Over the last month, the Locks Heath property market has seen some interesting movement in house prices, as property values in the Fareham Borough Council area rose by 1.5%, to leave annual price growth at 13.8%. These compare well to the national figures where property prices across the UK saw a monthly uplift of 0.42%, meaning the annual property values across the Country are 8.3% higher, this is all despite the constraining factors of Stamp Duty changes in the spring and more recently our friend Brexit.

Over the last month, the Locks Heath property market has seen some interesting movement in house prices, as property values in the Fareham Borough Council area rose by 1.5%, to leave annual price growth at 13.8%. These compare well to the national figures where property prices across the UK saw a monthly uplift of 0.42%, meaning the annual property values across the Country are 8.3% higher, this is all despite the constraining factors of Stamp Duty changes in the spring and more recently our friend Brexit.

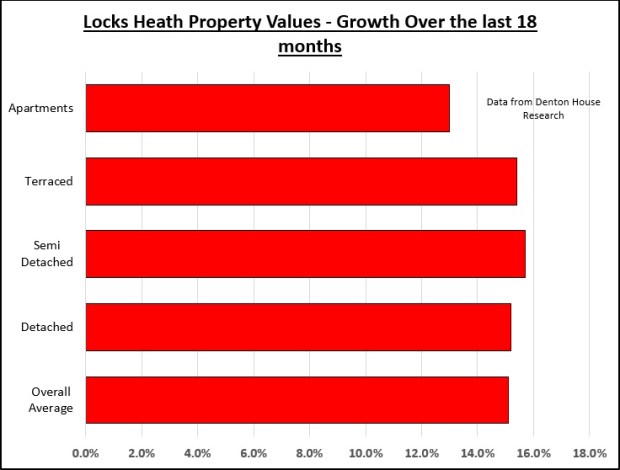

Looking at the figures for the last 18 months makes even more fascinating reading, whereby house prices are 15.1% higher, again thought provoking when compared to the national average figure of 13.6% higher.

However, it gets more remarkable when we look at how the different sectors of the Locks Heath market are performing. Over the last 18 months, in the Fareham Borough Council area, the best performing type of property was the semi, which outperformed the area average by 0.5% whilst the worst performing type was the apartment, which under-performed the area average by 1.8%.

Now the difference doesn’t sound that much, but remember two things, this is only over eighteen months and the gap of 2.3% (the difference between the semi at +0.5% and apartments at -1.8%) converts into a few thousand pounds disparity, when you consider the average price paid for a semi-detached property in Locks Heath itself over the last 12 months was £288,400 and the average price paid for a Locks Heath apartment was £163,900 over the same time frame.

I know all the Locks Heath Landlords and homeowners will want to know how each of the property types have performed, so this is what has happened to property prices over the last 18 months in the area:

- Overall Average +15.1%

- Detached +15.2%

- Semi Detached +15.7%

- Terraced +15.4%

- Apartments +13.0%

So what does all this mean to Locks Heath homeowners and Locks Heath Landlords and what does the future hold?

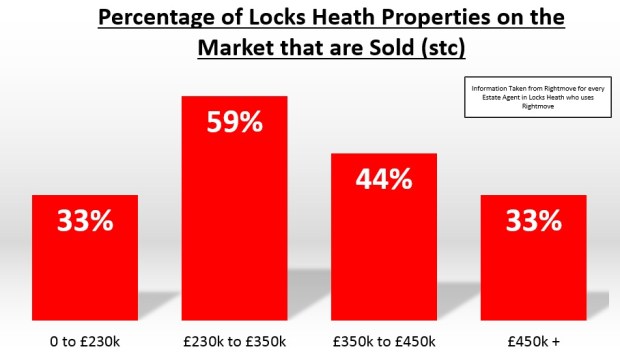

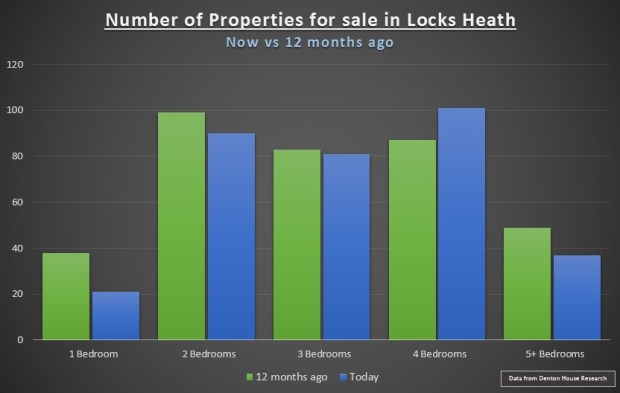

When I looked at the month-by-month figures for the area you can quite clearly see there is a slight tempering of the Locks Heath property market over these last few months. I have mentioned in previous articles that the number of properties on the market in Locks Heath has increased this summer, something that hasn’t happened since 2008. Greater choice for buyers means, using simple supply and demand economics, that top prices won’t be achieved on every Locks Heath property. You see, some of that growth in Locks Heath property values throughout early 2016 may have come about because of a surge in house purchase activity, an indirect result of the increase in stamp duty on second homes from April, thus providing a temporary boost to prices.

However, it may be possible the recent pattern of robust employment growth, growing real earnings and low borrowing costs will tilt the demand/supply seesaw in favour of sellers and exert upward pressure on prices once again in the quarters ahead.

For more articles like this please visit the Locks Heath Property Blog.

Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.

Well it has been a few months since Brexit and as we settle into the Autumn with The Great British Bake Off, Strictly and the Football season the newspapers are returning to their mixed messages of good news, bad news and indifferent news about the Brit’s favourite subject after the weather… the property market.

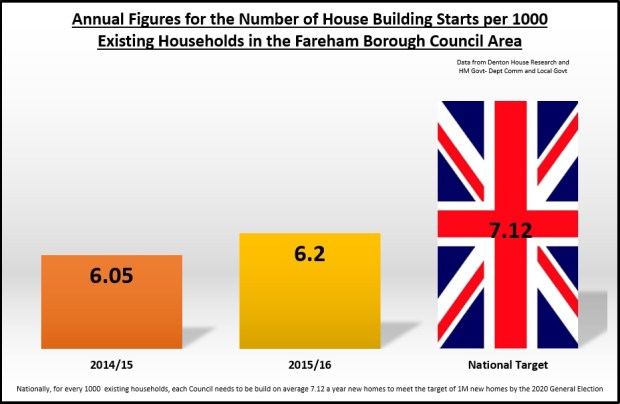

Let me speak frankly, even with Brexit and the fact immigration numbers will now be reduced in the coming years, there is an unending and severe shortage of new housing being built in the Locks Heath area (and the UK as a whole). Even if there are short term confidence trembles fueled by newspapers hungry for bad news, the ever growing population of Locks Heath with its high demand for property versus curtailed supply of properties being built, this imbalance of supply/demand and the possibility of even lower interest rates will underpin the property market.

Let me speak frankly, even with Brexit and the fact immigration numbers will now be reduced in the coming years, there is an unending and severe shortage of new housing being built in the Locks Heath area (and the UK as a whole). Even if there are short term confidence trembles fueled by newspapers hungry for bad news, the ever growing population of Locks Heath with its high demand for property versus curtailed supply of properties being built, this imbalance of supply/demand and the possibility of even lower interest rates will underpin the property market.

Even the most sane person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market. Excluding central London which is another world, most commentators are saying prices will be affected by around 10%. So looking at the commentators’ thoughts in more detail, property values in Locks Heath will be 10% lower than they would have been if we hadn’t voted to leave the EU.

Even the most sane person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market. Excluding central London which is another world, most commentators are saying prices will be affected by around 10%. So looking at the commentators’ thoughts in more detail, property values in Locks Heath will be 10% lower than they would have been if we hadn’t voted to leave the EU. A few weeks ago I was asked a fascinating question by a local Councillor who, after reading the Locks Heath Property Blog, emailed me and asked me –

A few weeks ago I was asked a fascinating question by a local Councillor who, after reading the Locks Heath Property Blog, emailed me and asked me –

Locks Heath is already in the clutches of a population crisis that has now started to affect the quality of life of those living in Locks Heath. There are simply not enough homes in Locks Heath to house the greater number of people wanting to live in the suburb. The burden on public services is almost at breaking point with many parents unable to send their child to their first choice of primary or secondary school and the chances of getting a decent Dentist or GP Doctor Surgery next to nil.

Locks Heath is already in the clutches of a population crisis that has now started to affect the quality of life of those living in Locks Heath. There are simply not enough homes in Locks Heath to house the greater number of people wanting to live in the suburb. The burden on public services is almost at breaking point with many parents unable to send their child to their first choice of primary or secondary school and the chances of getting a decent Dentist or GP Doctor Surgery next to nil.

The orthodox way of classifying property in the UK is to look at the number of bedrooms rather than its size in square metres (although now we are leaving the EU – I wonder if we can go back to feet and inches?). It seems that homeowners and tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger it is likely to be. The reason being not only the actual additional bedroom space, but the properties with more bedrooms tend to have larger / more reception (living) rooms. However, if you think about it, this isn’t so astonishing given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

The orthodox way of classifying property in the UK is to look at the number of bedrooms rather than its size in square metres (although now we are leaving the EU – I wonder if we can go back to feet and inches?). It seems that homeowners and tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger it is likely to be. The reason being not only the actual additional bedroom space, but the properties with more bedrooms tend to have larger / more reception (living) rooms. However, if you think about it, this isn’t so astonishing given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

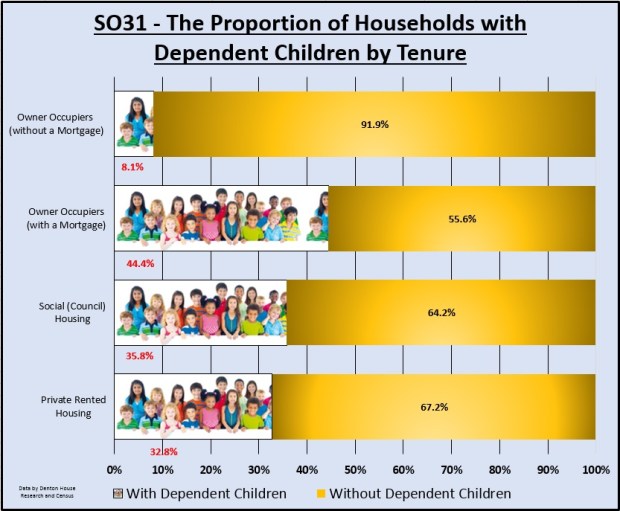

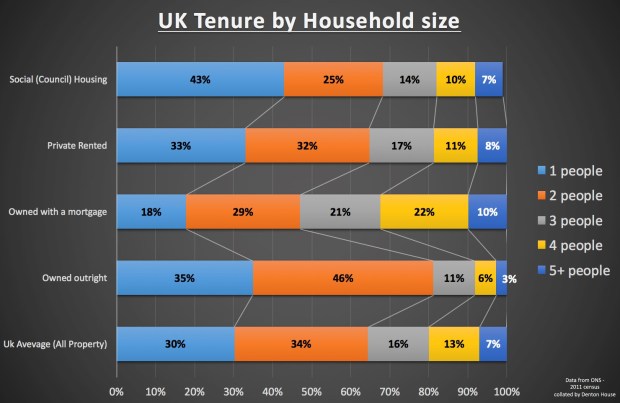

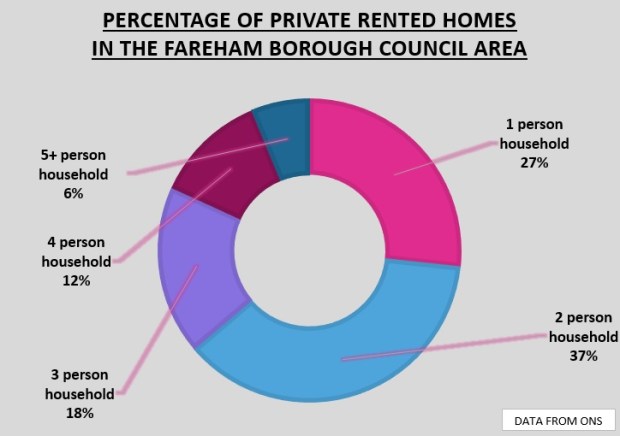

I was having an interesting chat with a Locks Heath buy to let Landlord the other day when the subject of size of households came up in conversation. For those of you who read my Brexit article published on the morning after the referendum, one of the reasons on why I thought the Locks Heath property market would, in the medium to long term, be OK, was the fact that the size of households in the 21st Century was getting smaller – which would create demand for Locks Heath Property and therefore keep property prices from dropping.

I was having an interesting chat with a Locks Heath buy to let Landlord the other day when the subject of size of households came up in conversation. For those of you who read my Brexit article published on the morning after the referendum, one of the reasons on why I thought the Locks Heath property market would, in the medium to long term, be OK, was the fact that the size of households in the 21st Century was getting smaller – which would create demand for Locks Heath Property and therefore keep property prices from dropping.

Well it’s been four weeks since the Referendum vote and we have had a chance to reflect on the momentous decision that the British public took. Many of you read the article I wrote on the morning of the results. I had gone to bed the night before with a draft of my Remain article nicely all but finished, to be presented, first thing in the morning, with the declaration by the BBC saying we were leaving the EU. I don’t think any of us were expecting that.

Well it’s been four weeks since the Referendum vote and we have had a chance to reflect on the momentous decision that the British public took. Many of you read the article I wrote on the morning of the results. I had gone to bed the night before with a draft of my Remain article nicely all but finished, to be presented, first thing in the morning, with the declaration by the BBC saying we were leaving the EU. I don’t think any of us were expecting that.