For most Locks Heath people, a mortgage is the only way to buy a property. However, for some, especially Locks Heath homeowners who have paid off their mortgage or Locks Heath buy to let landlords, many have the choice to pay exclusively with cash. So the question is, should you use all your cash, or could a mortgage be a more suitable option?

For most Locks Heath people, a mortgage is the only way to buy a property. However, for some, especially Locks Heath homeowners who have paid off their mortgage or Locks Heath buy to let landlords, many have the choice to pay exclusively with cash. So the question is, should you use all your cash, or could a mortgage be a more suitable option?

Well, looking at the numbers locally…

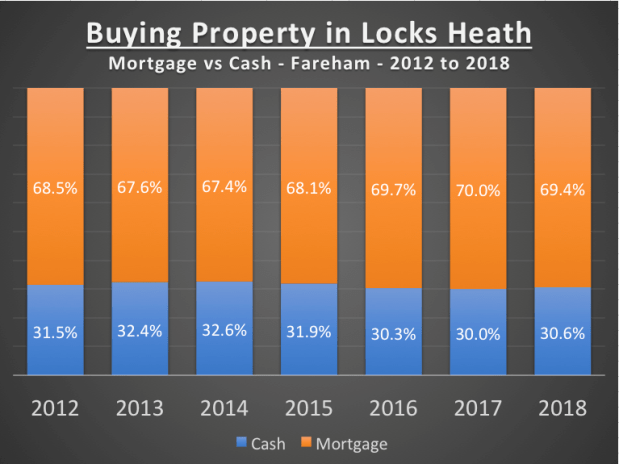

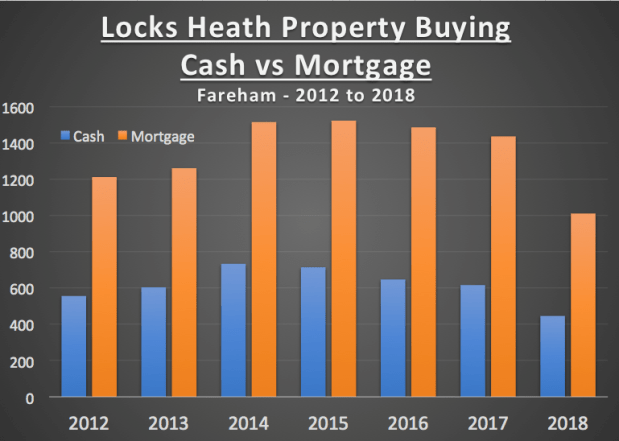

4,316 of the 13,753 property sales in the last 7 years in Fareham were made without a mortgage (i.e. 31.4%)

Interesting when compared with the national average of 31.9% cash purchases over the last seven years. Next, I wanted to see that cash percentage figure split down by years. As you can see from the graph, this level of cash purchases vs mortgage purchases has remained reasonably constant over those seven years…

Next, if you are going to go for a mortgage, the next question has to be whether you should fix the rate or have a variable rate mortgage. In the last Quarter, 90.57% of people that took out a mortgage, had a fixed rate mortgage at an average interest rate of 2.27%. Although what did surprise me was only 65.79% of the £1.429 trillion mortgages outstanding in the whole of the UK were on a fixed rate. The level of mortgage debt compared to the value of the home itself (referred to as the Loan to Value rate – LTV) was interesting, as 61.9% of people with a mortgage have a LTV of less than 75%. Although, one number that did jump out at me was only 4.33% of mortgages are 90% and higher LTV – meaning if we do have another property slump, the number of people in negative equity will be relatively small.

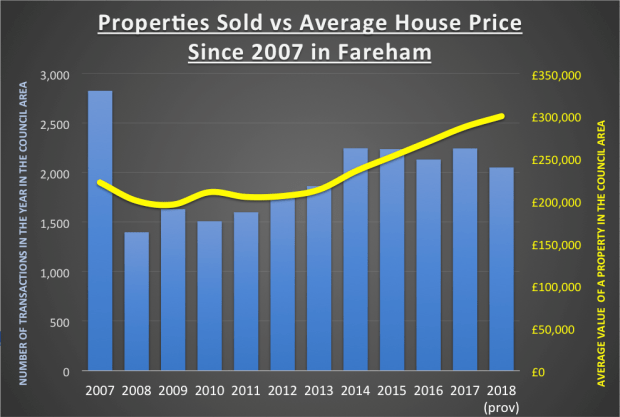

Next, looking at the actual number of properties sold, it can be clearly seen the number of house sales has dipped slightly in 2018…

So those are the numbers… let us have a look at the pros and cons of taking a mortgage, with specific focus on Locks Heath buy to let Landlords.

Taking a mortgage will help a landlord increase their investment across more properties to maximise the return, rather than putting everything into one Locks Heath buy to let property. This will enable the Landlord to ensure if there is a void in the tenancy, there should still be rent coming from the other properties. The flip side of the coin is that there is a mortgage to pay for, whether or not the property is let.

The other great motivation of taking a mortgage is that landlords can set the mortgage interest against the rental income, although that will only be at the basic rate of tax by 2021 due the recent tax changes. Banks and Building Societies will characteristically want at least a 25% deposit (meaning Locks Heath Landlords can only borrow up to 75%) and will assess the borrowing level based on the rental income covering the mortgage interest by a definite margin of 125%.

A lot will depend on what you, as a Locks Heath Landlord, hope to attain from your buy to let investment and how relaxed you would feel in making the mortgage payments when there is a void (interestingly, Direct Line calculated a few months ago that voids cost UK Landlords around £3bn a year or an average of £1000 per property per year). You also have to consider that interest rates could also increase, which would eat into your profit… although that can be mitigated with fixing your interest rate (as discussed above).

So, with everything that is happening in the world, does it make sense to buy rental properties? Now we help many newbie and existing Landlords work out their budgets, taking into account other costs such as agent’s fees, finance, maintenance and voids

in tenancy. The bottom line is we as a country aren’t building enough property, so demand will always outstrip supply in the medium to long term, meaning property values will keep rising in the medium to long term. That’s not to say property values might fall back in the short term, like they did in 2009 Credit Crunch, the 1988 Dual MIRAS crash, the recession of the early 1980’s, the 1974 Oil Crisis, the early 1930’s Great Depression… yet every time they have bounced back with vigour. Therefore, it makes sense to focus on getting the best property that will have continuing appeal and strong Tenant demand. And to conclude, buy to let should be tackled as a medium to long term investment because the wisest Landlords see buy to let investment in terms of decades – not years.

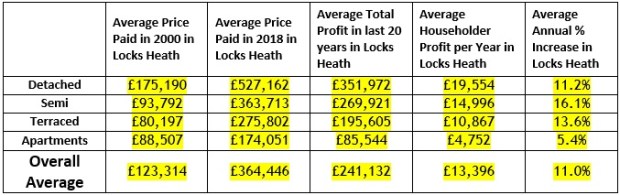

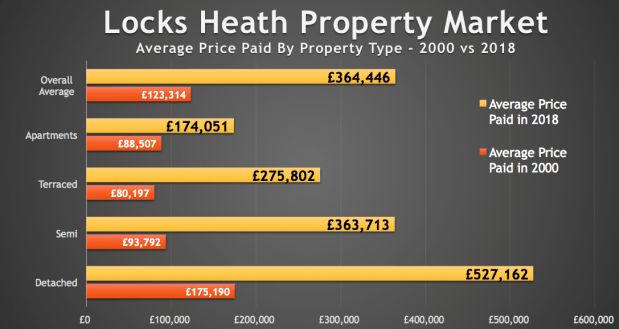

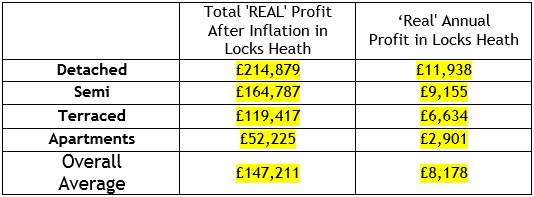

As we go full steam ahead into 2019, it’s certain that the Locks Heath housing market in 2018 was a little more restrained than 2016 and 2017 and I believe this will continue into 2019. Property ownership is a medium to long term investment so, looking at the long-term, the average Locks Heath homeowner, having owned their property since the Millennium, has seen its value rise by more than 198%.

As we go full steam ahead into 2019, it’s certain that the Locks Heath housing market in 2018 was a little more restrained than 2016 and 2017 and I believe this will continue into 2019. Property ownership is a medium to long term investment so, looking at the long-term, the average Locks Heath homeowner, having owned their property since the Millennium, has seen its value rise by more than 198%.

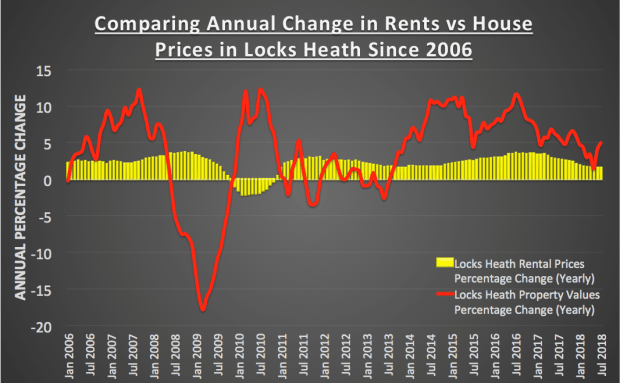

It’s now commonly agreed amongst economists and the general public that the dramatic rise in Locks Heath property prices of the last six years has come to an end.

It’s now commonly agreed amongst economists and the general public that the dramatic rise in Locks Heath property prices of the last six years has come to an end.

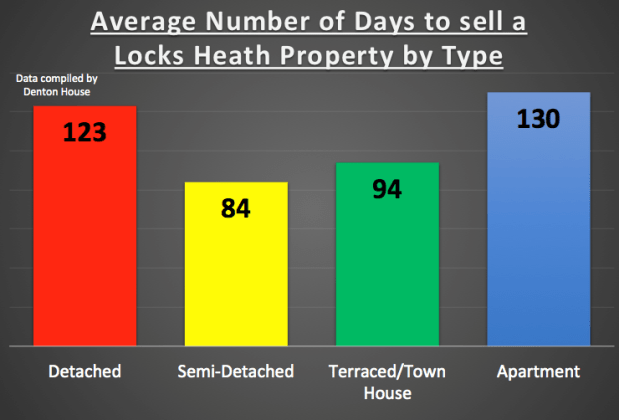

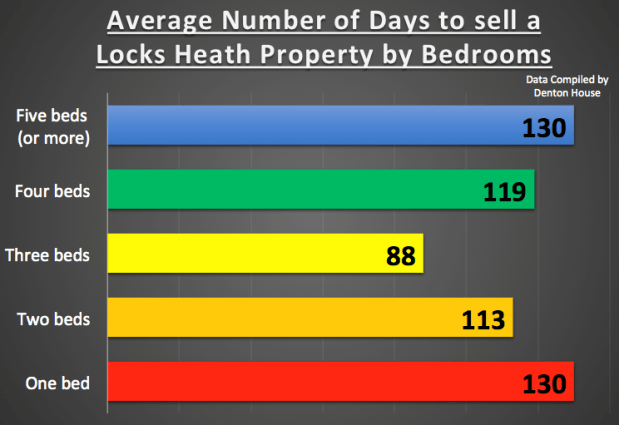

A few months ago I wrote an article on the Locks Heath Property Blog about the length of time it took to sell a property in Locks Heath and the saleability of the different price bands (i.e. whether the lower/middle or upper local property markets were moving slower or quicker than the others). For reference, a few months ago it was taking on average 62 days from the property coming on the market for it to be sold subject to contract (and that was based on every Estate Agent in Locks Heath)… and today… 108 days… does that surprise you with what is happening in the UK economy?

A few months ago I wrote an article on the Locks Heath Property Blog about the length of time it took to sell a property in Locks Heath and the saleability of the different price bands (i.e. whether the lower/middle or upper local property markets were moving slower or quicker than the others). For reference, a few months ago it was taking on average 62 days from the property coming on the market for it to be sold subject to contract (and that was based on every Estate Agent in Locks Heath)… and today… 108 days… does that surprise you with what is happening in the UK economy?

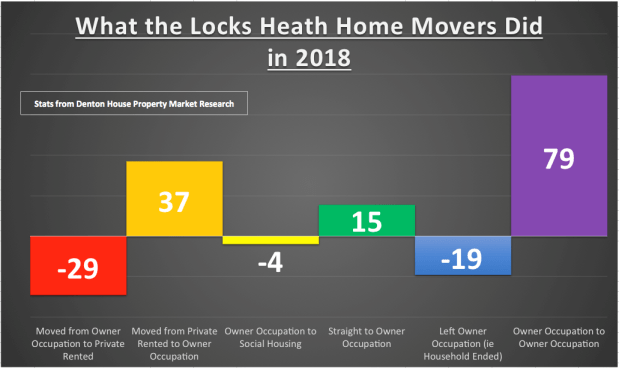

The Locks Heath housing market is a fascinating beast and has been particularly interesting since the Credit Crunch of 2008/9 with the subsequent property market crash. There is currently some talk of a ‘property bubble’ nationally as Brexit seems to be the ‘go-to’ excuse for every issue in the Country. Upon saying that, looking at both what we do as an agent, and chatting with my fellow property professionals in the area, the market has certainly changed for both buyers and sellers alike (be they Locks Heath buy to let Landlords, Locks Heath first time buyers or Locks Heath owner occupiers looking to make the move up the Locks Heath property ladder).

The Locks Heath housing market is a fascinating beast and has been particularly interesting since the Credit Crunch of 2008/9 with the subsequent property market crash. There is currently some talk of a ‘property bubble’ nationally as Brexit seems to be the ‘go-to’ excuse for every issue in the Country. Upon saying that, looking at both what we do as an agent, and chatting with my fellow property professionals in the area, the market has certainly changed for both buyers and sellers alike (be they Locks Heath buy to let Landlords, Locks Heath first time buyers or Locks Heath owner occupiers looking to make the move up the Locks Heath property ladder).

As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike.

As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike. I have been asked a number of times recently what a hard Brexit would mean to the Locks Heath property market. To be frank, I have been holding off giving my thoughts, as I did not want to add fuel to the stories being banded around in the national press. However, it’s obviously a topic that you as Locks Heath buy to let Landlords and Locks Heath homeowners are interested in… so I am going to try and give you what I consider a fair and unbiased piece on what would happen if a hard Brexit takes place in March 2019.

I have been asked a number of times recently what a hard Brexit would mean to the Locks Heath property market. To be frank, I have been holding off giving my thoughts, as I did not want to add fuel to the stories being banded around in the national press. However, it’s obviously a topic that you as Locks Heath buy to let Landlords and Locks Heath homeowners are interested in… so I am going to try and give you what I consider a fair and unbiased piece on what would happen if a hard Brexit takes place in March 2019.