The headlines …

- Locks Heath rents up by 3.3% in the last 12 months

- Locks Heath house prices up 10.0% in the last 12 months

- Locks Heath landlords helped by ultra-low mortgage rates and a stamp duty holiday

- Yet, some landlords in Locks Heath anxious about a possible end to no fault evictions

- New EPC rules could cost Locks Heath landlords £10,000+ per property

In this article, I will look at what happened in 2021 in the Locks Heath buy-to-let property market and give you my opinion as to what lies ahead for Locks Heath Landlords in 2022 and beyond.

On a positive note, Locks Heath house prices have rocketed, rents have risen faster than inflation, at the start of the year we had the benefit of a stamp duty holiday and finally, ultra-low mortgage rates, meaning Locks Heath Landlords had lots to be happy about in 2021.

On a more cautious note, the laws regarding renting are currently being debated in Parliament which will see the end of no-fault tenant evictions and changes in regulations will require Locks Heath Landlords to make their buy-to-let rental properties more eco-friendly at a cost of up to £10,000+ each.

So, let’s have a look at these points …

Locks Heath Rents will Continue to Rise in 2022

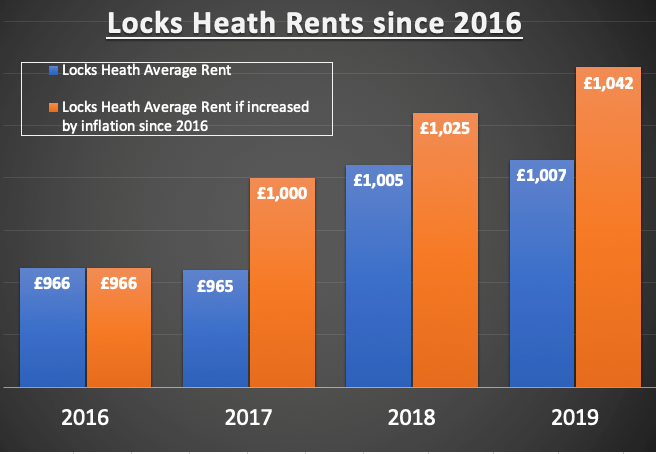

Locks Heath buy-to-let Landlords have seen the average rent of a Locks Heath rental property rise by 3.3% in the last 12 months.

The number of Locks Heath properties available to rent on the property portals (e.g. Rightmove etc) at any one time is roughly 35% to 40% below the last decade’s average, meaning there is much greater competition for each rental property.

Demand has increased for several reasons:

Firstly, some homeowners cashed in on the high prices, sold up and moved into rented property.

Secondly, some Locks Heath buy-to-let Landlords have also cashed in on the buoyant property market and sold their rental property when their existing Tenant handed in their notice.

Finally, the rental sector has an inverse relationship to the state of the general British economy, meaning with the uncertainty in the British economy in the early part of 2021, this meant more people decided to rent rather than tie themselves into a mortgage.

Looking at the supply side of the Locks Heath rental market, in the short term, rents will continue to grow as some Locks Heath Landlords are abandoning the rental market – some because of the impending regulation changes which I will talk about later and others with the natural flow of people cashing in their investments on retirement.

With increased demand and restricted supply, this will only lead to competition becoming more severe between renters, thus making Locks Heath rents continue to rise.

Locks Heath House Price Growth Will Slow

For those that own property, the way house prices grew in 2021 surprised most people.

Locks Heath house prices, according to the Land Registry, grew by 10% in 2021, with the typical Locks Heath home reaching £376,000.

Many local Landlords have been helped by this increase in Locks Heath house prices and will be in a place to cash in on those capital gains by either selling their buy-to-let property (as mentioned in the previous section) or releasing some equity by re-mortgaging.

Whether Locks Heath house price rises carry on at such a rate in 2022 will mainly depend on whether the imbalance between the number of properties that come on to the market (supply) is by the number of buyers (demand).

Most commentators believe that nationally house prices will be between 3% and 5% higher by the end of 2022 and I can see no reason why Locks Heath house prices won’t be in that range by the end of the year either.

Mortgage Rates Will Rise

The reduction in tax relief for Locks Heath buy-to-let Landlords with mortgages in the last five years hit some landlords hard, yet this has been tempered by the inexpensive ultra-low mortgages available to buy-to-let Landlords.

Yet even with the Bank of England increase in base rates, Locks Heath Landlords with big deposits of 40% or more can benefit from low rates. For example, at the time of writing, you can get a BTL mortgage at 1.49% fixed for 5 years with a 40% deposit (meaning borrowing £180,000 on a £300,000 purchase would only cost you £719 per month on a 25-year mortgage – or £224 per month on interest only).

However, those with only a 25% deposit must pay slightly more, but only at a mortgage rate of 1.64% – who can remember mortgage rates of 14% to 15% in 1992?

With inflation rising, the Bank of England has already indicated further interest rate rises are on the cards. I suspect they will be around the 1% mark by Christmas 2022. Therefore, if you are one of the one in five Landlords on a variable rate mortgage, your margins will be squeezed as your variable rate mortgage will rise in line with the Bank of England interest rate rise.

Maybe it’s time to consider fixing your mortgage?

The End of No-fault Evictions?

The Renters’ Reform Bill in England and The Renting Homes Act in Wales are both set to abolish Section 21 (no fault eviction). Section 21 laws allow Landlords to take back possession of their rental properties without having to prove fault by the tenant.

Yet in 2022, Westminster will issue plans for a change of this law which will probably incorporate the eradication of Section 21, which would signify a major change in the balance of power between the Landlord and Tenant.

Some doom mongers are worried that with the abolition of Section 21, Locks Heath Landlords may be unenthusiastic about renting and therefore sell up and leave the rental sector altogether. Yet these people said the same when tax relief for Landlords was changed five years ago.

The Scottish equivalent of Section 21 was abolished at the end of 2017.

At the time, there was some anxiety about how this would affect the Scottish rental market, as anxious Landlords and letting agents felt that they could lose control of their rental properties under this new law. Nonetheless, just over four years later, the rental sector has not collapsed in Scotland. The buy-to-let market remains upbeat, and there are signs that a Scottish Landlords’ right to evict their tenant has been reinforced by these changes in the law.

The reason the Scottish changes worked was the new grounds for repossessing rental properties was clear and wide-ranging. The Scots sped up the slow and unwieldy eviction process where the Landlord had a legal and genuine reason to re-claim their property.

All I hope is the same changes are made south of the border to the court procedure.

New EPC Rules Could Cost Locks Heath Landlords £10,000+ per Property

The law currently stands that Locks Heath Landlords need an Energy Performance Certificate (EPC) with at least a rating of E.

Westminster is anticipated to increase the EPC requirement for private rental properties in England and Wales to an EPC rating of C for all new rental tenancies by 2025/6, and for all existing Tenancies by 2028, whilst Scottish Landlords are also expected to see energy efficiency measures in their new proposed Housing Bill.

The problem is 1,959,045 of the 2,965,455 registered rental properties on the EPC database have an energy rating of D or below.

To take a property from an EPC D rating to a C rating might only cost a few hundred pounds, yet the average for all rental D and E rated properties has been calculated at just over £10,000 per property.

My advice to every Locks Heath Landlord is to look at the full EPC report of their rental property (and if you haven’t got it, contact me and I will send it to you – whether you are a client or not) as that will tell you whether this will be a big or small job.

Renovating the UK’s rental stock to meet the Government’s carbon neutral targets will be a big trial for Landlords. There is talk of exemptions, as there currently is for the existing minimum EPC E rating – yet only time will tell on that front.

Maybe those Locks Heath Landlords currently buying properties to add to their rental portfolio should reconsider their buying strategy? In the past, it has been normal for Locks Heath buy-to-let investors to be attracted to the inexpensive older properties that need an overhaul. However, with the potential energy efficiency laws coming into the game, it’s rational to suggest that buy-to-let Landlords will be more predisposed to buying slightly newer properties rather than have the cost for the upgrades to meet the potential energy targets.

Conclusion

Roll the clock back 20 years and making money from buy-to-let in Locks Heath was as easy as falling off a log. Yet with increased legislation and regulation, together with the changing dynamics of the British economy and the requirements Tenants want in a rental property, making money won’t be as easy over the next 20 years.

It amazes me that 11 out of 20 Landlords do not use a letting agent to help them with their rental portfolio, considering the cost can be offset against your tax.

Moving forward, the savvy Locks Heath Landlords will more and more utilise their letting agent not only to collect the rent and manage the property but also build up their portfolio to withstand the regulatory and demographic changes on the horizon, and to ensure that their investment is fit for purpose in the medium to long-term.

If your existing letting agent does not offer such advice, or you are a self-managing Landlord, let’s have a chat about the future of the Locks Heath rental market.

Whether you are a client of mine or not, if you would like me to look at your rental portfolio and see where you stand, then drop me a line and maybe we can meet for a coffee (or we can meet virtually over Zoom) to discuss the matter – all at no charge.

Should you wait to buy your first home in Locks Heath or buy now? What sort of mortgages are available? What sort of deposit is required? These are questions all Locks Heath buyers are asking at the moment, yet this week I would like to focus on Locks Heath first time buyers and what it means directly and indirectly to Locks Heath homeowners looking to move up the property ladder and Locks Heath buy to let Landlords.

Should you wait to buy your first home in Locks Heath or buy now? What sort of mortgages are available? What sort of deposit is required? These are questions all Locks Heath buyers are asking at the moment, yet this week I would like to focus on Locks Heath first time buyers and what it means directly and indirectly to Locks Heath homeowners looking to move up the property ladder and Locks Heath buy to let Landlords. Before the Covid-19 pandemic hit, 2,690 Locks Heath people worked mainly from home, or about 11.5% of Locks Heath’s 23,360 workforce (compared to the national average of 14.9%). Yet over the last few weeks many hundreds, even thousands more Locks Heath workers have joined them in their spare rooms or at their kitchen or dining room tables.

Before the Covid-19 pandemic hit, 2,690 Locks Heath people worked mainly from home, or about 11.5% of Locks Heath’s 23,360 workforce (compared to the national average of 14.9%). Yet over the last few weeks many hundreds, even thousands more Locks Heath workers have joined them in their spare rooms or at their kitchen or dining room tables. So now we are only a matter of a couple of weeks into lockdown, yet can you believe it I am still speaking with agents from all over the UK, and I do not jest, properties are still being sold and let even in these unprecedented times. Yet I would like to address the question I have been asked many times recently “What will be the effect of Covid-19 on the Locks Heath property market in the short, medium and long term?”

So now we are only a matter of a couple of weeks into lockdown, yet can you believe it I am still speaking with agents from all over the UK, and I do not jest, properties are still being sold and let even in these unprecedented times. Yet I would like to address the question I have been asked many times recently “What will be the effect of Covid-19 on the Locks Heath property market in the short, medium and long term?” Washing Machine Energy Ratings for Houses was the phrase one Locks Heath Landlord told me a few years ago when we were talking about the colour bar chart graphs that every property has had for over 10 years now. Now these weren’t brought in to use the whole palate of ink in people’s printers, but to increase the energy efficiency of the UK’s housing stock. The vast majority of Locks Heath Landlords are, by now, acquainted with the legislation that came into force on the 1st of April 2018, that means all new and renewed private tenancy agreements must have an Energy Performance Certificate (EPC) rating of E or above, otherwise it would be illegal to rent the property out (EPC ratings go A to G – A being the best and G the worst).

Washing Machine Energy Ratings for Houses was the phrase one Locks Heath Landlord told me a few years ago when we were talking about the colour bar chart graphs that every property has had for over 10 years now. Now these weren’t brought in to use the whole palate of ink in people’s printers, but to increase the energy efficiency of the UK’s housing stock. The vast majority of Locks Heath Landlords are, by now, acquainted with the legislation that came into force on the 1st of April 2018, that means all new and renewed private tenancy agreements must have an Energy Performance Certificate (EPC) rating of E or above, otherwise it would be illegal to rent the property out (EPC ratings go A to G – A being the best and G the worst). If you are buying a home in England costing more than £125,000, you will have to pay Stamp Duty Land Tax on the purchase of your new home. In the provinces, it’s called something slightly different, so if you are buying a property in Scotland over £145,000 you will pay Land and Buildings Transaction Tax (LBTT) and for any property over £180,000 in Wales you will pay Land Transaction Tax (LTT). Whatever the tax is called, it is an important factor when moving, when you consider that

If you are buying a home in England costing more than £125,000, you will have to pay Stamp Duty Land Tax on the purchase of your new home. In the provinces, it’s called something slightly different, so if you are buying a property in Scotland over £145,000 you will pay Land and Buildings Transaction Tax (LBTT) and for any property over £180,000 in Wales you will pay Land Transaction Tax (LTT). Whatever the tax is called, it is an important factor when moving, when you consider that It seems that quite a few Locks Heath homeowners and Locks Heath Landlords have become acclimatised to living with the uncertainty of Brexit throughout most of 2019, as figures show many of them decided to get on with living life, started reinvesting their money into Locks Heath property and buying and selling their Locks Heath homes and BTL investments. Land Registry stats confirm that. Current data shows that…

It seems that quite a few Locks Heath homeowners and Locks Heath Landlords have become acclimatised to living with the uncertainty of Brexit throughout most of 2019, as figures show many of them decided to get on with living life, started reinvesting their money into Locks Heath property and buying and selling their Locks Heath homes and BTL investments. Land Registry stats confirm that. Current data shows that… Investing in a Locks Heath buy to let property has become a very different sport over the last few years.

Investing in a Locks Heath buy to let property has become a very different sport over the last few years.

Irrespective of the shenanigans and political goings on in Westminster recently, the housing market (for the time being anyway) shows a striking resilience, fostered by the on-going wide-ranging monetary policy by the Bank of England. With interest rates and unemployment low, UKplc is heading into 2020 in reasonable condition. Additionally, despite the UK’s new homes industry improving its year on year new build figures (building 173,660 new homes this year to date – notably 8% more new homes than at the same time last year), there has been an unequal increase in demand for housing, especially in the most thriving areas of the Country.

Irrespective of the shenanigans and political goings on in Westminster recently, the housing market (for the time being anyway) shows a striking resilience, fostered by the on-going wide-ranging monetary policy by the Bank of England. With interest rates and unemployment low, UKplc is heading into 2020 in reasonable condition. Additionally, despite the UK’s new homes industry improving its year on year new build figures (building 173,660 new homes this year to date – notably 8% more new homes than at the same time last year), there has been an unequal increase in demand for housing, especially in the most thriving areas of the Country.