Well, hasn’t 2016 been eventful. The ups and downs of Brexit, the Queen’s 90th, Andy Murray winning Wimbledon, Trump, Bake Off to Channel 4 and something close to the hearts of every buy to let Landlord and homeowner in Locks Heath … the Locks Heath property market.

Well, hasn’t 2016 been eventful. The ups and downs of Brexit, the Queen’s 90th, Andy Murray winning Wimbledon, Trump, Bake Off to Channel 4 and something close to the hearts of every buy to let Landlord and homeowner in Locks Heath … the Locks Heath property market.

So, let’s look at the headlines for the Locks Heath property market…

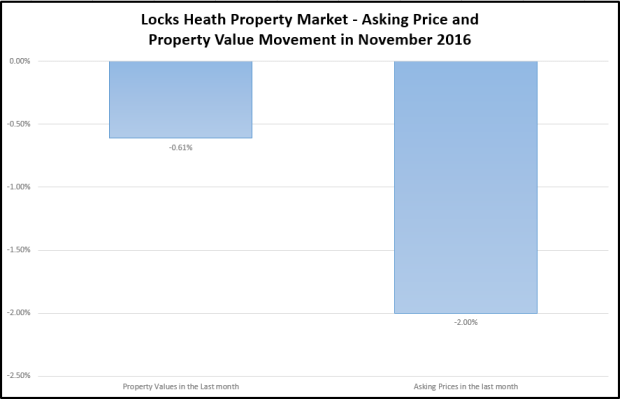

In the last month, Locks Heath property values dropped by 0.61%, leaving them, year on year 10.1% higher, whilst interestingly, Locks Heath asking prices are down 2.0% month on month. All three statistics go to show the Locks Heath property market has recovered well after the summer lull, which was worsened by the uncertainty surrounding the EU vote back in June. Irrespective of all the issues, the average value of a Locks Heath home now stands at £344,700.

Generally, Locks Heath asking prices continue to hold up well, as asking prices are 4.7% higher year on year. At this time of year, asking prices tend to drop on the run up to Christmas, and locally they dropped by 2.0% in November 2016, although this still compares well with last year’s drop in Locks Heath asking prices, as we saw asking prices drop by 1.1% in November 2015.

It is also interesting to take note from a recent survey by the Royal Institution of Chartered Surveyors, stating new buyer enquiries and new instructions are falling at the same rate, suggesting that there will not be a downward pressure on property values.

Looking at the figures for the UK (as we can’t just look at Locks Heath in isolation), property values are generally rising slower than a few years ago, but on a positive note, there is still growth across the UK. You see, slowing property value growth isn’t solely Brexit related, but after a number years of double digit rises in property values, affordability has weakened and cooling price growth is widely seen to be a natural correction of the market.

On the other hand, interest rates being at a record low of 0.25% are helping the property market. The cut in interest rates in the late summer was the medicine for the post-Brexit worry and will, as a consequence, ensure that the UK economy continues to be underpinned by buoyant property prices.

So, what will happen in 2017 in the Locks Heath property market?

Some say until we know what type of exit the UK will make from the EU it is hard to evaluate the outcome. Although, I believe, the whole Brexit issue is a sideshow to the main issue in the UK (and Locks Heath) housing market as a whole. As I have mentioned time and time again over the last few months, the biggest issue is demand outstripping supply when it comes to the number of households required to house us all. Locks Heath has an ever-growing population: with immigration (we still have at least two years of free movement from EU members into the UK), people living longer and the fact we need thousands of additional households as the country has nearly 115,000 divorces a year (where one household becomes two households). These are interesting times ahead!

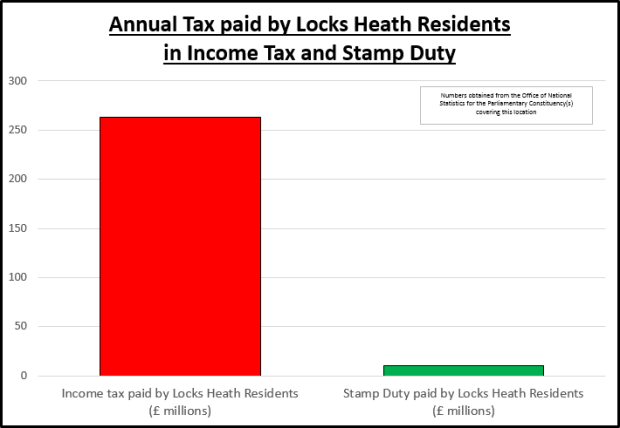

Apart from some minor exemptions, Stamp Duty is paid by anyone buying a property over £125,000 in the UK. It presently raises £10.68bn a year for the HM Treasury (interesting when compared with £27.6bn in fuel duty, £10.69bn in alcohol duty and £9.48bn in tobacco duty).

Apart from some minor exemptions, Stamp Duty is paid by anyone buying a property over £125,000 in the UK. It presently raises £10.68bn a year for the HM Treasury (interesting when compared with £27.6bn in fuel duty, £10.69bn in alcohol duty and £9.48bn in tobacco duty).

Figures just released by the Bank of England, show that for the first half of 2016, £128.73bn was lent by UK banks to buy UK property – impressive when you consider only £106.7bn was lent in the first half of 2015. Even more interesting, was that most of the difference was in Q2, as £68.12bn was lent by UK banks in new mortgages for house purchases, which is the highest it has been for two years. Looking locally, in Locks Heath last quarter, £939.9m was loaned on SO31 properties alone!

Figures just released by the Bank of England, show that for the first half of 2016, £128.73bn was lent by UK banks to buy UK property – impressive when you consider only £106.7bn was lent in the first half of 2015. Even more interesting, was that most of the difference was in Q2, as £68.12bn was lent by UK banks in new mortgages for house purchases, which is the highest it has been for two years. Looking locally, in Locks Heath last quarter, £939.9m was loaned on SO31 properties alone!