This was a question posed to me on social media a few weeks ago, after my article about our mature members of Locks Heath society and the fact many retirees feel trapped in their homes. After working hard for many years and buying a home for themselves and their family, the children have subsequently flown the nest and now they are left to rattle round in a big house. Many feel trapped in their big homes (hence I dubbed these Locks Heath home owning mature members of our society, ‘Generation Trapped’).

This was a question posed to me on social media a few weeks ago, after my article about our mature members of Locks Heath society and the fact many retirees feel trapped in their homes. After working hard for many years and buying a home for themselves and their family, the children have subsequently flown the nest and now they are left to rattle round in a big house. Many feel trapped in their big homes (hence I dubbed these Locks Heath home owning mature members of our society, ‘Generation Trapped’).

So, should we force OAP Locks Heath homeowners to downsize?

Well in the original article, I suggested that we as a society should encourage, through building, tax breaks and social acceptance that it’s a good thing to downsize. But should the Government force OAP’s?

Well, one of the biggest reasons OAP’s move home is health (or lack of it)

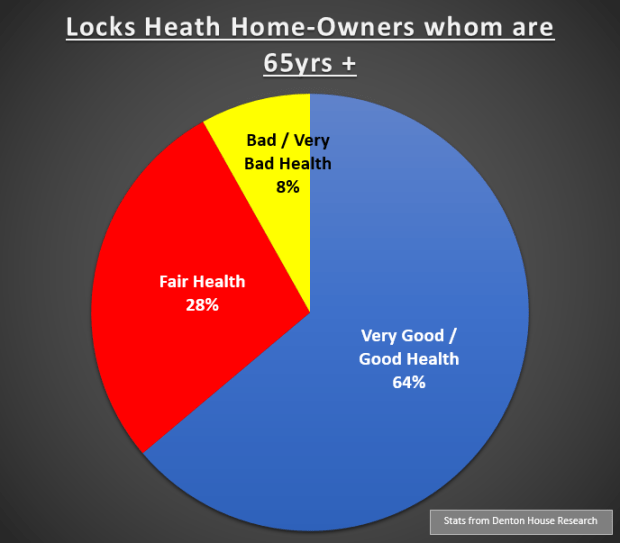

Looking at the statistics for Locks Heath (includes Warsash and Whiteley), of the 5,841 Homeowners who are 65 years and older, whilst 3,730 of them described themselves in good or very good health, a sizeable 1,636 home owning OAPs described themselves as in fair health and 475 in bad or very bad health.

8.13% of Locks Heath home owning OAP’s are in poor health

But if you look at the figures for the whole of Fareham Borough Council (not just Locks Heath), there are only 807 specialist retirement homes that one could buy (if they were in fact for sale) and 415 homes available to rent from the Council and other specialist providers (again- you would be waiting for dead man’s shoes to get your foot in the door) and many older homeowners wouldn’t feel comfortable with the idea of renting a retirement property after enjoying the security of owning their own home for most of their adult lives.

My intuition tells me the majority ‘would be’ Locks Heath downsizers could certainly afford to move but are staying put in bigger family homes because they can’t find a suitable smaller property. The fact is there simply aren’t enough bungalows for the healthy older members of the Locks Heath population and specialist retirement properties for the ones who aren’t in such good health… we need to build more appropriate houses in Locks Heath.

The Government’s Housing White Paper, published a few weeks ago, could have solved so many problems with the UK housing market, including the issue of homing our aging population. Instead, it ended up feeling annoyingly ambiguous. Forcing our older generation to move with such measures as a punitive taxation (say a tax on wasted bedrooms for people who are retired) would be the wrong thing to do. Instead of the stick – maybe the Government could use the carrot tactics and offered tax breaks for downsizers. Who knows, but something has to happen.

Come to think about it, isn’t the word ‘downsize’ such an awful word? I prefer to use the word ‘decent-size’ instead of ‘down-size’- as the other phrase feels like they are lowering themselves, as though they are having to downgrade themselves in their retirement (and let’s be frank – no one likes to be downgraded).

The simple fact is we are living longer as a population and constantly growing with increased birth rates and immigration. So, what I would say to all the homeowners and property owning public of Locks Heath is… more houses and apartments need to be built in the Locks Heath area, especially more specialist retirement properties and bungalows. The Government had a golden opportunity with the White Paper – and were sadly found lacking.

And a message to my Locks Heath property investor readers whilst this issue gets sorted in the coming decade(s)… maybe seriously consider doing up older bungalows. People will pay handsomely for them – be they for sale or even rent? Just a thought!

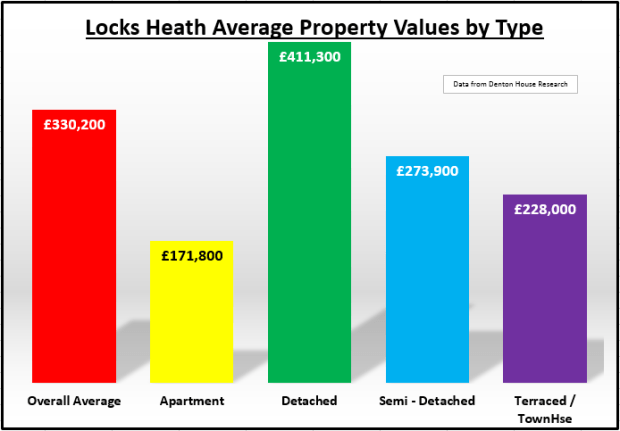

According to the Land Registry’s latest House Price Index for Locks Heath and the surrounding locality, the value of apartments/flats are rising at a faster rate than terraced/town houses, semi-detached properties and even detached property.

According to the Land Registry’s latest House Price Index for Locks Heath and the surrounding locality, the value of apartments/flats are rising at a faster rate than terraced/town houses, semi-detached properties and even detached property.

So all cards up in the air! A general election will be on the books, but one thing is for sure… whoever gets the job to deal with Brexit has a hard job on their hands (I’m just glad its not me!). As it currently stands, by not assuring the rights of EU citizens in the UK, Theresa May has wasted an opportunity to give peace of mind to our EU co-workers working and living in Locks Heath (and the rest of the UK). No.10 Downing Street’s point of view is that in promising the rights of EU citizens in the UK, it will postpone the same guarantee to the 1.5 million UK citizens living in the other nations of the EU.

So all cards up in the air! A general election will be on the books, but one thing is for sure… whoever gets the job to deal with Brexit has a hard job on their hands (I’m just glad its not me!). As it currently stands, by not assuring the rights of EU citizens in the UK, Theresa May has wasted an opportunity to give peace of mind to our EU co-workers working and living in Locks Heath (and the rest of the UK). No.10 Downing Street’s point of view is that in promising the rights of EU citizens in the UK, it will postpone the same guarantee to the 1.5 million UK citizens living in the other nations of the EU.

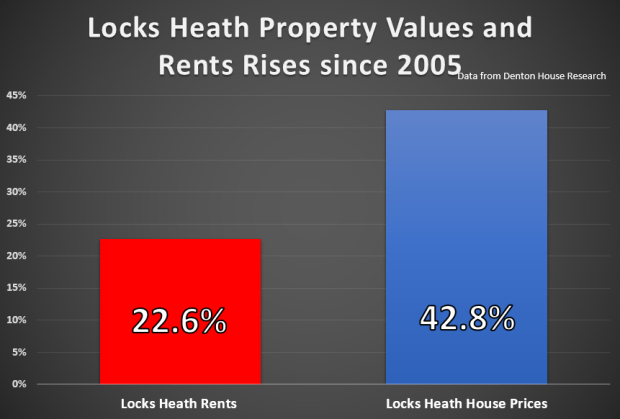

The Locks Heath Property Market is a very interesting animal and has been particularly fascinating over the last 12 years when we consider what has happened to Locks Heath rents and house prices.

The Locks Heath Property Market is a very interesting animal and has been particularly fascinating over the last 12 years when we consider what has happened to Locks Heath rents and house prices.