Philip Hammond today announced government plans to ban Letting Agents from charging Tenants upfront Agency Fees.

This news will be music to prospective Tenants’ ears as according to Citizens Advice currently the national average fee charged to Tenants when renting a property is £337 per person. In Park Gate Tenants’ Fees can even be as high as £500 with some Agents.

However I think once the dust settles on this news and Agents are forced to review their business models it could end up proving very costly for Tenants.

David Cox, the Managing Director of the Association of Residential Letting Agents (ARLA), has already released a statement today warning that

“A ban on letting agent fees is a draconian measure, and will have a profoundly negative impact on the rental market. It will be the fourth assault on the sector in just over a year, and do little to help cash-poor renters save enough to get on the housing ladder. This decision is a crowd-pleaser, which will not help renters in the long-term. All of the implications need to be taken into account.

Most letting agents do not profit from fees. Our research shows that the average fee charged by ARLA Licensed agents is £202 per tenant, which we think is fair, reasonable and far from exploitative for the service tenants receive.”

Ultimately if Tenant Fees are banned, the costs will end up being passed on to Landlords in one form or another. The Landlords, of course, will then be looking to recover these increased costs elsewhere – inevitably through higher rents.

I fear that banning Tenant Fees will end up hurting the very people the government is intending on helping the most.

If you are concerned about how this change could affect you, please feel free to email me.

The Locks Heath Property Market continues to disregard the end of the world prophecies of a post Brexit fallout with a return to business as usual after the summer break.

The Locks Heath Property Market continues to disregard the end of the world prophecies of a post Brexit fallout with a return to business as usual after the summer break.

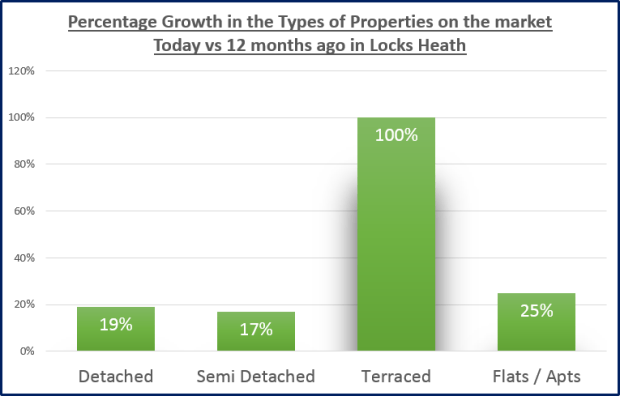

Back in the Spring there was a surge in Locks Heath Landlords buying buy to let property in Locks Heath as they tried to beat George Osborne’s new stamp duty changes which kicked in on the 1st April 2016. To give you an idea of the sort of numbers we are talking about, below are the property statistics for sales either side of the deadline in SO31.

Back in the Spring there was a surge in Locks Heath Landlords buying buy to let property in Locks Heath as they tried to beat George Osborne’s new stamp duty changes which kicked in on the 1st April 2016. To give you an idea of the sort of numbers we are talking about, below are the property statistics for sales either side of the deadline in SO31.

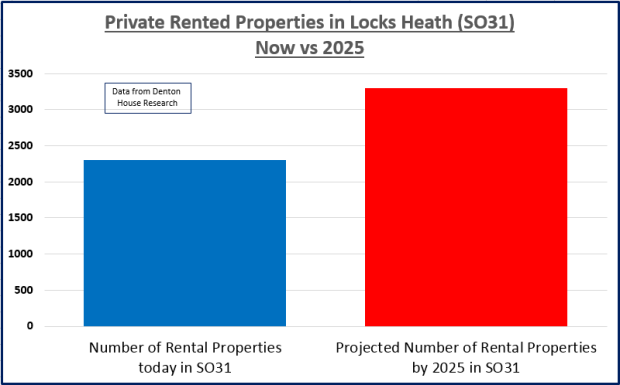

I was having an interesting chat the other day with a Locks Heath landlord. We got talking about the Locks Heath Property Market and this landlord brought up the subject of a report he had read from the Royal Institution of Chartered Surveyors (RICS) and PricewaterhouseCoopers (PwC) that stated that almost 1.8m new rental homes are needed by 2025 to keep up with current demand from tenants. He wanted to know what this meant for Locks Heath.

I was having an interesting chat the other day with a Locks Heath landlord. We got talking about the Locks Heath Property Market and this landlord brought up the subject of a report he had read from the Royal Institution of Chartered Surveyors (RICS) and PricewaterhouseCoopers (PwC) that stated that almost 1.8m new rental homes are needed by 2025 to keep up with current demand from tenants. He wanted to know what this meant for Locks Heath.