Yes, I said ‘rentirement’, not retirement… rentirement, and it relates to the 397 (and growing) Locks Heath people, who don’t own their own Locks Heath home but rent their home, privately from a buy to let Landlord and who are currently in their 50’s and early to mid-60’s.

Yes, I said ‘rentirement’, not retirement… rentirement, and it relates to the 397 (and growing) Locks Heath people, who don’t own their own Locks Heath home but rent their home, privately from a buy to let Landlord and who are currently in their 50’s and early to mid-60’s.

The truth is that these Locks Heath people are prospectively soon to retire with little more than their state pension of £155.95 per week, probably with a small private pension of a couple of hundred pounds a month, meaning the average Locks Heath retiree can expect to retire on about £200 a week once they retire at 67.

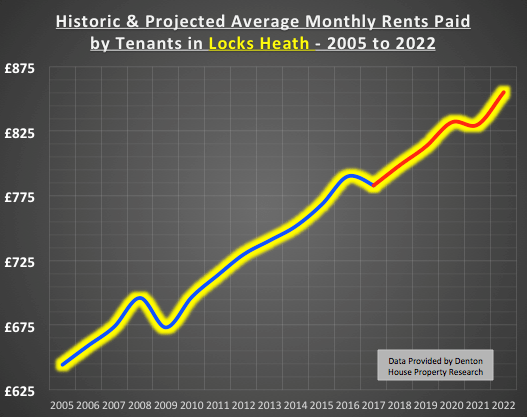

The average rent in Locks Heath is £886 a month, so a lot of the retirement “income” will be taken up in rent, meaning the remainder will have to be paid for out their savings or the taxpayer will have to stump up the bill – and with life expectancy currently in the mid to late 80’s, that is quite a big bill… a total of £84,418,080 over the next 20 years to be paid from the tenant’s savings or the taxpayers coffers to be precise!

You might say it’s not fair for Locks Heath tax payers to pick up the bill and that these mature Locks Heath renters should start saving thousands of pounds a year now to be able to afford their rent in retirement. However, in many circumstances, the reason these people are privately renting in the first place is that they were never able to find the money for a mortgage deposit on their home in the first place, or didn’t earn enough to qualify for a mortgage… and now as they approach retirement with hope of a nice council bungalow, that hope is diminishing because of the council house sell off in the 1980’s!

For a change, the Locks Heath 30 to 40 somethings will be better off, as their parents are more likely to be homeowners and cascade their equity down the line when their parents pass away. For example, that is what is happening in Europe where renting is common, the majority of people rent in their 20’s, 30’s and 40’s, but by the time they hit 50’s and 60’s (and retirement), they will invest the money they have inherited from their parents passing away and buy their own home.

So, what does this all mean for buy to let Landlords in Locks Heath?

Have you noticed how the new homes builders don’t build bungalows anymore? In fact some would said the ‘bungalow storey’ is over! The waning in the number of bungalows being built has more to do with supply than demand. The fact is that for new homes builders there is more money in constructing houses than there is in constructing bungalows. Bungalows are voracious when it comes to land they need as a bungalow has a larger footprint for the same amount of square meterage as a two/three storey house due to the fact they are on one level instead of two or three.

That means, as demand will continue to rise for bungalows supply will remain the same. We all know what happens when demand outs strips supply… prices (i.e. rents) for bungalows will inevitably go up.

As I am sure you are aware, one the best things about my job as an agent is helping Locks Heath Landlords with their strategic portfolio management. Gone are the days of making money by buying any old Locks Heath property to rent out or sell on. Nowadays, property investment is both an art and science. The art is your gut reaction to a property, but with the power of the internet and the way the Locks Heath property market has gone in the last 11 years, science must also play its part on a property’s future viability for investment.

As I am sure you are aware, one the best things about my job as an agent is helping Locks Heath Landlords with their strategic portfolio management. Gone are the days of making money by buying any old Locks Heath property to rent out or sell on. Nowadays, property investment is both an art and science. The art is your gut reaction to a property, but with the power of the internet and the way the Locks Heath property market has gone in the last 11 years, science must also play its part on a property’s future viability for investment. As head in to the second month of 2018 I believe UK interest rates will stay low, even with the additional 0.25% increase that is expected in May or June. That rise will add just over £20 to the typical £160,000 tracker mortgage, although with 57.1% of all borrowers on fixed rates, it will probably go undetected by most buy-to-let Landlords and homeowners. I forecast that we won’t see any more interest rate rises due to the fragile nature of the British economy and the Brexit challenge. Even though mortgages will remain inexpensive, with retail price inflation outstripping salary rises, it will still very much feel like a heavy weight to some Locks Heath households.

As head in to the second month of 2018 I believe UK interest rates will stay low, even with the additional 0.25% increase that is expected in May or June. That rise will add just over £20 to the typical £160,000 tracker mortgage, although with 57.1% of all borrowers on fixed rates, it will probably go undetected by most buy-to-let Landlords and homeowners. I forecast that we won’t see any more interest rate rises due to the fragile nature of the British economy and the Brexit challenge. Even though mortgages will remain inexpensive, with retail price inflation outstripping salary rises, it will still very much feel like a heavy weight to some Locks Heath households.

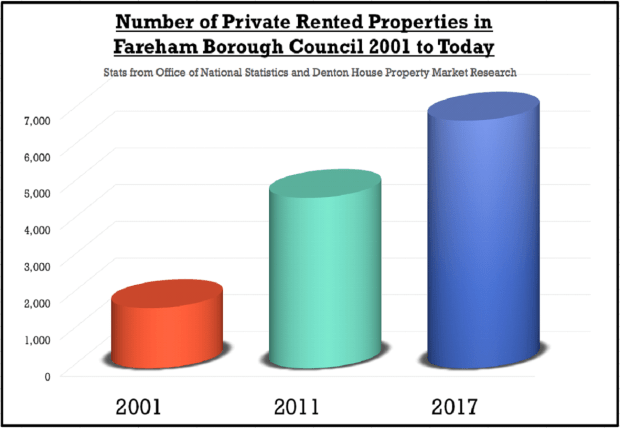

I was recently reading a report by the Home website which suggested that hordes of Landlords are selling their buy-to-let investments due to increasing burdens on them in the buy-to-let market. Their findings suggest the number of new properties that came onto the market nationally (for sale) jumped by 11% across the UK as a result.

I was recently reading a report by the Home website which suggested that hordes of Landlords are selling their buy-to-let investments due to increasing burdens on them in the buy-to-let market. Their findings suggest the number of new properties that came onto the market nationally (for sale) jumped by 11% across the UK as a result.

Talk to many Locks Heath 20 something’s, where home ownership has looked but a vague dream, many of them have been vexatious towards the Baby Boomer generation and their pushover ‘easy go lucky’ walk through life; jealous of their free university education with grants, their eye watering property windfalls, their golden final salary pensions and their free bus passes.

Talk to many Locks Heath 20 something’s, where home ownership has looked but a vague dream, many of them have been vexatious towards the Baby Boomer generation and their pushover ‘easy go lucky’ walk through life; jealous of their free university education with grants, their eye watering property windfalls, their golden final salary pensions and their free bus passes.

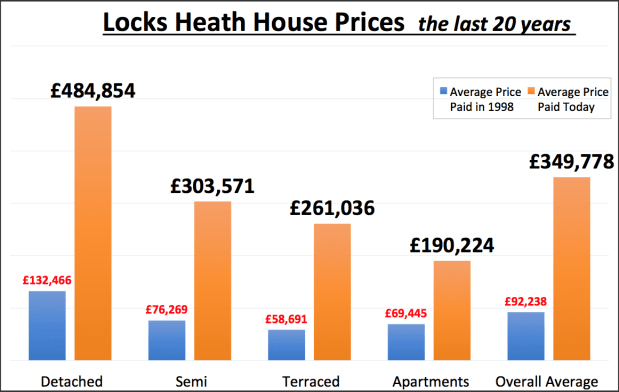

My research shows that certain types of Locks Heath property are more affordable today than before the 2007 credit crunch.

My research shows that certain types of Locks Heath property are more affordable today than before the 2007 credit crunch.

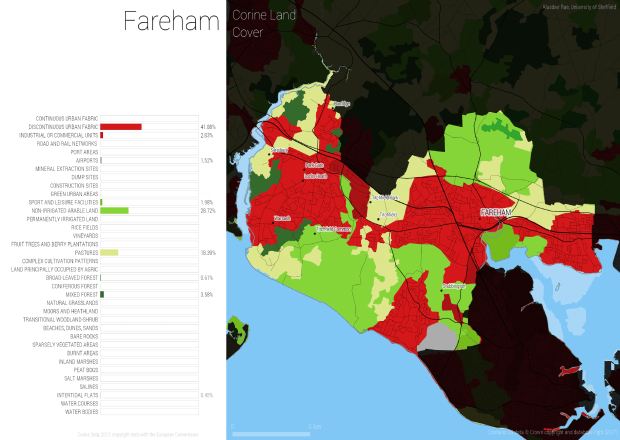

Well, the fallout from the recent Budget is still continuing. I was chatting to a couple of movers and shakers from the Locks Heath area the other day, when one said, “There isn’t enough land to build all these 300,000 houses Philip Hammond wants to build each year”.

Well, the fallout from the recent Budget is still continuing. I was chatting to a couple of movers and shakers from the Locks Heath area the other day, when one said, “There isn’t enough land to build all these 300,000 houses Philip Hammond wants to build each year”.

I miss the good old days of George Osborne as Chancellor, with his hardhat and hi-vis jacket. He must have visited every new home building site in the UK with his trademark attire! For the last few years, the nearest Philip Hammond got to donning a ‘Bob the Builder’ outfit was at his grandchild’s birthday party. However, with what appears to be a change in focus by the Tories to ensure they get back in power in 2022, they appear to have fallen in love with house building again with the Chancellor’s promise to create 300,000 new households in a year.

I miss the good old days of George Osborne as Chancellor, with his hardhat and hi-vis jacket. He must have visited every new home building site in the UK with his trademark attire! For the last few years, the nearest Philip Hammond got to donning a ‘Bob the Builder’ outfit was at his grandchild’s birthday party. However, with what appears to be a change in focus by the Tories to ensure they get back in power in 2022, they appear to have fallen in love with house building again with the Chancellor’s promise to create 300,000 new households in a year.

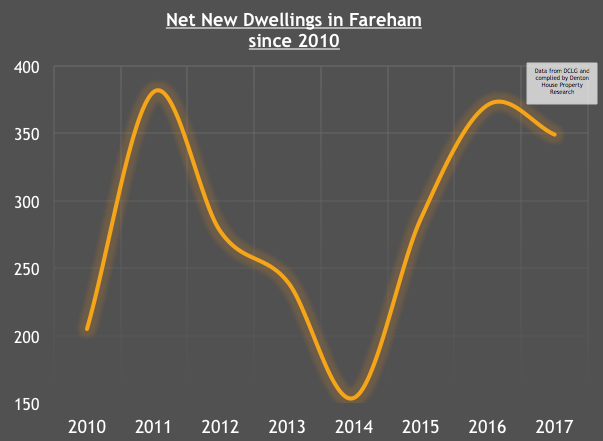

It’s now been a good 12/18 months since annual rental price inflation in Locks Heath peaked at 3.4%. Since then we have seen increasingly more humble rent increases. In fact, in certain parts of the Locks Heath rental market over the autumn, the rental market saw some slight falls in rents. So, could this be the earliest indication that the trend of high rent increases seen over the last few years, may now be starting to buck that trend?

It’s now been a good 12/18 months since annual rental price inflation in Locks Heath peaked at 3.4%. Since then we have seen increasingly more humble rent increases. In fact, in certain parts of the Locks Heath rental market over the autumn, the rental market saw some slight falls in rents. So, could this be the earliest indication that the trend of high rent increases seen over the last few years, may now be starting to buck that trend?