An Englishman’s Home is His Castle as Maggie Thatcher lauded – everyone should own their own home. In 1971, around 50% of people owned their own home and, as the baby-boomers got better jobs and pay, that proportion of homeowners rose to 69% by 2001. Homeownership was here to stay as many baby boomers assumed it’s very much a cultural thing here in Britain to own your own home.

But on the back of TV programmes like Homes Under the Hammer, these same baby boomers started to jump on the band wagon of Locks Heath buy to let properties as an investment. Locks Heath first time buyers were in competition with Locks Heath Landlords to buy these smaller starter homes pushing house prices up in the 2000’s (as mentioned in Part One last week) beyond the reach of first time buyers. However, it is not as simple as that. Many factors come into play, such as economics, the banks and government policy. But are Locks Heath Landlords fanning the flames of the Locks Heath housing crisis bonfire?

I believe that the Landlords of the 2,299 Locks Heath rental properties are not exploitative and are, in fact, making many positive contributions to Locks Heath and the people of Locks Heath. Like I have said before, Locks Heath (and the rest of the UK) isn’t building enough properties to keep up the demand; with high birth rate, job mobility, growing population and longer life expectancy.

According to the Barker Review, for the UK to standstill and meet current demand, the country needs to be building 8.7 new households each and every year for every 1,000 households already built. Nationally, we are currently running at 5.07 per thousand and in the early part of this decade were running at 4.1 to 4.3 per thousand.

It doesn’t sound a lot of difference, so let us look at what this means for Locks Heath…

For Locks Heath to meet its obligation on the building of new homes, Locks Heath would need to build 162 households each year. Yet, we are missing that figure by around 67 households a year.

For the Government to buy the land and build those additional 67 households, it would need to spend £23,046,072 a year in Locks Heath alone. Add up all the additional households required over the whole of the UK and the Government would need to spend £23.31bn each year… the Country hasn’t got that sort of money!

With these problems, it is the property developers who are buying the old run-down houses and office blocks which are deemed uninhabitable by the local authority, and turning them into new attractive homes to either be rented privately to Locks Heath families or Locks Heath people who need council housing because the local authority hasn’t got enough properties to go around.

The bottom line is that, as the population grows, there aren’t enough properties being built for everyone to have a roof over their head. Rogue Landlords need to be put out of business, whilst Tenants should expect a more regulated rental market, with greater security for Tenants, where they can rely on good Landlords providing them high standards from their safe and modernised home. As in Europe, where most people rent rather than buy, it doesn’t matter who owns the house – all people want is a clean, decent roof over their head at a reasonable rent.

So only you, the reader, can decide if buy to let is immoral. But first let me ask this question – if the private buy to let Landlords had not taken up the slack and provided a roof over these people’s heads over the last decade where would these Tenants be living now?

I know how my readers like to keep abreast of planned developments in the local area. Having read the article below on the Daily Echo’s website over the weekend regarding two planned sites in Warsash I thought it was worth sharing.

I know how my readers like to keep abreast of planned developments in the local area. Having read the article below on the Daily Echo’s website over the weekend regarding two planned sites in Warsash I thought it was worth sharing.

Investing in Locks Heath buy to let property is different from investing in the stock market or depositing your hard-earned cash in the Building Society. When you invest your money in the Building Society, this is considered by many as the ‘safe option’ but the returns you can achieve are awfully low (the best 2-year bond rate from Nationwide is a whopping 0.75% a year!). Another investment is the Stock Market, which can give good returns, but unless you are on the phone every day to your Stockbroker, most people invest in stock market funds, making the investment quite hands-off and one always has the feeling of not being in control.

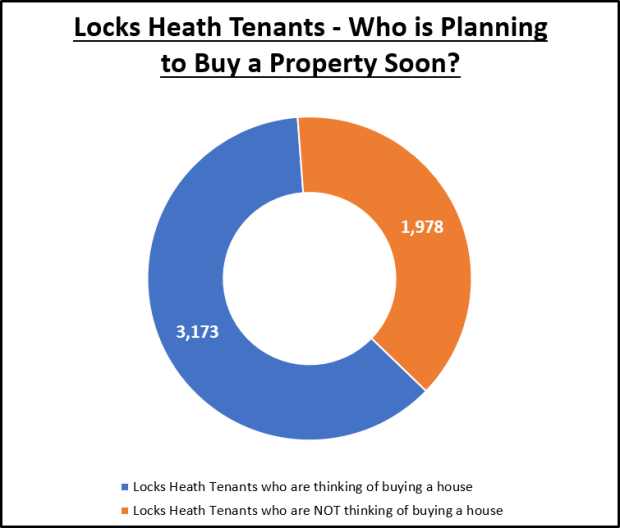

Investing in Locks Heath buy to let property is different from investing in the stock market or depositing your hard-earned cash in the Building Society. When you invest your money in the Building Society, this is considered by many as the ‘safe option’ but the returns you can achieve are awfully low (the best 2-year bond rate from Nationwide is a whopping 0.75% a year!). Another investment is the Stock Market, which can give good returns, but unless you are on the phone every day to your Stockbroker, most people invest in stock market funds, making the investment quite hands-off and one always has the feeling of not being in control. Two weeks ago I wrote an article on the plight of the Locks Heath 20 something’s often referred to by the press as ‘Generation Rent’. Attitudes to renting have certainly changed over the last twenty years and as my analysis suggested, this change is likely to be permanent. In the article, whilst a minority of this Generation Rent feel trapped, the majority don’t – making renting a choice not a predicament. The Royal Institution of Chartered Surveyors (RICS) predicted that the private rental sector is likely to grow substantially by 1.8m households across the UK in the next 8 years, with demand for rental property unlikely to slow and newly formed households continuing to choose the rental market as opposed to buying.

Two weeks ago I wrote an article on the plight of the Locks Heath 20 something’s often referred to by the press as ‘Generation Rent’. Attitudes to renting have certainly changed over the last twenty years and as my analysis suggested, this change is likely to be permanent. In the article, whilst a minority of this Generation Rent feel trapped, the majority don’t – making renting a choice not a predicament. The Royal Institution of Chartered Surveyors (RICS) predicted that the private rental sector is likely to grow substantially by 1.8m households across the UK in the next 8 years, with demand for rental property unlikely to slow and newly formed households continuing to choose the rental market as opposed to buying.

The Locks Heath housing market has gone through a sea of change in the past decades with the Buy-to-Let (BTL) sector evolving as a key trend, for both Locks Heath Tenants and Locks Heath Landlords.

The Locks Heath housing market has gone through a sea of change in the past decades with the Buy-to-Let (BTL) sector evolving as a key trend, for both Locks Heath Tenants and Locks Heath Landlords.

The good old days of the 1980’s eh… with such

The good old days of the 1980’s eh… with such

If I were a buy to let Landlord in Locks Heath today, I might feel a little bruised by the assault made on my wallet after being (and continuing to be) ransacked over the last 12 months by HM Treasury’s tax changes on buy to let. To add insult to injury, Brexit has caused a tempering of the Locks Heath property market with property prices not increasing by the levels we have seen in the last few years. I think we might even see a very slight drop in property prices this year and, if Locks Heath property prices do drop, the downside to that is that first time buyers could be attracted back into the Locks Heath property market; meaning less demand for renting (meaning rents will go down). Yet, before we all run for the hills, all these things could be serendipitous to every Locks Heath Landlord, almost a blessing in disguise.

If I were a buy to let Landlord in Locks Heath today, I might feel a little bruised by the assault made on my wallet after being (and continuing to be) ransacked over the last 12 months by HM Treasury’s tax changes on buy to let. To add insult to injury, Brexit has caused a tempering of the Locks Heath property market with property prices not increasing by the levels we have seen in the last few years. I think we might even see a very slight drop in property prices this year and, if Locks Heath property prices do drop, the downside to that is that first time buyers could be attracted back into the Locks Heath property market; meaning less demand for renting (meaning rents will go down). Yet, before we all run for the hills, all these things could be serendipitous to every Locks Heath Landlord, almost a blessing in disguise. Yields will rise if Locks Heath property prices fall, which will also make it easier to obtain a buy to let mortgage, as the income would cover more of the interest cost. If property values were to level off or come down that could help Locks Heath Landlords add to their portfolio. Rental demand in Locks Heath is expected to stay solid and may even see an improvement if uncertainty is prolonged. However, there is something even more important that Locks Heath Landlords should be aware of: the change in the human nature of these 20 something potential first time buyers.

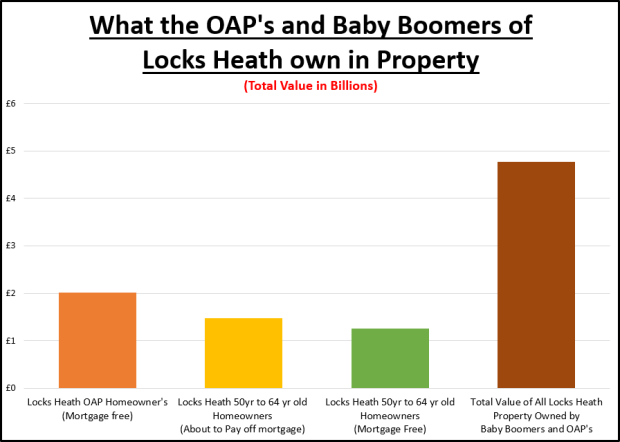

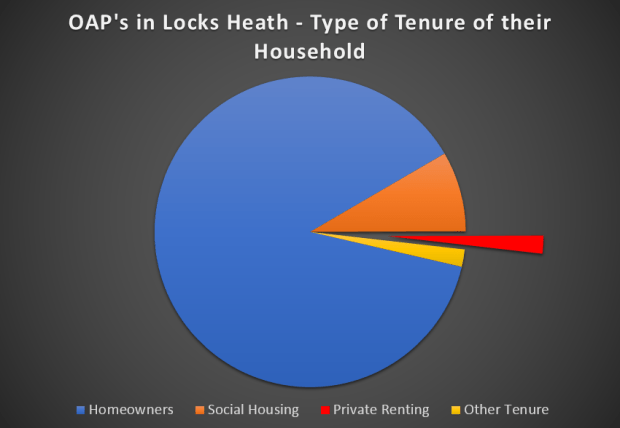

Yields will rise if Locks Heath property prices fall, which will also make it easier to obtain a buy to let mortgage, as the income would cover more of the interest cost. If property values were to level off or come down that could help Locks Heath Landlords add to their portfolio. Rental demand in Locks Heath is expected to stay solid and may even see an improvement if uncertainty is prolonged. However, there is something even more important that Locks Heath Landlords should be aware of: the change in the human nature of these 20 something potential first time buyers. Recent statistics published by the Office of National Statistics show that there are 267,704 private rented households in the Country that are occupied by people aged 65 and older, meaning 4.39% of OAP’s are living in private rented property.

Recent statistics published by the Office of National Statistics show that there are 267,704 private rented households in the Country that are occupied by people aged 65 and older, meaning 4.39% of OAP’s are living in private rented property.

Can we blame the 55 to 70-year-old Locks Heath citizens for the current housing crisis in the town?

Can we blame the 55 to 70-year-old Locks Heath citizens for the current housing crisis in the town?