Well, it doesn’t seem like two minutes ago that it was Christmas – and now it’s all over! One cold December afternoon, after arranging the office’s Christmas cards I thought I would nip out to Waitrose to get some lunch. I met an old client of mine in there and we got talking about the Locks Heath property market. I had just completed my research for my next blog article and I would like to share with you the parts of the conversation relating to the Locks Heath property market.

He asked me what my thoughts were about the last half of the year in regard to the Locks Heath property market and if there were any great buy to let deals around. In reply I said that, in my view, shrugging off the uncertainty of the initial post Brexit vote, I have seen an increase in supply and a rise in the number of properties selling at the lower to middle end of the market, meaning both first time buyers and buy to let Landlords have been returning in the last few months – proof the market is beginning to bounce back.

So let’s look at the numbers…

In November 2016, according to the three main property portals (Rightmove, Zoopla and OnTheMarket) there were a total of 335 properties for sale in Locks Heath. In November 2015, there were only 293 properties for sale, a rise of 14%.

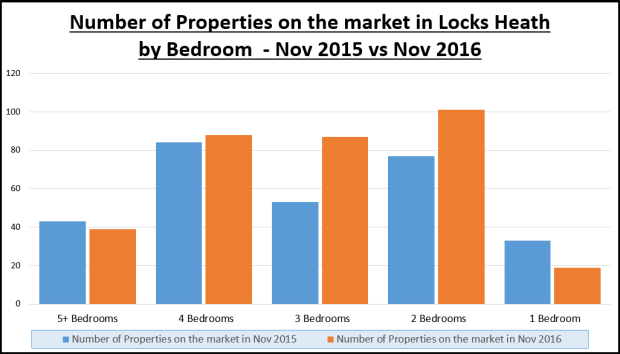

When I split it down into bedrooms (note things like building plots and part commercial/part residential etc won’t be in these figures so the numbers below wont exactly match up to those in the above paragraph).

| # Properties on the market in Nov 2015 | # Properties on the market in Nov 2016 | Percentage Change | |

| 5+ Bedrooms | 43 | 39 | -9% |

| 4 Bedrooms | 84 | 88 | +5% |

| 3 Bedrooms | 53 | 87 | +64% |

| 2 Bedrooms | 77 | 101 | +31% |

| 1 Bedroom | 33 | 19 | -42% |

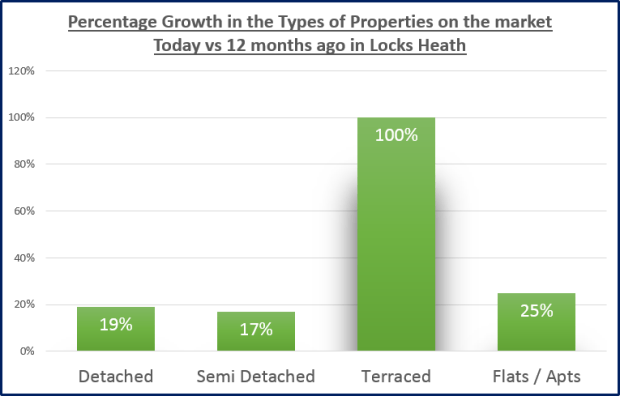

… and when I looked at type of properties it got even more interesting…

| Type of Property | # Properties on the market in Nov 2015 | # Properties on the market in Nov 2016 | Percentage Change |

| Detached | 139 | 149 | +7% |

| Semi | 37 | 48 | +30% |

| Terraced | 7 | 27 | +286% |

| Flat | 79 | 76 | -4% |

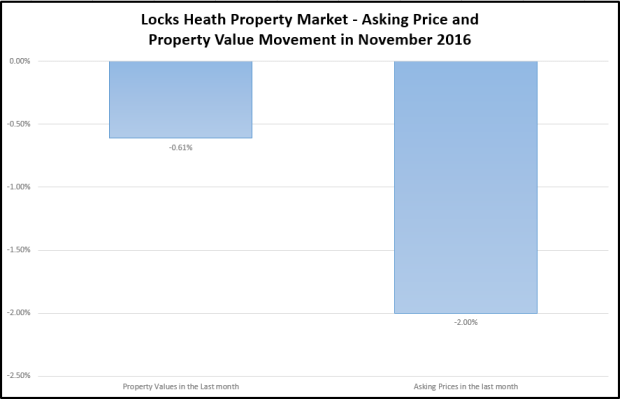

As the number of Locks Heath properties put up for sale has risen by 14%, homeowners have become more realistic about how much their homes are worth. This increase in homeowners wanting to sell suggests there is renewed confidence in the Locks Heath property market and there are also signs that people are being more realistic about pricing their property.

As you can see, there has been a significant uplift in terraced properties, which means they are a great choice for first time buyers and Landlords. So with a combination of realistic pricing and more properties on the market – both first time buyers and Landlords alike might be able to pick up a few bargains!

While Brexit has not yet had a sizeable impact on the Locks Heath housing market, my analysis is pointing to the fact that the economic viewpoint still remains uncertain and Locks Heath property price growth is likely to be more subdued in 2017 – although that isn’t a bad thing so let me explain.

While Brexit has not yet had a sizeable impact on the Locks Heath housing market, my analysis is pointing to the fact that the economic viewpoint still remains uncertain and Locks Heath property price growth is likely to be more subdued in 2017 – although that isn’t a bad thing so let me explain.

Well, hasn’t 2016 been eventful. The ups and downs of Brexit, the Queen’s 90th, Andy Murray winning Wimbledon, Trump, Bake Off to Channel 4 and something close to the hearts of every buy to let Landlord and homeowner in Locks Heath … the Locks Heath property market.

Well, hasn’t 2016 been eventful. The ups and downs of Brexit, the Queen’s 90th, Andy Murray winning Wimbledon, Trump, Bake Off to Channel 4 and something close to the hearts of every buy to let Landlord and homeowner in Locks Heath … the Locks Heath property market.

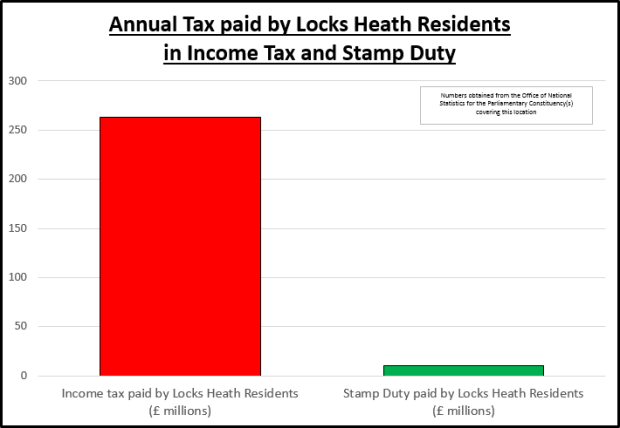

Apart from some minor exemptions, Stamp Duty is paid by anyone buying a property over £125,000 in the UK. It presently raises £10.68bn a year for the HM Treasury (interesting when compared with £27.6bn in fuel duty, £10.69bn in alcohol duty and £9.48bn in tobacco duty).

Apart from some minor exemptions, Stamp Duty is paid by anyone buying a property over £125,000 in the UK. It presently raises £10.68bn a year for the HM Treasury (interesting when compared with £27.6bn in fuel duty, £10.69bn in alcohol duty and £9.48bn in tobacco duty).

Figures just released by the Bank of England, show that for the first half of 2016, £128.73bn was lent by UK banks to buy UK property – impressive when you consider only £106.7bn was lent in the first half of 2015. Even more interesting, was that most of the difference was in Q2, as £68.12bn was lent by UK banks in new mortgages for house purchases, which is the highest it has been for two years. Looking locally, in Locks Heath last quarter, £939.9m was loaned on SO31 properties alone!

Figures just released by the Bank of England, show that for the first half of 2016, £128.73bn was lent by UK banks to buy UK property – impressive when you consider only £106.7bn was lent in the first half of 2015. Even more interesting, was that most of the difference was in Q2, as £68.12bn was lent by UK banks in new mortgages for house purchases, which is the highest it has been for two years. Looking locally, in Locks Heath last quarter, £939.9m was loaned on SO31 properties alone!

The Locks Heath Property Market continues to disregard the end of the world prophecies of a post Brexit fallout with a return to business as usual after the summer break.

The Locks Heath Property Market continues to disregard the end of the world prophecies of a post Brexit fallout with a return to business as usual after the summer break.

Back in the Spring there was a surge in Locks Heath Landlords buying buy to let property in Locks Heath as they tried to beat George Osborne’s new stamp duty changes which kicked in on the 1st April 2016. To give you an idea of the sort of numbers we are talking about, below are the property statistics for sales either side of the deadline in SO31.

Back in the Spring there was a surge in Locks Heath Landlords buying buy to let property in Locks Heath as they tried to beat George Osborne’s new stamp duty changes which kicked in on the 1st April 2016. To give you an idea of the sort of numbers we are talking about, below are the property statistics for sales either side of the deadline in SO31.

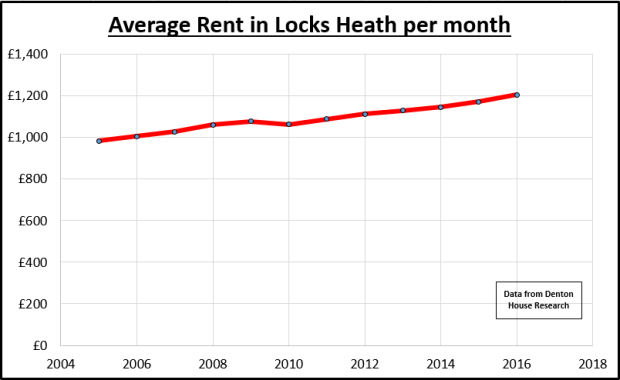

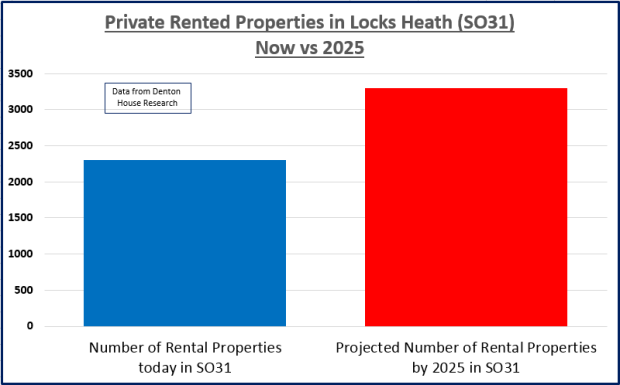

I was having an interesting chat the other day with a Locks Heath landlord. We got talking about the Locks Heath Property Market and this landlord brought up the subject of a report he had read from the Royal Institution of Chartered Surveyors (RICS) and PricewaterhouseCoopers (PwC) that stated that almost 1.8m new rental homes are needed by 2025 to keep up with current demand from tenants. He wanted to know what this meant for Locks Heath.

I was having an interesting chat the other day with a Locks Heath landlord. We got talking about the Locks Heath Property Market and this landlord brought up the subject of a report he had read from the Royal Institution of Chartered Surveyors (RICS) and PricewaterhouseCoopers (PwC) that stated that almost 1.8m new rental homes are needed by 2025 to keep up with current demand from tenants. He wanted to know what this meant for Locks Heath.

I had an interesting chat with a Warsash landlord who owns a few properties in the area this week – He popped his head in to my office whilst he was in Park Gate on some errands. We had never spoken before (because he uses another agent in the suburb to manage his Locks Heath properties) yet, after reading my blog on the Locks Heath Property Market for a while, the landlord wanted to know my thoughts on how the recent interest rate cut would affect the Locks Heath property market. I would also like to share these thoughts with you…

I had an interesting chat with a Warsash landlord who owns a few properties in the area this week – He popped his head in to my office whilst he was in Park Gate on some errands. We had never spoken before (because he uses another agent in the suburb to manage his Locks Heath properties) yet, after reading my blog on the Locks Heath Property Market for a while, the landlord wanted to know my thoughts on how the recent interest rate cut would affect the Locks Heath property market. I would also like to share these thoughts with you…

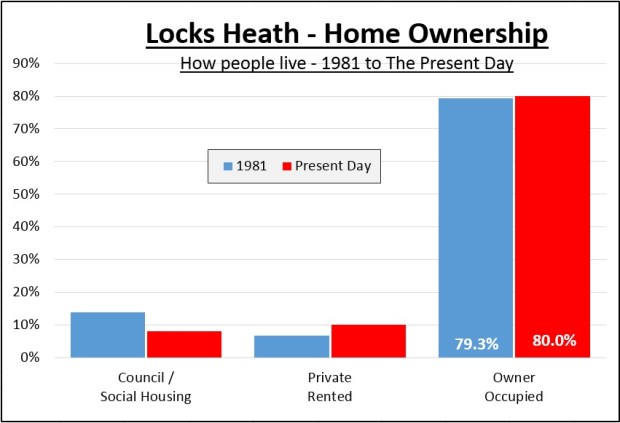

Roll the clock back 35 years to 1981, and Mrs. Thatcher was in power, we had a Royal Wedding, Britain won the Ashes and Bucks Fizz won Eurovision with ‘Making your Mind up’. Haven’t things changed? The number of homeowners and property investors who said they wish they had hindsight and bought up every house in Locks Heath all those years ago, especially when you consider what has happened to Locks Heath property values, as…

Roll the clock back 35 years to 1981, and Mrs. Thatcher was in power, we had a Royal Wedding, Britain won the Ashes and Bucks Fizz won Eurovision with ‘Making your Mind up’. Haven’t things changed? The number of homeowners and property investors who said they wish they had hindsight and bought up every house in Locks Heath all those years ago, especially when you consider what has happened to Locks Heath property values, as…