Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.

Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.

The thing is, the UK does not have one housing market. Instead, it is a patchwork of mini property markets all performing in a different way. At one end of the scale is Kensington and Chelsea, which has seen average prices drop in the last twelve months by 6.2% . Whilst in our South East region, house prices are 12.3% higher. But what about Locks Heath?

Property prices in Locks Heath are 12.8% higher than a year ago

and 3.1% higher than last month.

So what does this mean for Locks Heath Landlords and homeowners? Not that much unless you are buying or selling in reality. Most sellers are buyers anyway, so if the one you are buying has gone up, yours has gone up. Everything is relative and what I would say is, if you look hard enough, there are even in this market still some bargains to be had in Locks Heath.

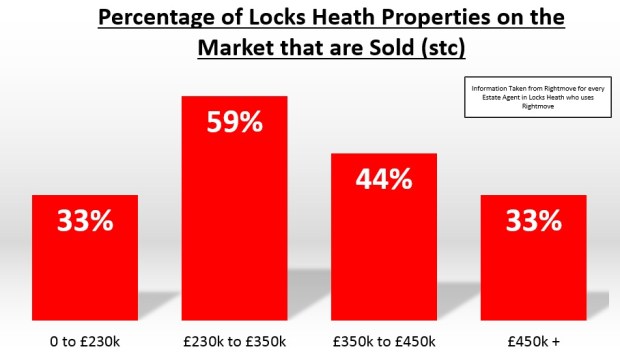

However, the most important question you should be asking though is not only is what happening to property prices, but exactly which price band is selling? I like to keep an eye on the property market in Locks Heath on a daily basis because it enables me to give the best advice and opinion on what (or not) to buy in Locks Heath.

If you look at Locks Heath and split the property market into four equal sized price bands each price band would have around 25% of the property in Locks Heath, from the lowest in value band (the bottom 25%) all the way through to the highest 25% band (in terms of value).

Nil to £230k 22 properties for sale and 11 sold (stc) i.e. 33% sold

£230k to £350k 22 properties for sale and 32 sold (stc) i.e. 59% sold

£350k to £450k 30 properties for sale and 24 sold (stc) i.e. 44% sold

£450k + 26 properties for sale and 13 sold (stc) i.e. 33% sold

Fascinating don’t you think that it is the middle Locks Heath market that is doing the best?

The next nine months’ activity will be crucial in understanding which way the market will go this year after Brexit. But, Brexit or no Brexit, people will always need a roof over their head and that is why the property market has ridden the storms of oil crisis’ in the 1970’s, the 1980’s depression, Black Monday in the 1990’s, and latterly the credit crunch together with the various house price crashes of 1973, 1987 and 2008.

And why? Because Britain’s chronic lack of housing will prop up house prices and prevent a post spike crash. There is always a silver lining when it comes to the property market!

For more articles like this please visit the The Locks Heath Property Blog.