It might surprise you that it isn’t always the poshest villages around the Fareham Borough or the swankiest Locks Heath streets where properties sell and let the quickest. Quite often, it is the ones that have the best transport links. I mean, there is a reason why one of the most popular property programmes on television is called Location, Location, Location!

It might surprise you that it isn’t always the poshest villages around the Fareham Borough or the swankiest Locks Heath streets where properties sell and let the quickest. Quite often, it is the ones that have the best transport links. I mean, there is a reason why one of the most popular property programmes on television is called Location, Location, Location!

As an agent in Locks Heath, I am frequently confronted with queries about the Locks Heath property market, and most days I am asked “What is the best part of Locks Heath and the surrounding villages to live in these days?”. Now the answer is different for each person – a lot depends on the demographics of their family, their age, schooling requirements and interests etc. Nonetheless, one of the principal necessities for most tenants and buyers is ease of access to transport links, including public transport – of which the railways are very important.

Official figures recently released state that, in total, 955 people jump on a train each and every day from Swanwick Train station. Of those, 475 are season ticket holders. That’s a lot of money being spent when a season ticket, standard class, to London is £5,424 a year.

So, if up to £2.58m is being spent on rail season tickets each year from Swanwick, those commuters must have some impressive jobs and incomes to allow them to afford that season ticket in the first place. That means demand for middle to upper market properties remains strong in Locks Heath and the surrounding area and so, in turn, these are the type of people who are happy to invest in the Locks Heath buy to let market – providing homes for the Tenants of Locks Heath.

The bottom line is that property values in Locks Heath would be much lower if it wasn’t for the proximity of the railway station and the people it serves in the suburb

And this isn’t a flash in the pan. Rail is becoming increasingly important as the costs associated with car travel continue to rise and roads are becoming more and more congested. This has resulted in a huge surge in rail travel.

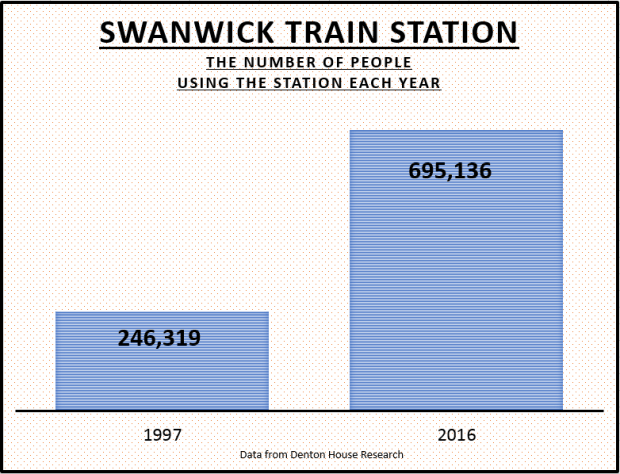

Overall usage of the station at Swanwick has increased over the last 20 years. In 1997, a total of 246,319 people went through the barriers or connected with another train at the station in that 12-month period. However, in 2016, that figure had risen to 695,136 people using the station (that’s 1,910 people a day).

The juxtaposition of the property and the train station has an important effect on the value and saleability of a Locks Heath property. It is also significant for Tenants – so if you are a Locks Heath buy to let investor looking for a property the distance to and from the railway station can be extremely significant.

One of the first things house buyers and Tenants do when surfing the web for somewhere to live is find out the proximity of a property to the train station. That is why Rightmove displays the distance to the railway station alongside each and every property on their website.

For more thoughts on the Locks Heath Property market please visit The Locks Heath Property Blog.

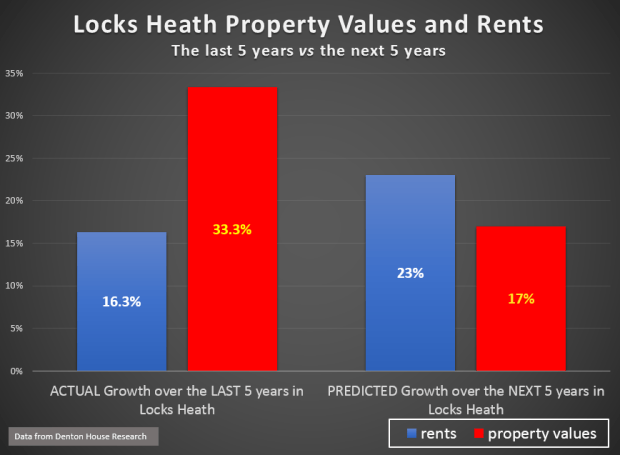

The next five years will see an interesting change in the Locks Heath property market. My recent research has concluded that the rent private tenants pay in Locks Heath will rise faster than Locks Heath property prices over the next five years, creating further issues to Locks Heath’s growing multitude of renters. In fact, my examination of statistics forecasts that ..

The next five years will see an interesting change in the Locks Heath property market. My recent research has concluded that the rent private tenants pay in Locks Heath will rise faster than Locks Heath property prices over the next five years, creating further issues to Locks Heath’s growing multitude of renters. In fact, my examination of statistics forecasts that ..

I know how my readers like to keep abreast of planned developments in the local area. Having read the article below on the Daily Echo’s website over the weekend regarding two planned sites in Warsash I thought it was worth sharing.

I know how my readers like to keep abreast of planned developments in the local area. Having read the article below on the Daily Echo’s website over the weekend regarding two planned sites in Warsash I thought it was worth sharing.