I had a very interesting conversation the other day with a Locks Heath resident. He is a Locks Heath homeowner, retired and mortgage free. He stated how un-affordable Locks Heath’s rising property prices were and that he worried how the younger generation of Locks Heath could ever afford to buy. He went on to ask if it was right for Landlords to make money on the inability of others to buy property and if, by buying a buy to let property, Locks Heath Landlords are denying the younger generation the ability to buy their own home.

I had a very interesting conversation the other day with a Locks Heath resident. He is a Locks Heath homeowner, retired and mortgage free. He stated how un-affordable Locks Heath’s rising property prices were and that he worried how the younger generation of Locks Heath could ever afford to buy. He went on to ask if it was right for Landlords to make money on the inability of others to buy property and if, by buying a buy to let property, Locks Heath Landlords are denying the younger generation the ability to buy their own home.

Whilst doing my research for my many blog posts on the Locks Heath Property Market, I know that a third of 25 to 30 year olds still live at home. It’s no wonder people are kicking out against buy to let Landlords; as they are the greedy bad people who are cashing in on a social woe. In fact, most people believe the high increases in Locks Heath’s (and the rest of the UK’s) house prices are the very reason owning a home is outside the grasp of these younger would-be property owners.

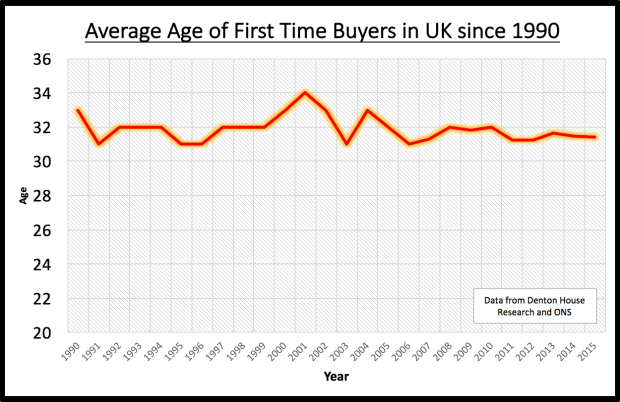

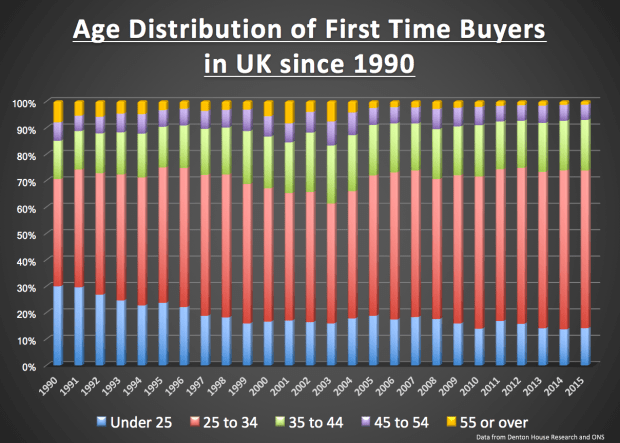

However, the numbers tell a different story. Looking at the age of first time buyers since 1990, the statistics could be seen to pour cold water on the idea that younger people are being priced out of the housing market. In 1990, when data was first published, the average age of a first time buyer was 33, today it’s 31.

Nevertheless, the average age doesn’t tell the whole story. In the early 1990’s, 26.7% of first-time buyers were under 25, while in the last five years just 14.9% were. In the early 1990’s, four out of ten first time buyers were 25 to 34 years of age and now its six out of ten first time buyers.

Although there are also indications of how un-affordable housing is, the house price-to-earnings ratio has almost doubled for first-time buyers in the past 30 years. In 1983 the average Locks Heath home cost a first-time buyer (or buyers in the case of joint mortgages) the equivalent of 3.0 times their total annual earnings, whilst today, that has escalated to 6.1 times their income.

Again, those figures don’t tell the whole story. Back in 1983, the mortgage payments as percentage of mean take home pay for a Locks Heath first time buyer was 31.2%. In 1989, that had risen to 78.6%. Today it is 38.6%… and no that’s not a typo… 38.6% is the correct figure.

So, to answer the gentleman’s questions about the younger generation of Locks Heath being able to afford to buy and if it was right for Landlords to make money on the inability of others to buy property? It isn’t all to do with affordability as the numbers show.

And what of the Landlords? Some say the government should sort the housing problem out themselves, but according to my calculations, £18bn a year would need to be spent for the next 20 or so years to meet current demand for households. That would be the equivalent of raising income tax by 4p in the Pound. I don’t think UK tax payers would swallow that.

So, if the Government haven’t got the money who else will house these people? Private Sector Landlords and thankfully they have taken up the slack over the last 15 years.

Some say there is a tendency to equate property ownership with national prosperity, but this isn’t necessarily the case. The youngsters of Locks Heath are buying houses, but buying later in life. Also, many Locks Heath youngsters are actively choosing to rent for the long term, as it gives them flexibility – something our 21st Century society craves more than ever.

For more articles like this and all of the latest Buy to Let Deals please visit The Locks Heath Property Blog.

There are 23.36 million properties in England and Wales with 64% being owner occupied and 36% being rented either from a private landlord, local authority or housing association.

There are 23.36 million properties in England and Wales with 64% being owner occupied and 36% being rented either from a private landlord, local authority or housing association.

In Locks Heath, of the 17,423 households, 5,718 homes are owned without a mortgage and 8,190 homes are owned by a mortgage. Many homeowners have made contact with me asking what the General Election will do to the Locks Heath property market? The best way to tell the future is to look at the past.

In Locks Heath, of the 17,423 households, 5,718 homes are owned without a mortgage and 8,190 homes are owned by a mortgage. Many homeowners have made contact with me asking what the General Election will do to the Locks Heath property market? The best way to tell the future is to look at the past.

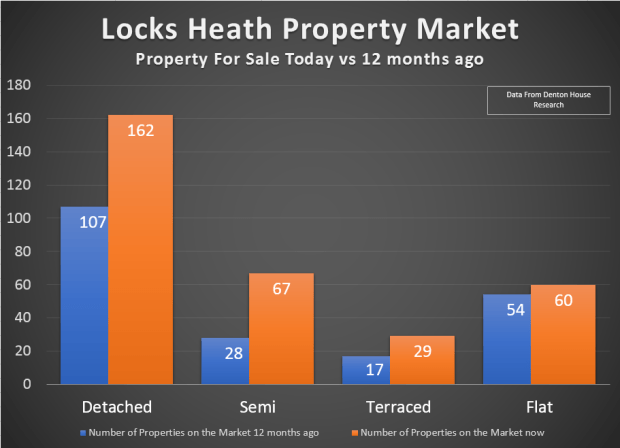

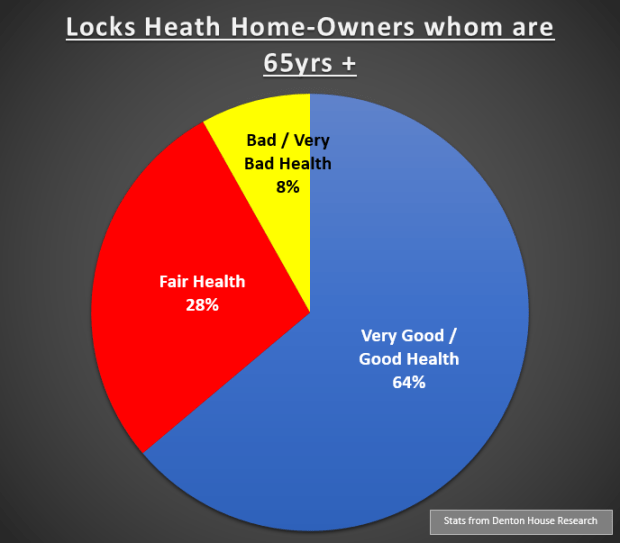

This was a question posed to me on social media a few weeks ago, after my article about our mature members of Locks Heath society and the fact many retirees feel trapped in their homes. After working hard for many years and buying a home for themselves and their family, the children have subsequently flown the nest and now they are left to rattle round in a big house. Many feel trapped in their big homes (hence I dubbed these Locks Heath home owning mature members of our society, ‘Generation Trapped’).

This was a question posed to me on social media a few weeks ago, after my article about our mature members of Locks Heath society and the fact many retirees feel trapped in their homes. After working hard for many years and buying a home for themselves and their family, the children have subsequently flown the nest and now they are left to rattle round in a big house. Many feel trapped in their big homes (hence I dubbed these Locks Heath home owning mature members of our society, ‘Generation Trapped’).

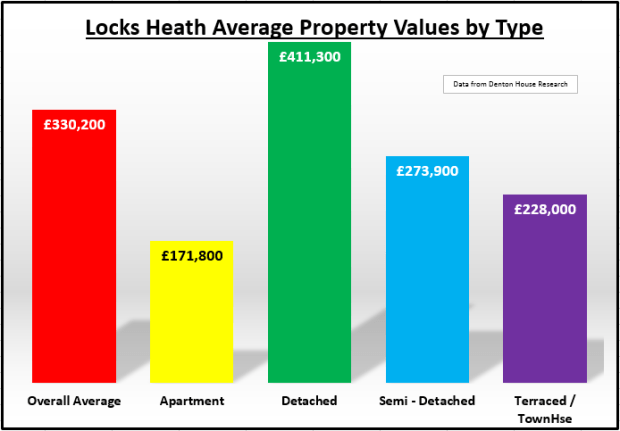

According to the Land Registry’s latest House Price Index for Locks Heath and the surrounding locality, the value of apartments/flats are rising at a faster rate than terraced/town houses, semi-detached properties and even detached property.

According to the Land Registry’s latest House Price Index for Locks Heath and the surrounding locality, the value of apartments/flats are rising at a faster rate than terraced/town houses, semi-detached properties and even detached property.

So all cards up in the air! A general election will be on the books, but one thing is for sure… whoever gets the job to deal with Brexit has a hard job on their hands (I’m just glad its not me!). As it currently stands, by not assuring the rights of EU citizens in the UK, Theresa May has wasted an opportunity to give peace of mind to our EU co-workers working and living in Locks Heath (and the rest of the UK). No.10 Downing Street’s point of view is that in promising the rights of EU citizens in the UK, it will postpone the same guarantee to the 1.5 million UK citizens living in the other nations of the EU.

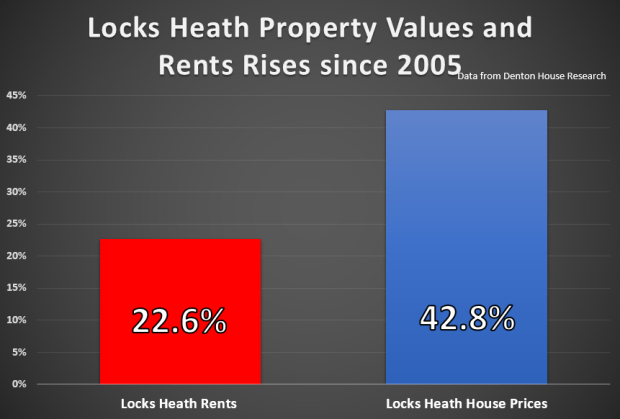

So all cards up in the air! A general election will be on the books, but one thing is for sure… whoever gets the job to deal with Brexit has a hard job on their hands (I’m just glad its not me!). As it currently stands, by not assuring the rights of EU citizens in the UK, Theresa May has wasted an opportunity to give peace of mind to our EU co-workers working and living in Locks Heath (and the rest of the UK). No.10 Downing Street’s point of view is that in promising the rights of EU citizens in the UK, it will postpone the same guarantee to the 1.5 million UK citizens living in the other nations of the EU. The Locks Heath Property Market is a very interesting animal and has been particularly fascinating over the last 12 years when we consider what has happened to Locks Heath rents and house prices.

The Locks Heath Property Market is a very interesting animal and has been particularly fascinating over the last 12 years when we consider what has happened to Locks Heath rents and house prices.

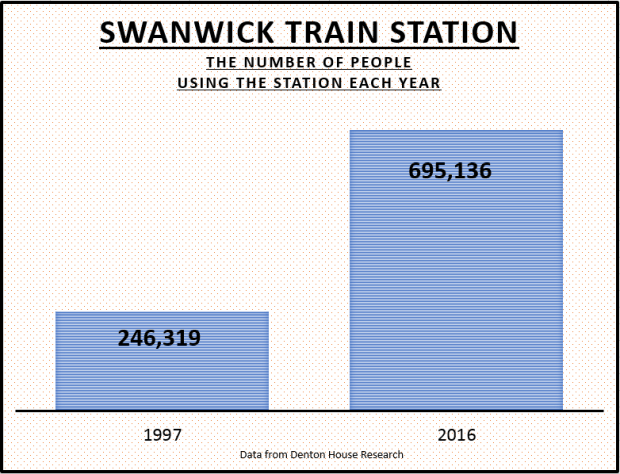

It might surprise you that it isn’t always the poshest villages around the Fareham Borough or the swankiest Locks Heath streets where properties sell and let the quickest. Quite often, it is the ones that have the best transport links. I mean, there is a reason why one of the most popular property programmes on television is called Location, Location, Location!

It might surprise you that it isn’t always the poshest villages around the Fareham Borough or the swankiest Locks Heath streets where properties sell and let the quickest. Quite often, it is the ones that have the best transport links. I mean, there is a reason why one of the most popular property programmes on television is called Location, Location, Location!

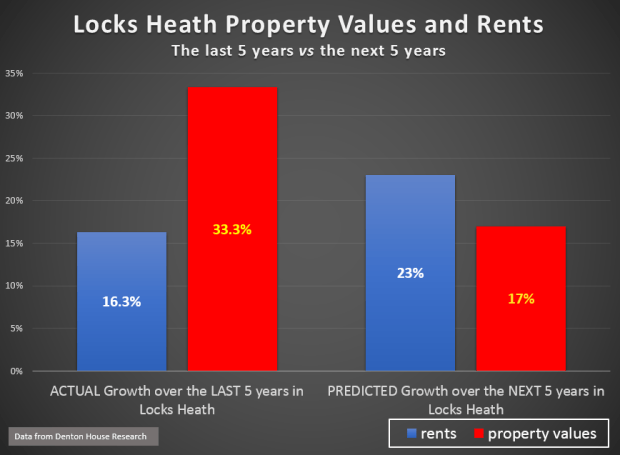

The next five years will see an interesting change in the Locks Heath property market. My recent research has concluded that the rent private tenants pay in Locks Heath will rise faster than Locks Heath property prices over the next five years, creating further issues to Locks Heath’s growing multitude of renters. In fact, my examination of statistics forecasts that ..

The next five years will see an interesting change in the Locks Heath property market. My recent research has concluded that the rent private tenants pay in Locks Heath will rise faster than Locks Heath property prices over the next five years, creating further issues to Locks Heath’s growing multitude of renters. In fact, my examination of statistics forecasts that ..