Locks Heath property values are currently 0.7% higher than at the end of 2017, notwithstanding the uncertainty and threats over the potential impact of Brexit in 2019. This has exceeded all the predictions (aka guesses) of all the City of London economists, in an astonishing sign of strength for the local Locks Heath and wider national economy.

Locks Heath property values are currently 0.7% higher than at the end of 2017, notwithstanding the uncertainty and threats over the potential impact of Brexit in 2019. This has exceeded all the predictions (aka guesses) of all the City of London economists, in an astonishing sign of strength for the local Locks Heath and wider national economy.

Nevertheless, the statistics from the Land Registry come after a lethargic year for the number of properties in Locks Heath compared to the actual prices achieved for those properties. All this against a framework of amplified political ambiguity and ensuing years of rising Locks Heath property values that have reduced the affordability of homes in the locality.

The average value of a Locks Heath property today currently stands at £346,300

Looking in finer detail, it isn’t a surprise that 166 property sales in Locks Heath over the last 12 months is somewhat lower than the long-term average over the last 20 years of 245 property sales per year in Locks Heath as the long-term trend of people moving less has meant a decline in the number of property transactions.

I believe locally, Locks Heath property value growth will be more reserved in 2019 after two decades of weaker wage rises. One of main drivers in the demand (and thus the price people are prepared to pay for a home) is the growth of peoples wage packets. Interestingly, wage inflation over the last six months has risen from 2.4% in the late summer to its current level of 3.3% (which is higher than the average since the Millennium, which has been a modest 2.1%). One of the reasons why wages are growing in the short term is the unemployment rate in the country currently only stands at 4.1%, continuing to stay close to its lowest level since the 1970’s.

However, even though Locks Heath salaries and wages are rising comparatively higher than they were last year, looking over the long term, Locks Heath property values are 122.55% higher than they were in January 2002, yet average salaries are only 76.1% higher over the same time frame. This means over the last few years, with average property values so high comparative to salary/wages, many Locks Heath potential buyers have been priced out of being able to purchase their first home.

At first glance, these stats are actually rather positive during this reported time of political uncertainty and the height of Brexit commotion… because I genuinely believe that to be the case. The press have always looked for the bad news (well they do say it is that that sells newspapers), and whilst I am not entering into the pros and cons of Brexit itself, the numbers do stack up quite well since the Brexit vote took place nearly 3 years ago.

Moving forward, when taken with the recent reduction in short to medium term number of property transactions (i.e. the number of Locks Heath properties sold), it should be noted that a lot of the buoyant house price increase has a lot more to do with a shortage of properties on the market rather than an uplift in the Locks Heath housing market generally.

And we can’t forget that Locks Heath isn’t in its own little bubble, as there are noteworthy differences across the UK in property value inflation. House prices in London and the South East have hardly risen or even fallen in some places, whilst in the Midlands, North and other parts of the country they have generally increased.

Looking forward, I would say to the homeowners and buy to let Landlords of the locality that I expect Locks Heath house price growth to remain stable between -0.2% and 0.8% by the end of this year (although they could dip slightly during the summer) … as long as nothing unexpected happens in the world economically or politically of course.

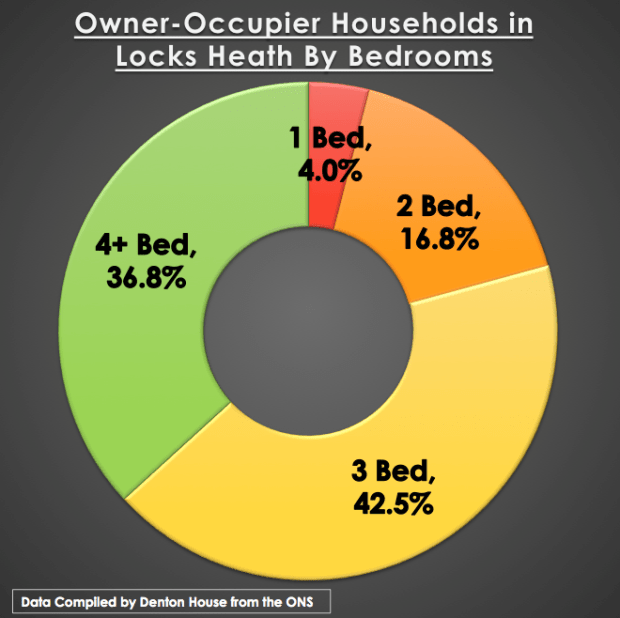

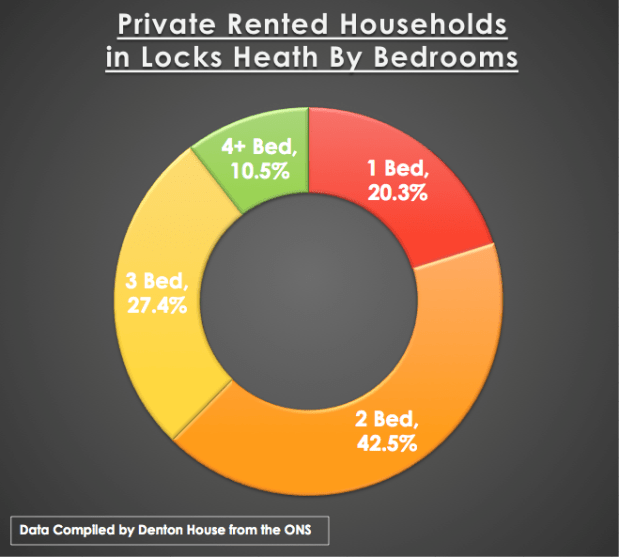

The conventional way of categorising property in Britain is to look at the number of bedrooms rather than its size in square metres (square feet for those of you over 50!). My intuition tells me that homeowners and Tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger the property is likely to be. And it’s not only the tangible additional bedrooms, but those properties with those additional bedrooms tend to have larger (and more) reception (living) rooms. However, if you think about it, this isn’t so surprising given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

The conventional way of categorising property in Britain is to look at the number of bedrooms rather than its size in square metres (square feet for those of you over 50!). My intuition tells me that homeowners and Tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger the property is likely to be. And it’s not only the tangible additional bedrooms, but those properties with those additional bedrooms tend to have larger (and more) reception (living) rooms. However, if you think about it, this isn’t so surprising given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

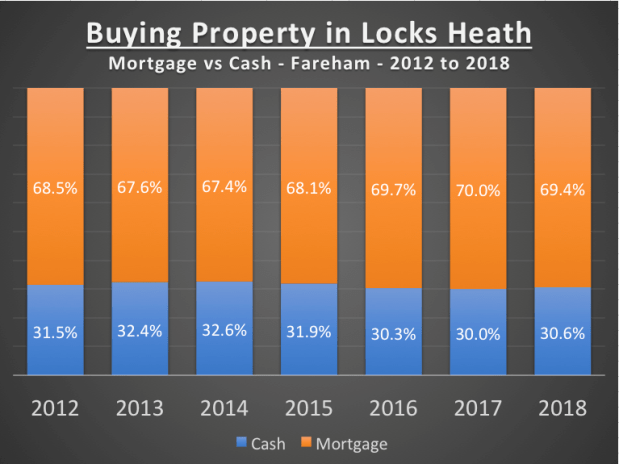

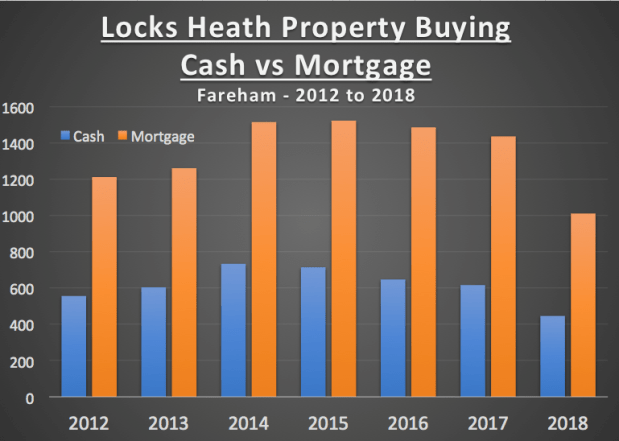

For most Locks Heath people, a mortgage is the only way to buy a property. However, for some, especially Locks Heath homeowners who have paid off their mortgage or Locks Heath buy to let landlords, many have the choice to pay exclusively with cash. So the question is, should you use all your cash, or could a mortgage be a more suitable option?

For most Locks Heath people, a mortgage is the only way to buy a property. However, for some, especially Locks Heath homeowners who have paid off their mortgage or Locks Heath buy to let landlords, many have the choice to pay exclusively with cash. So the question is, should you use all your cash, or could a mortgage be a more suitable option?