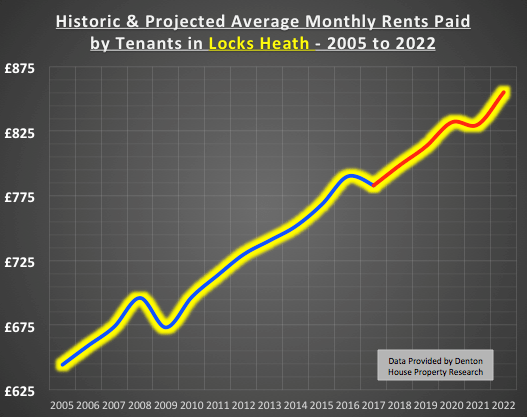

It’s now been a good 12/18 months since annual rental price inflation in Locks Heath peaked at 3.4%. Since then we have seen increasingly more humble rent increases. In fact, in certain parts of the Locks Heath rental market over the autumn, the rental market saw some slight falls in rents. So, could this be the earliest indication that the trend of high rent increases seen over the last few years, may now be starting to buck that trend?

It’s now been a good 12/18 months since annual rental price inflation in Locks Heath peaked at 3.4%. Since then we have seen increasingly more humble rent increases. In fact, in certain parts of the Locks Heath rental market over the autumn, the rental market saw some slight falls in rents. So, could this be the earliest indication that the trend of high rent increases seen over the last few years, may now be starting to buck that trend?

Well, possibly in the short term, but in the coming few years, it is my opinion Locks Heath rents will regain their upward trend and continue to increase as demand for Locks Heath rental property will outstrip supply, and this is why….

The only counterbalance to that improved rental growth would be to meaningfully increase rental stock (i.e. the number of rental properties in Locks Heath). However, because of the Government’s new taxes on Landlords being introduced between 2017 and 2021, that means buy-to-let has (and will) be less attractive in the short term for certain types of Landlords (meaning less new properties will be bought to let out).

Interestingly, countless market experts assumed at the start of 2017 that the number of rental properties would in fact drop throughout the year. The assumption being as the new tax rules for Landlords started to kick in, Landlords looked to kick their tenants out, sell up and invest their capital elsewhere. (Although ironically that would lower supply of rental properties, decreasing the supply, meaning rents would increase again!).

Anecdotal evidence suggests, confirmed by my discussions with fellow property, accountancy and banking professionals in Locks Heath, that Locks Heath Landlords are (instead of selling up en masse), actually either (1) re-mortgaging their Locks Heath buy-to-let properties instead or (2) converting their rental portfolios into limited companies to side step the new taxation rules.

The sentiment of many Locks Heath Landlords is that property has always weathered the many stock market crashes and runs in the last 50 years. There is something inherently understandable about bricks and mortar – compared to the voodoo magic of the stock market and other exotic investment vehicles like debentures and crypto-currency (e.g. BitCoin).

Remarkably, there is some good news for Tenants, as Tory’s recently published the draft Tenants’ Fee Bill, which is designed to prohibit the charging of Tenants lettings fees on set up of the tenancy. However, looking at evidence in Scotland, I expect rents to rise to compensate Landlords, thus hammering faithful Tenants looking for long-term tenancy agreements the hardest. This growth will be on top of any usual organic rent growth. It really is swings and roundabouts!

So, what does this all mean for Landlords and Tenants in Locks Heath? In my considered opinion….

Rents in Locks Heath over the next 5 years will rise by 9.2%, taking the average rent for a Locks Heath property from £783 per month to £855 per month.

To put all that into perspective though, rents in Locks Heath over the last 12 years have risen by 21.5%. In fact, that rise won’t be a straight-line growth either, because I have to take into account the national and local Locks Heath economy, demand and supply of rental property, interest rates, Brexit and other external factors. Please see the graph for my projections:

In the past, making money from Locks Heath buy-to-let property was as easy as falling off a log. But with these new tax rules, new rental regulations and the overall changing dynamics of the Locks Heath property market, as a Locks Heath Landlord, you are going to need work smarter and have every piece of information, advice and opinion to hand on the Locks Heath, Regional and National property market’s, to enable you to continue to make money.

Locks Heath homeowners will be among those affected by the latest rise in the Bank of England interest rates. The first increase in 10 years; they have just been raised from 0.25 percent to 0.5 per cent. This uplift comes as inflation hits a 51-month high of 2.9 per cent whilst the national unemployment rate is at an all-time low of 4.3 per cent.

Locks Heath homeowners will be among those affected by the latest rise in the Bank of England interest rates. The first increase in 10 years; they have just been raised from 0.25 percent to 0.5 per cent. This uplift comes as inflation hits a 51-month high of 2.9 per cent whilst the national unemployment rate is at an all-time low of 4.3 per cent. As the winter months draw in and the temperature starts to drop, keeping one’s home warm is vital. Yet, with the price of gas and electricity rising quicker than a Saturn V rocket and gas, oil and electricity taking on average 4.4% of a typical Brit’s pay packet (and for those Brit’s with the lowest 10% of incomes, that rockets to an eye watering 9.7%), whether you are a tenant or homeowner, keeping your energy costs as low as possible is vital for the household budget and the environment as a whole.

As the winter months draw in and the temperature starts to drop, keeping one’s home warm is vital. Yet, with the price of gas and electricity rising quicker than a Saturn V rocket and gas, oil and electricity taking on average 4.4% of a typical Brit’s pay packet (and for those Brit’s with the lowest 10% of incomes, that rockets to an eye watering 9.7%), whether you are a tenant or homeowner, keeping your energy costs as low as possible is vital for the household budget and the environment as a whole.

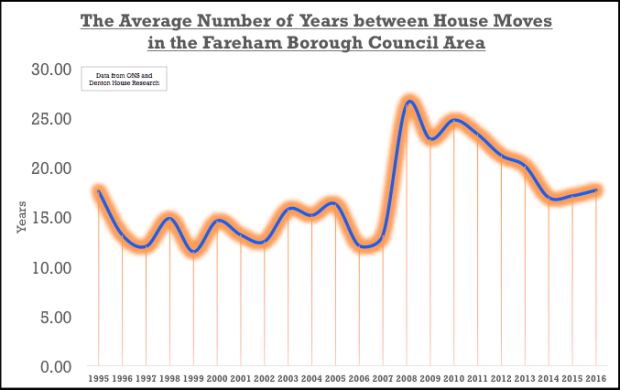

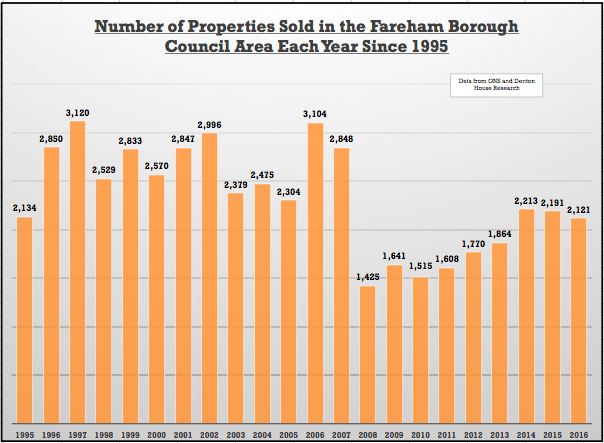

In the credit crunch of 2008/9 the rate of home moving plunged to its lowest level ever. In 2009 the rate at which a typical house would change hands slumped to only once every 23 years. The biggest reason being that confidence was low and many homeowners didn’t want to sell their home as Locks Heath property prices plunged after the onset of the financial crisis in 2008. However, since 2009, the rate of home moving has increased (see the table and graph below), meaning today:

In the credit crunch of 2008/9 the rate of home moving plunged to its lowest level ever. In 2009 the rate at which a typical house would change hands slumped to only once every 23 years. The biggest reason being that confidence was low and many homeowners didn’t want to sell their home as Locks Heath property prices plunged after the onset of the financial crisis in 2008. However, since 2009, the rate of home moving has increased (see the table and graph below), meaning today: