The simple fact is we are not building enough properties. If the supply of new properties is limited and demand continues to soar with heightened divorce rates, i.e. one household becoming two, people living longer and continued immigration, this means the values of those existing properties continues to remain high and out of reach for a lot of people, especially the blue collar working families of Locks Heath.

The simple fact is we are not building enough properties. If the supply of new properties is limited and demand continues to soar with heightened divorce rates, i.e. one household becoming two, people living longer and continued immigration, this means the values of those existing properties continues to remain high and out of reach for a lot of people, especially the blue collar working families of Locks Heath.

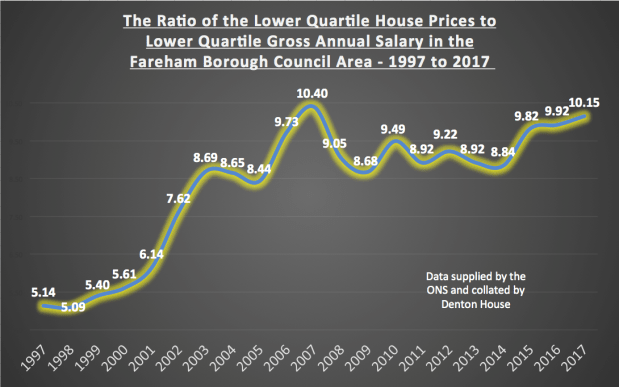

Looking at some recent statistics released by the Government, the ratio of the lower quartile house prices to lower quartile gross annual salaries in Fareham Borough Council has hit 10.15 to 1.

What does that mean exactly and why does it matter to Locks Heath landlords and homeowners?

If we ordered every property in the Fareham Borough Council area by the value of those properties, the average value of the lower quartile properties (i.e. lowest 25%) would be £222,000. If we then did the same, and ordered everyone’s salary in the same council area, the average of the lowest quartile (lowest 25%), the average salary of the lowest 25% is £21,879 pa, therefore dividing one with the other, we get the ratio of 10.15 to 1.

Assuming there is one wage earner in the house, the chances of a Locks Heath working family being able to afford to buy their own home, when it’s over ten times their annual salary, is very slim indeed. The existing affordability crisis of people wanting to buy their own home is the unavoidable outcome of the decade on decade failure to build enough homes to keep up with demand. Nevertheless, improving affordability is not a case of just constructing more homes. Fareham Borough Council needs to ensure more properties are not only built, but built in the right locations and of the right type and at the right price to ensure the needs of these lower income working families are met. Because at the moment they presently have few options apart from the private rental sector.

Looking at the historic nature of the ratio, it can clearly be seen in the graph below that this has been an issue since the early to mid 2000’s.

However, if we look at the historic data, those on the bottom rung of the ladder (those in the lower quartile of wage earners) used to be housed by the local authority instead of buying. However, the vast majority of council houses were sold off in the 1980’s, meaning there are much fewer council houses today to house this generation.

Many of the lower quartile working class families were given a lifeline to buy their own homes in middle 2000’s, with 100% mortgages, but the with the credit crunch in 2009, that rug (of 100% mortgages) was rudely pulled from under their feet. You see it is cheaper to buy than rent… it’s the finding of the 5% deposit that is the challenging issue for these Locks Heath working class families. So unless the Government allow 100% mortgages back, the fact is, demand for rental properties will outstrip supply.

However all this means is demand for rental properties will continue to grow, keeping Locks Heath house prices high and Locks Heath rents high.