That number surprised you didn’t it? With the General Election done, I thought it time to reflect on renting in the manifestos and party-political broadcasts and ask why?

That number surprised you didn’t it? With the General Election done, I thought it time to reflect on renting in the manifestos and party-political broadcasts and ask why?

As the best way to tell the future is to look at to the past, so we decided to look at the number of people who rented a century ago (1920’s), and surprisingly 76% of people rented their home in the UK (as renting then was considered the norm). Yet in the latter part of the 1920’s, builders of the suburban housing estates with their bay fronted semis started to sell the dream of home ownership to smart renters.

Up until the mid 1920’s, the mortgage had been seen as a millstone around your neck. Now, due to some clever marketing by those same builders, it was started to be seen as a shrewd long-term investment to buy your own home with a mortgage. It fuelled the ambitions and goals of the up and coming well-to-do working class who reclassed themselves as lower-middle class. Meanwhile, the Government encouraged (through tax breaks) people to save in Building Societies whom in turn lent the money to these up and coming new homeowners thorough mortgages.

Roll the clock forward to the decade of the young Elvis, Chuck Berry, and Bill Haley (1950’s) and still 72% of Brits rented their home. Homeownership had boomed in the preceding 30 years, yet so had council house building. Then, as we entered the 1960’s and 1970’s homeownership started to grow at a higher rate than council housing.

The rate of homeownership started to drop substantially after the mid 1990’s, and now we roll the clock forward to today, there is no stigma at all to renting … everyone is doing it. In fact, of the…

42,795 residents of Locks Heath, 7,538 of you rent your house

from either the council, housing association or private Landlords – meaning 17.6% of Locks Heath people are Tenants. Yet read the Daily Mail, and you would think the idea of homeownership is deeply embedded in the British soul?

34,657 Locks Heath people live in an owner-occupied property (or 81%)

So, we have a paradox – homeowners or renters? The reason I suggest this, is, I noticed on the run up to the Election that housing was used at the General Election as way to get votes. This is nothing new, as all parties have always used housing to get votes, although previously it was about which party would build more council houses in the 1950’s through to council Right to Buy with Thatcher (and everyone since) – running election campaigns promising everybody their own home in one way or another.

Yet, did you notice at this election something changed? The parties weren’t talking so much about increasing homeownership but about protecting the Tenant. It seems the link between homeownership as the main goal of British life is starting to change as we are slowly turning to a more European way of living. Renting is here to stay in Locks Heath and incrementally growing year on year. You see, in Britain there is no property tax based on ownership, which many other western countries have. Instead Council Tax is paid by the occupier of the home (meaning the Tenant pays – not necessarily the owner).

Both parties wanted to end no-fault evictions, yet Labour went further and mentioned rent controls in their manifesto. As I have mentioned before in other articles on the Locks Heath property market, rents since 2008 (even in central London) have not kept up with inflation – so again was that another headline to grab votes/election bribe? The fact is the majority of new British households formed since the Millennium can now expect to rent from a private Landlord for life – therefore the parties focus on this important demographic.

Yet even with the new mortgage relief tax rules for Landlords and the 200+ of legislation that govern the private rental sector, buy to let is still a viable investment option for most investors in Locks Heath. There has never been a better time to purchase buy to let property in Locks Heath … but buy wisely. Gone are the days when you would make a profit on anything with four walls and a roof. Most importantly do your homework, take advice and consider your options.

In the late spring, the Government announced that they were planning to end no-fault evictions for tenants living in private rented accommodation.

In the late spring, the Government announced that they were planning to end no-fault evictions for tenants living in private rented accommodation. Many mature readers of this Locks Heath property market blog will remember buying their first home as 20 or 30 somethings, probably in Locks Heath many years ago, yet read the newspapers now and feel it is all doom and gloom for todays’ first-time buyers.

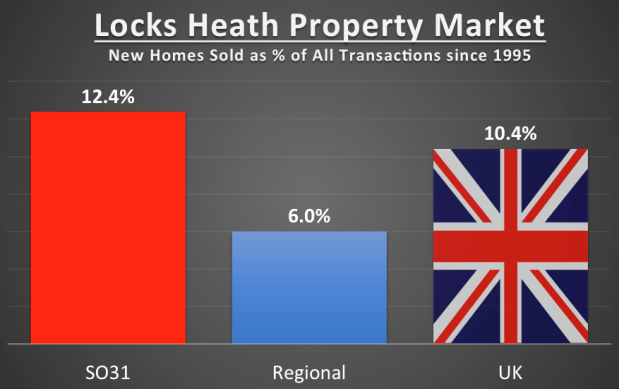

Many mature readers of this Locks Heath property market blog will remember buying their first home as 20 or 30 somethings, probably in Locks Heath many years ago, yet read the newspapers now and feel it is all doom and gloom for todays’ first-time buyers. Of the 23,500 houses and apartments sold in Locks Heath (SO31) since 1995, 2,700 of those have been new homes, representing 12.4% of property sold. So, I wondered how that compared to both the regional and the national picture… and from that, the pertinent questions are: are we building too many new homes or are we not building enough?

Of the 23,500 houses and apartments sold in Locks Heath (SO31) since 1995, 2,700 of those have been new homes, representing 12.4% of property sold. So, I wondered how that compared to both the regional and the national picture… and from that, the pertinent questions are: are we building too many new homes or are we not building enough?

Over the last 5 years we have seen some interesting subtle changes to the Locks Heath property market as buying patterns of Landlords have changed ever so slightly.

Over the last 5 years we have seen some interesting subtle changes to the Locks Heath property market as buying patterns of Landlords have changed ever so slightly.

With the Government preparing to control Tenants’ deposits at five weeks rent, Locks Heath Landlords will soon only be protected in the event of a single month of unpaid rental-arrears, at a time when Universal Credit has seen some rent arrears quadrupling and that’s before you consider damage to the property or solicitor costs.

With the Government preparing to control Tenants’ deposits at five weeks rent, Locks Heath Landlords will soon only be protected in the event of a single month of unpaid rental-arrears, at a time when Universal Credit has seen some rent arrears quadrupling and that’s before you consider damage to the property or solicitor costs. Locks Heath property values are currently 0.7% higher than at the end of 2017, notwithstanding the uncertainty and threats over the potential impact of Brexit in 2019. This has exceeded all the predictions (aka guesses) of all the City of London economists, in an astonishing sign of strength for the local Locks Heath and wider national economy.

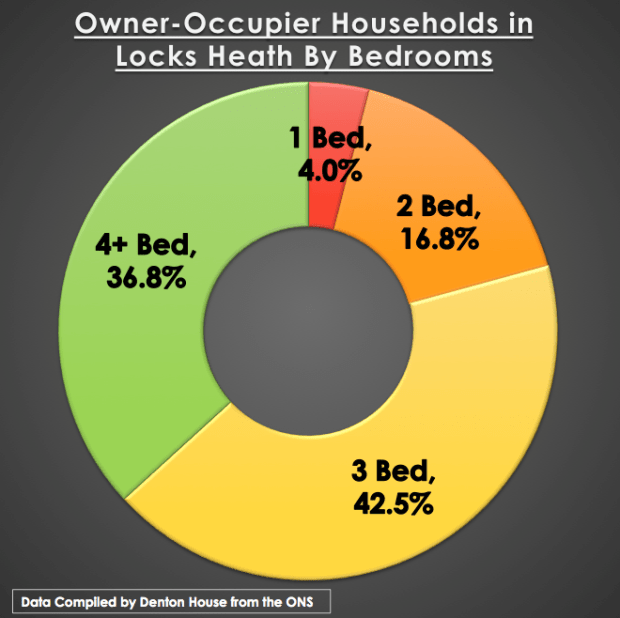

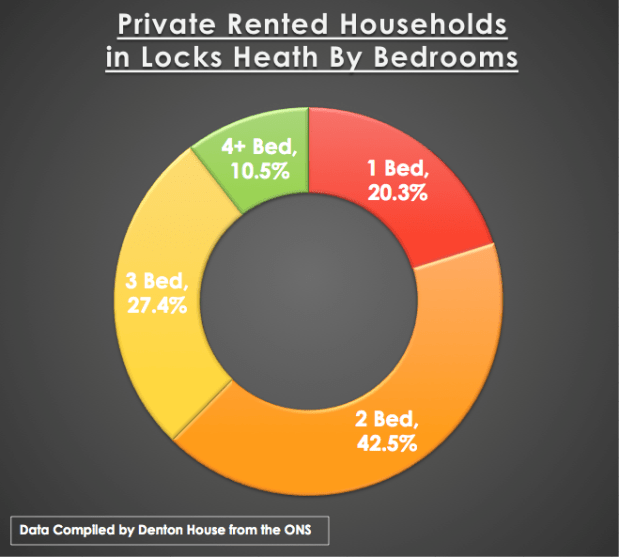

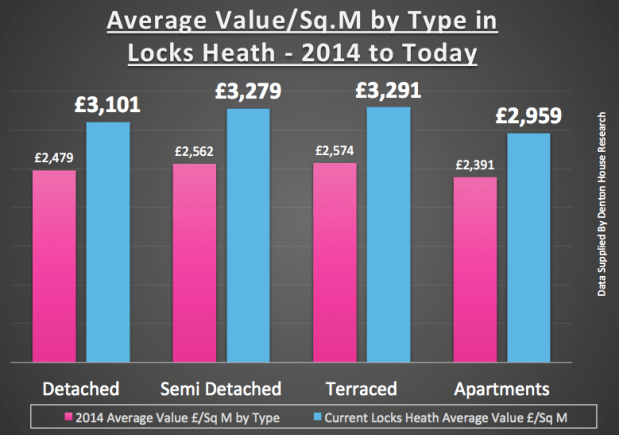

Locks Heath property values are currently 0.7% higher than at the end of 2017, notwithstanding the uncertainty and threats over the potential impact of Brexit in 2019. This has exceeded all the predictions (aka guesses) of all the City of London economists, in an astonishing sign of strength for the local Locks Heath and wider national economy. The conventional way of categorising property in Britain is to look at the number of bedrooms rather than its size in square metres (square feet for those of you over 50!). My intuition tells me that homeowners and Tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger the property is likely to be. And it’s not only the tangible additional bedrooms, but those properties with those additional bedrooms tend to have larger (and more) reception (living) rooms. However, if you think about it, this isn’t so surprising given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

The conventional way of categorising property in Britain is to look at the number of bedrooms rather than its size in square metres (square feet for those of you over 50!). My intuition tells me that homeowners and Tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger the property is likely to be. And it’s not only the tangible additional bedrooms, but those properties with those additional bedrooms tend to have larger (and more) reception (living) rooms. However, if you think about it, this isn’t so surprising given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.