That got your attention … didn’t it!

That got your attention … didn’t it!

But before we start, what is Generation X, let alone Generation Z, Millennials, Baby Boomers… these are phrases banded around about the different life stages (or subcomponents) of our society. But when terminologies like this are used as often and habitually as these phrases (i.e. Gen X this, Millennial that etc.), it appears particularly vital we have some practical idea of what these terms actually mean. The fact is that everyone uses these phrases, but often, like myself, they are not exactly sure where the lines are drawn… until now…

So, for clarity …

Generation Z: Born after 1996

Millennials: Born 1977 to 1995

Generation X: Born 1965 to 1976

Baby Boomers: Born 1946 to 1964

Silent Generation: Born 1945 and before

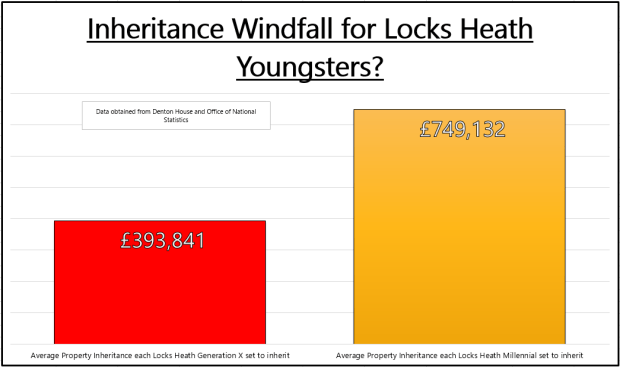

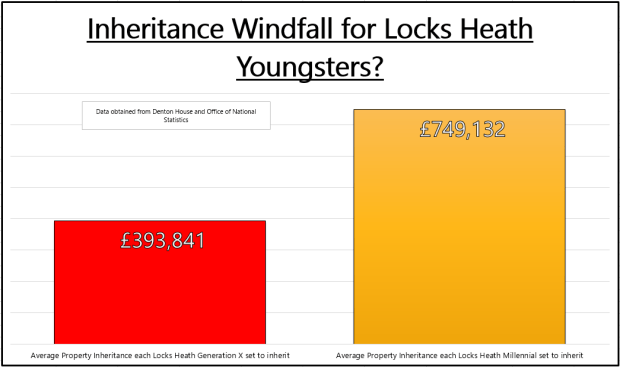

My research shows there are 6,614 households in Locks Heath owned by Locks Heath Baby Boomers (born 1946 to 1964) and Locks Heath’s Silent Generation (born 1945 and before). It also shows there are 8,912 Generation X’s of Locks Heath (Locks Heath people born between 1965 to 1976). Looking at demographics, homeownership statistics and current life expectancy, around two-thirds of those Locks Heath 8,912 Generation X’s have parents and grandparents who own those 6,614 Locks Heath properties.

They will profit from one of the biggest inheritance explosions of any post-war generation to the tune of £2.341bn of Locks Heath property or £393,841 each but they will have to wait until their early 60’s to get it!

However, it’s the Millennials that are in line for an even bigger inheritance windfall.

There are 5,563 Millennials in Locks Heath and my research shows around two thirds of them are set to inherit the 7,853 Locks Heath Generation X’s properties. Those Generation X’s Locks Heath homes are worth £2.780bn meaning, on average, each Millennial will inherit £749,132; but not until at least 2040 to 2060!

While the Locks Heath Millennials have done far less well in amassing their own savings and assets, they are more likely to take advantage of an inheritance boom in the years to come. This will probably be very welcome news for those Locks Heath Millennials, including some from poorer upbringings who in the past would have been unlikely to receive gifts and legacies.

However, inheritance is not the magic weapon that will get the Millennials on to the Locks Heath housing ladder or tackle growing wealth cracks in UK society, as the inheritance is unlikely to be made available when they are trying to buy their first home… but before all you Locks Heath Millennials start running up debts, over 50% of females and around 35% of men are going to have to pay for nursing home care. Interestingly, I read recently that a quarter of people who have to pay for their care, run out of money.

So, if you are a Locks Heath Millennial there potentially will be nothing left for you.

Of course, most parents want to give their children an inheritance, the consideration that what you have worked genuinely hard for over your working life won’t go to your children to help them through their lives is a really awful one… maybe that is why I am seeing a lot of Locks Heath grandparents doing something meaningful, and helping their grandchildren, the Millennials, with the deposit for their first house.

One solution to the housing crisis in Locks Heath (and the UK as a whole) is if grandparents, where they are able to, help financially with the deposit for a house. Buying is cheaper than renting – we have proved it many times in these articles… so, it’s not a case of not affording the mortgage, the issue is raising the 5% to 10% mortgage deposit for these Millennials.

Maybe families should be distributing a part of the family wealth now (in the form of helping with house deposits) as opposed to waiting to the end… it will make so much more of a difference to everyone in the long run.

Just a thought…?

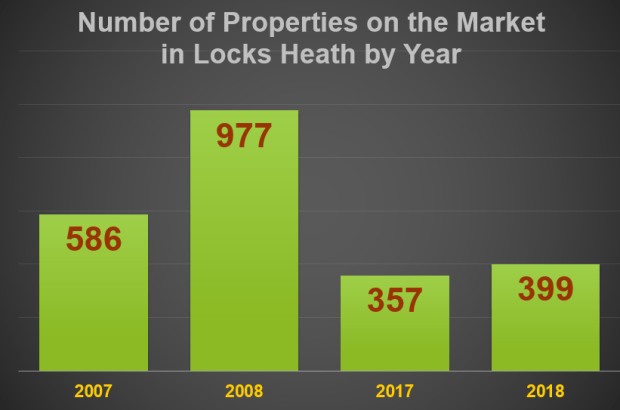

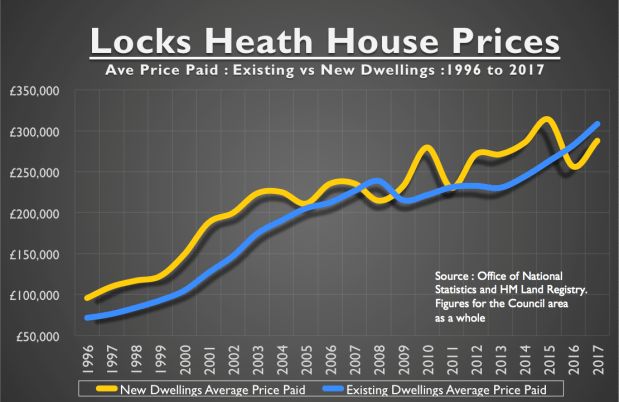

As I have mentioned a number times in my local property market blog, with not enough new-build properties being built in Locks Heath and the surrounding areas to keep up with demand for homes to live in (be that Tenants or homebuyers), it’s good to know more Locks Heath home sellers are putting their properties on to the market than a year ago.

As I have mentioned a number times in my local property market blog, with not enough new-build properties being built in Locks Heath and the surrounding areas to keep up with demand for homes to live in (be that Tenants or homebuyers), it’s good to know more Locks Heath home sellers are putting their properties on to the market than a year ago.

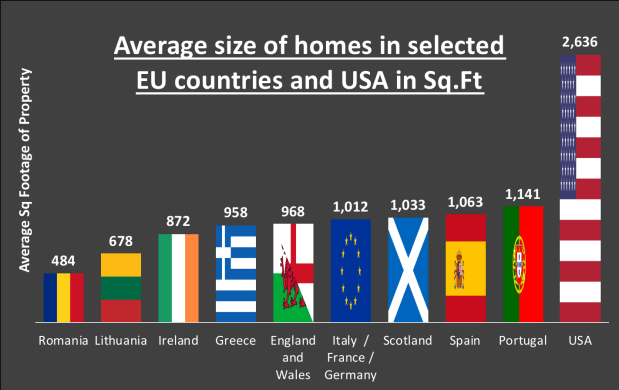

As our families grow bigger the need for more space, be that bedrooms or reception rooms, has grown with it. Also, as our older generation lives longer and nursing home bills continue to rise quicker than a rocket on the 5th of November (the average nursing home bill in the area being £715 per week) many families are bringing two households into one larger one.

As our families grow bigger the need for more space, be that bedrooms or reception rooms, has grown with it. Also, as our older generation lives longer and nursing home bills continue to rise quicker than a rocket on the 5th of November (the average nursing home bill in the area being £715 per week) many families are bringing two households into one larger one.

According to the National House Building Council (NHBC), more than 26,142 new homes were registered to be built in the South East last year, on par with 2016 levels of 26,147 dwellings. Great news when you consider it is one of the highest number of new builds in the region since the pre-recession levels of the Credit Crunch and the uncertainty of Brexit and the General Election.

According to the National House Building Council (NHBC), more than 26,142 new homes were registered to be built in the South East last year, on par with 2016 levels of 26,147 dwellings. Great news when you consider it is one of the highest number of new builds in the region since the pre-recession levels of the Credit Crunch and the uncertainty of Brexit and the General Election.

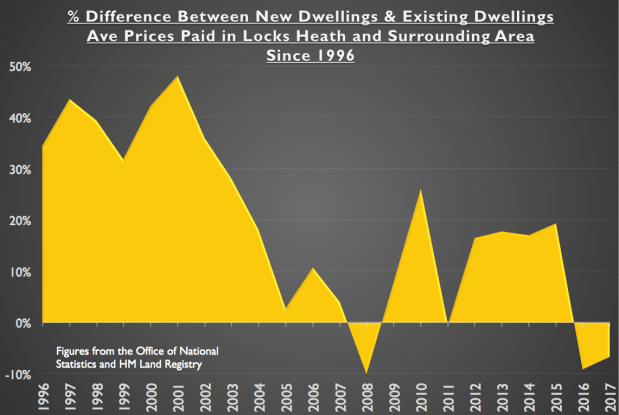

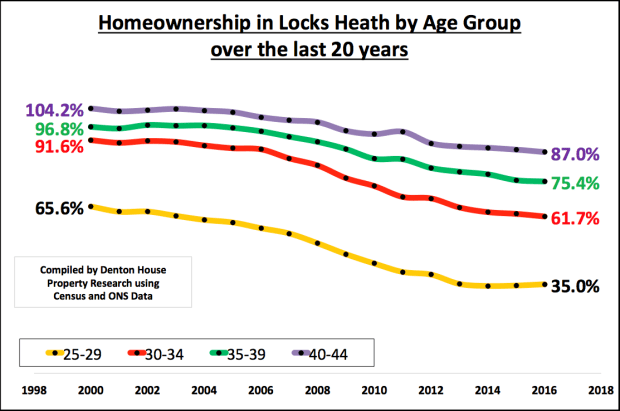

The degree to which young Locks Heath people are locked out of the Locks Heath housing market has been revealed in new statistics.

The degree to which young Locks Heath people are locked out of the Locks Heath housing market has been revealed in new statistics.

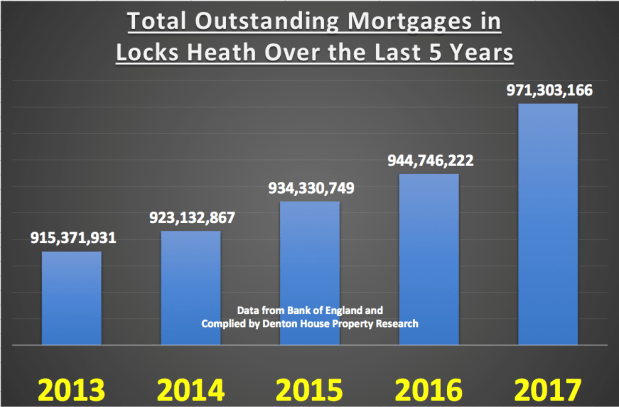

A little bit of good news this week on the Locks Heath Property Market as recently released data shows that the number of first time buyers taking out their first mortgage in 2017 increased more than in any other year since the global financial crisis in 2009. The data shows there were 54 first time buyers in Locks Heath, the largest number since 2006.

A little bit of good news this week on the Locks Heath Property Market as recently released data shows that the number of first time buyers taking out their first mortgage in 2017 increased more than in any other year since the global financial crisis in 2009. The data shows there were 54 first time buyers in Locks Heath, the largest number since 2006.

That got your attention … didn’t it!

That got your attention … didn’t it!