I have been doing some research, looking both at National and Regional reports on the demand and supply of property and people together with future projections on the economy, population and family demographics with some interesting results. According to the Office of National Statistics, in the last financial year nationally, private renting grew by 74,000 households, whilst the owner occupied dwelling stock increased by 101,000 and social (aka council and housing association) stock increased by 12,000 dwellings.

I have been doing some research, looking both at National and Regional reports on the demand and supply of property and people together with future projections on the economy, population and family demographics with some interesting results. According to the Office of National Statistics, in the last financial year nationally, private renting grew by 74,000 households, whilst the owner occupied dwelling stock increased by 101,000 and social (aka council and housing association) stock increased by 12,000 dwellings.

It was the private rental figures that caught my eye. With eight or nine years of recovery since the Credit Crunch, economic recovery and continuing low interest rates have done little to setback the mounting need for rented housing. In fact, with house price inflation pushing upwards much quicker than wage growth, this has made owning one’s home even more out of reach for many Millennials. All this at a time when the number of council/social housing has shrunk by just over 2.5% since 2003, making more households move into private renting.

There are 5,151 people living in 2,299 privately rented properties in Locks Heath.

In the next nine years, looking at the future population growth statistics for the Locks Heath area and making careful and moderate calculations of what proportion of those extra people due to live in Locks Heath will rent as opposed to buy, in the next ten years, 2,208 people (adults and children combined) will require a private rented property to live in.

Therefore, the number of Private Rented homes in Locks Heath will need to rise by 985 households over the next nine years.

That’s 109 additional Locks Heath properties per year that will need to be bought by Locks Heath Landlords, for the next nine years to meet that demand.

… and remember, I am being conservative with those calculations, as demand for privately rented homes in Locks Heath could still rise more abruptly than I have predicted and I would ask if Theresa May’s policies of building 400,000 affordable homes (which would syphon in this 5-year Parliamentary term) is rather optimistic, if not fanciful?

So, one has to wonder if it was wise to introduce a buy to let stamp duty surcharge of 3% and the constraint on mortgage tax relief could curtail and hold back the ability of private Landlords to expand their portfolios?

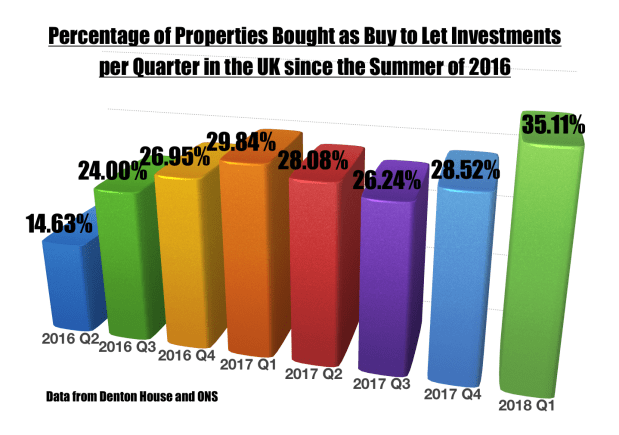

Well a lot of Landlords are taking on these new hurdles to buy to let and working smarter. Buying the property at the right price and using an agent to negotiate on your behalf (we do this all the time)… and the 3% stamp duty level isn’t an issue. Incorporating your property portfolio into a Limited Company is also a way to circumnavigate the issues of mortgage tax relief (although there are other hurdles that need to be navigated on that tack), but just look at the growth of the proportion of Buy to Let properties in the Country since the Summer of 2016… something tells me smart Landlords are seeing these challenges as just that… challenges which can be overcome by working smarter.

I have a steady stream of Locks Heath Landlords every week asking me my opinion on the future of the Locks Heath property market and their individual future strategy and, whether you are a Landlord of mine or not, if you ever want to send me an email or pop into my office to chat on how you could navigate these new Buy to Let waters… it will be good to speak to you (because you wouldn’t want other landlords to have an advantage over you – would you?).

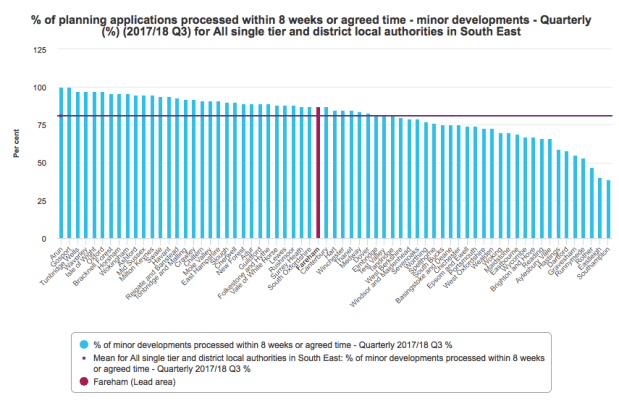

It’s been nearly 18 months since Sajid Javid, the Tory Government’s Housing Minister published the White Paper “Fixing the Broken UK Housing Market”, meanwhile Locks Heath property values continue to rise at 3.1% (year on year for the council area) and the number of new homes being constructed locally bumps along at a snail’s pace, creating a potential perfect storm for those looking to buy and sell.

It’s been nearly 18 months since Sajid Javid, the Tory Government’s Housing Minister published the White Paper “Fixing the Broken UK Housing Market”, meanwhile Locks Heath property values continue to rise at 3.1% (year on year for the council area) and the number of new homes being constructed locally bumps along at a snail’s pace, creating a potential perfect storm for those looking to buy and sell.

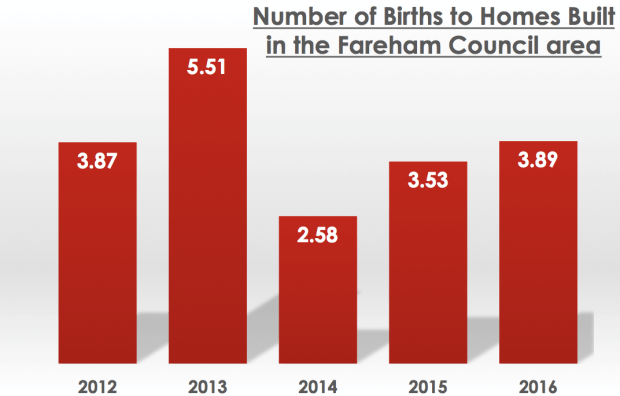

Nearly 4 babies have been born for every new home that has been built in Fareham since 2012, deepening the Locks Heath housing shortage.

Nearly 4 babies have been born for every new home that has been built in Fareham since 2012, deepening the Locks Heath housing shortage.

The simple fact is we are not building enough properties. If the supply of new properties is limited and demand continues to soar with heightened divorce rates, i.e. one household becoming two, people living longer and continued immigration, this means the values of those existing properties continues to remain high and out of reach for a lot of people, especially the blue collar working families of Locks Heath.

The simple fact is we are not building enough properties. If the supply of new properties is limited and demand continues to soar with heightened divorce rates, i.e. one household becoming two, people living longer and continued immigration, this means the values of those existing properties continues to remain high and out of reach for a lot of people, especially the blue collar working families of Locks Heath.

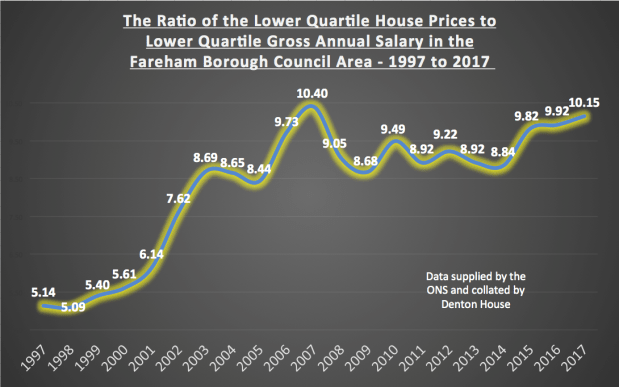

The value of all the homes in Locks Heath has risen by more than 247% in the past two decades, to £5.267bn, meaning its worth more than the stock listed company Marks and Spencer Group, which is worth £4.874bn.

The value of all the homes in Locks Heath has risen by more than 247% in the past two decades, to £5.267bn, meaning its worth more than the stock listed company Marks and Spencer Group, which is worth £4.874bn.