A few months ago I wrote an article on the Locks Heath Property Blog about the length of time it took to sell a property in Locks Heath and the saleability of the different price bands (i.e. whether the lower/middle or upper local property markets were moving slower or quicker than the others). For reference, a few months ago it was taking on average 62 days from the property coming on the market for it to be sold subject to contract (and that was based on every Estate Agent in Locks Heath)… and today… 108 days… does that surprise you with what is happening in the UK economy?

A few months ago I wrote an article on the Locks Heath Property Blog about the length of time it took to sell a property in Locks Heath and the saleability of the different price bands (i.e. whether the lower/middle or upper local property markets were moving slower or quicker than the others). For reference, a few months ago it was taking on average 62 days from the property coming on the market for it to be sold subject to contract (and that was based on every Estate Agent in Locks Heath)… and today… 108 days… does that surprise you with what is happening in the UK economy?

Well, a number of Locks Heath Landlords and homeowners who are looking to sell in the coming months contacted me following that article to enquire what difference the type of property (i.e. Detached/Semi/Terraced/Apartment) made to saleability and also the saleability of property by the number of bedrooms). As I have said before, whether you are a Locks Heath Landlord looking to liquidate your buy to let investment or a homeowner looking to sell your home, finding a buyer and selling your property can take an annoyingly long time… but anything you can do to mitigate that is helpful to everyone.

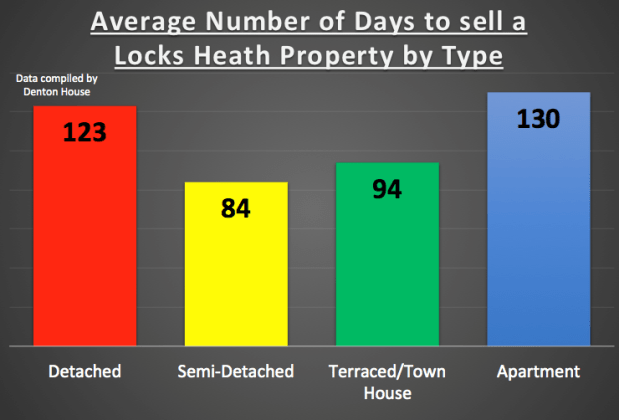

So I did some research on the whole of the Locks Heath property market and these were my findings… to start with by type (i.e. Detached/Semi/Terraced/Apartment):

As you can see, the star players are the terraced/town house and semi-detached variants of Locks Heath property, whilst apartments seem to be sticking in Locks Heath.

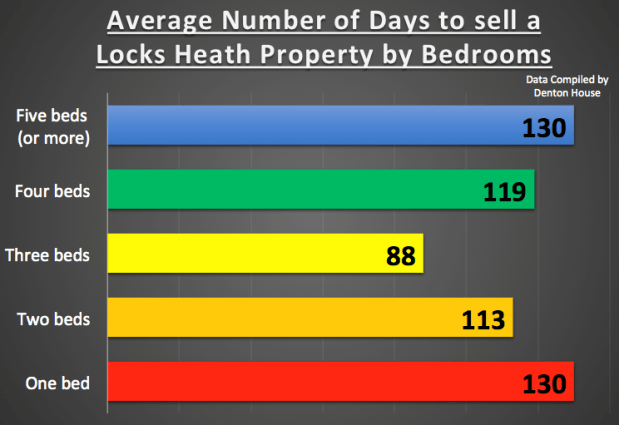

Next I looked at what the number of bedrooms does to the saleability of Locks Heath property..

As you can see the one and five bedroom properties seem to be taking the longest time to sell.

And to answer the question in the title….. it is three bed properties!

So, what does this mean for Locks Heath buy-to-let Landlords and homeowners?

There is no doubt that there is a plethora of properties on the market in Locks Heath compared to 18 months ago… it is not because more houses are coming on to the market, it is because they are also taking a little longer to sell. This makes it slightly more a buyer’s market than the seller’s market we had back in 2014/5/6. Therefore, in some sectors of the Locks Heath property market, it is much tougher to sell, especially if you want to sell your Locks Heath home fast.

Therefore, to conclude, on the run up to the New Year, if you are looking to buy and plan to stay in the buy to let market a long time, perhaps take a look at the Locks Heath properties that are sticking as there could be some bargains to be had there(?). Want to know where they are? Drop me a line and I will tell you a nifty little trick to find all the properties that are sticking.

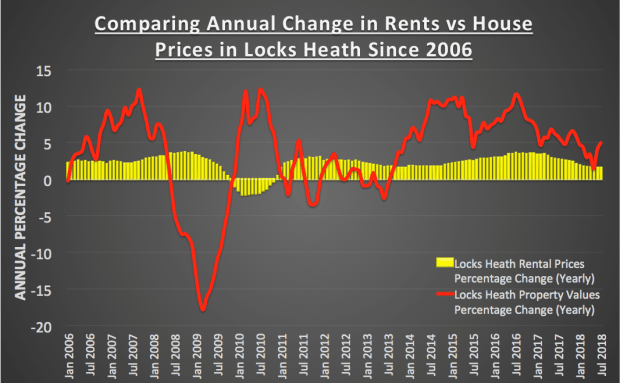

The Locks Heath housing market is a fascinating beast and has been particularly interesting since the Credit Crunch of 2008/9 with the subsequent property market crash. There is currently some talk of a ‘property bubble’ nationally as Brexit seems to be the ‘go-to’ excuse for every issue in the Country. Upon saying that, looking at both what we do as an agent, and chatting with my fellow property professionals in the area, the market has certainly changed for both buyers and sellers alike (be they Locks Heath buy to let Landlords, Locks Heath first time buyers or Locks Heath owner occupiers looking to make the move up the Locks Heath property ladder).

The Locks Heath housing market is a fascinating beast and has been particularly interesting since the Credit Crunch of 2008/9 with the subsequent property market crash. There is currently some talk of a ‘property bubble’ nationally as Brexit seems to be the ‘go-to’ excuse for every issue in the Country. Upon saying that, looking at both what we do as an agent, and chatting with my fellow property professionals in the area, the market has certainly changed for both buyers and sellers alike (be they Locks Heath buy to let Landlords, Locks Heath first time buyers or Locks Heath owner occupiers looking to make the move up the Locks Heath property ladder).

As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike.

As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike.