whole, the subsequent recent interest rate cuts and the availability of cheap mortgages. However, something bigger than Brexit and interest rates is the inherent undersupply of housing (something I have spoken about many times in my blog and the specific affect on Locks Heath). The severe under-supply means that Locks Heath property prices are likely to increase further in the medium to long term, even if there is a dip in the short term. This only confirms what every homeowner and landlord has known for decades – investing in property is a long term project and as an investment vehicle, it will continue to outstrip other forms of investment due to the high demand for a roof over people’s heads and the low supply of new properties being built.

For more thoughts on the Locks Heath Property Market, please visit the Locks Heath Property Blog www.thelocksheathpropertyblog.co.uk.

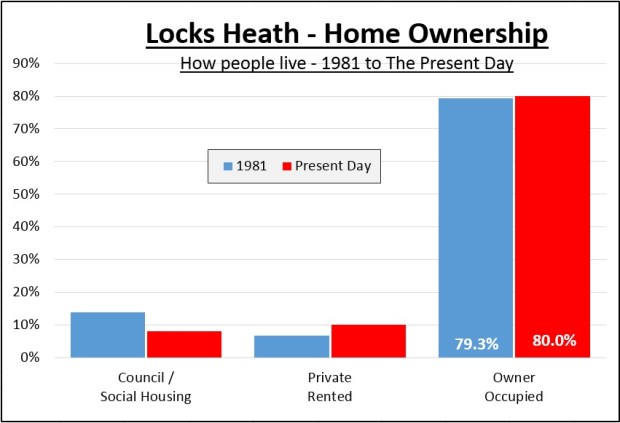

Roll the clock back 35 years to 1981, and Mrs. Thatcher was in power, we had a Royal Wedding, Britain won the Ashes and Bucks Fizz won Eurovision with ‘Making your Mind up’. Haven’t things changed? The number of homeowners and property investors who said they wish they had hindsight and bought up every house in Locks Heath all those years ago, especially when you consider what has happened to Locks Heath property values, as…

Roll the clock back 35 years to 1981, and Mrs. Thatcher was in power, we had a Royal Wedding, Britain won the Ashes and Bucks Fizz won Eurovision with ‘Making your Mind up’. Haven’t things changed? The number of homeowners and property investors who said they wish they had hindsight and bought up every house in Locks Heath all those years ago, especially when you consider what has happened to Locks Heath property values, as…

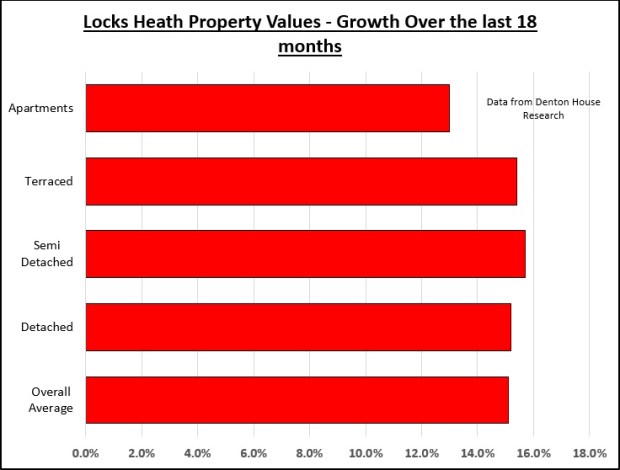

Over the last month, the Locks Heath property market has seen some interesting movement in house prices, as property values in the Fareham Borough Council area rose by 1.5%, to leave annual price growth at 13.8%. These compare well to the national figures where property prices across the UK saw a monthly uplift of 0.42%, meaning the annual property values across the Country are 8.3% higher, this is all despite the constraining factors of Stamp Duty changes in the spring and more recently our friend Brexit.

Over the last month, the Locks Heath property market has seen some interesting movement in house prices, as property values in the Fareham Borough Council area rose by 1.5%, to leave annual price growth at 13.8%. These compare well to the national figures where property prices across the UK saw a monthly uplift of 0.42%, meaning the annual property values across the Country are 8.3% higher, this is all despite the constraining factors of Stamp Duty changes in the spring and more recently our friend Brexit.

Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.

Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.