Locks Heath homeowners will be among those affected by the latest rise in the Bank of England interest rates. The first increase in 10 years; they have just been raised from 0.25 percent to 0.5 per cent. This uplift comes as inflation hits a 51-month high of 2.9 per cent whilst the national unemployment rate is at an all-time low of 4.3 per cent.

Locks Heath homeowners will be among those affected by the latest rise in the Bank of England interest rates. The first increase in 10 years; they have just been raised from 0.25 percent to 0.5 per cent. This uplift comes as inflation hits a 51-month high of 2.9 per cent whilst the national unemployment rate is at an all-time low of 4.3 per cent.

Interestingly, the Governor of the Bank of England has indicated that the interest rate is likely to increase again over the next couple of years, but Mr Carney said mortgages and savings would not be affected in the short term. However, look at all the big banks and just about all of them have increased their standard variable mortgage rate.

The average Locks Heath mortgage is £124,924

I have to ask by how much Locks Heath homeowners (on variable rate or tracker mortgages) will see their repayments increase?

In the SO31 postcode there are 7,619 homeowners with a mortgage, of which 3,273 have a variable rate mortgage (the remaining have fixed rate mortgages). The total amount owed by those SO31 homeowners with those variable rate mortgages is £408,892,681, meaning the average monthly mortgage payment for those home owners on variable rate mortgages before the interest rate rise was £974.06 per month and now its £1,000.09 per month… meaning

The interest rate rise will cost Locks Heath homeowners on average an extra £312.31 per year

Whilst this is the first raise in interest rates in over 10 years, it must be noted it is at a significantly low level compared to figures in the 1970s and early 1990s. Many of my readers talk of interest rates at 17 per cent when Sir Geoffrey Howe increased them to try and combat the hyperinflation (from the fallout of the financial crisis that hit Britain in the 1970’s) and Norman Lamont in September 1992 with the infamous Black Wednesday crisis, when interest rates were raised from 10% to 15% in just one day.

So, what will this interest rate actually do to the Locks Heath housing market?

Well, if I’m being frank, not a great deal. The proportion of Locks Heath homeowners with variable rate mortgages (and thus directly affected by a Bank of England rate rise) will be smaller than in the past, in part because the vast majority of new mortgages in recent years were taken on fixed interest rates. The proportion of outstanding mortgages on variable rates has fallen to a record low of 42.3 per cent, down from a peak of 72.9 per cent in the autumn of 2011.

If more Locks Heath people are protected from interest rate rises, because they are on a fixed rate mortgage, then there is less chance of those Locks Heath people having to sell their Locks Heath properties because they can’t afford the monthly repayments or even worse case scenario, have them repossessed.

However, and this will be of interest to both Locks Heath homeowners and Locks Heath buy to let landlords…

For every 1% increase in the Bank of England interest rate, it will cost the average Locks Heath homeowner on a variable rate mortgage £104.10 per month

So, what next? Because UK inflation levels are at 2.9 per cent (the country’s highest rate since April 2012) and the Bank of England is tasked by HM Government to keep inflation at 2 per cent using various monetary tools (one of which is interest rates) – you can see why interest rate rises might be on the cards in the future as increasing interest rates tends to dampen inflation.

Now of course there is a certain amount of uncertainty with regard to Brexit and the negotiations thereof, but fundamentally the British economy is in decent shape. People will always need housing and as we aren’t building enough houses (as I have mentioned many times in the Locks Heath Property Blog), we might see a slight dip in prices in the short term, but in the medium to long term, the Locks Heath property market will always remain strong for both Locks Heath homeowners and Locks Heath Landlords alike.

As the winter months draw in and the temperature starts to drop, keeping one’s home warm is vital. Yet, with the price of gas and electricity rising quicker than a Saturn V rocket and gas, oil and electricity taking on average 4.4% of a typical Brit’s pay packet (and for those Brit’s with the lowest 10% of incomes, that rockets to an eye watering 9.7%), whether you are a tenant or homeowner, keeping your energy costs as low as possible is vital for the household budget and the environment as a whole.

As the winter months draw in and the temperature starts to drop, keeping one’s home warm is vital. Yet, with the price of gas and electricity rising quicker than a Saturn V rocket and gas, oil and electricity taking on average 4.4% of a typical Brit’s pay packet (and for those Brit’s with the lowest 10% of incomes, that rockets to an eye watering 9.7%), whether you are a tenant or homeowner, keeping your energy costs as low as possible is vital for the household budget and the environment as a whole.

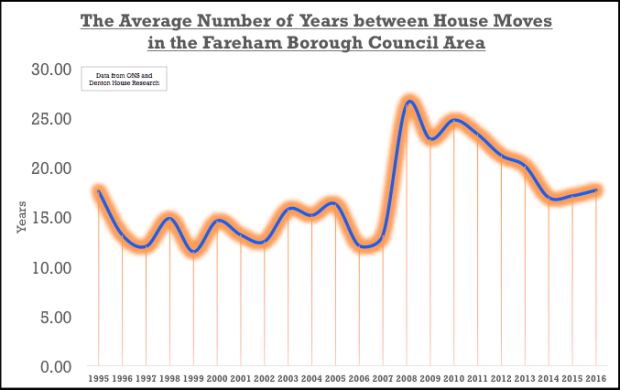

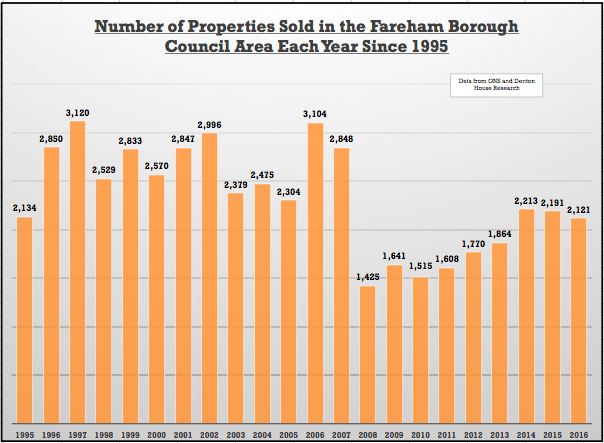

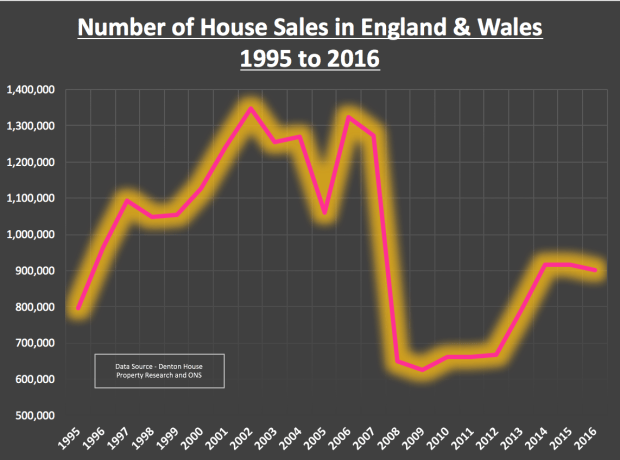

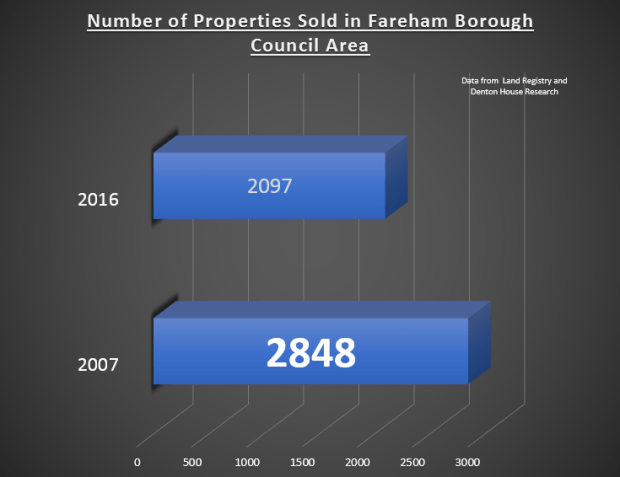

In the credit crunch of 2008/9 the rate of home moving plunged to its lowest level ever. In 2009 the rate at which a typical house would change hands slumped to only once every 23 years. The biggest reason being that confidence was low and many homeowners didn’t want to sell their home as Locks Heath property prices plunged after the onset of the financial crisis in 2008. However, since 2009, the rate of home moving has increased (see the table and graph below), meaning today:

In the credit crunch of 2008/9 the rate of home moving plunged to its lowest level ever. In 2009 the rate at which a typical house would change hands slumped to only once every 23 years. The biggest reason being that confidence was low and many homeowners didn’t want to sell their home as Locks Heath property prices plunged after the onset of the financial crisis in 2008. However, since 2009, the rate of home moving has increased (see the table and graph below), meaning today:

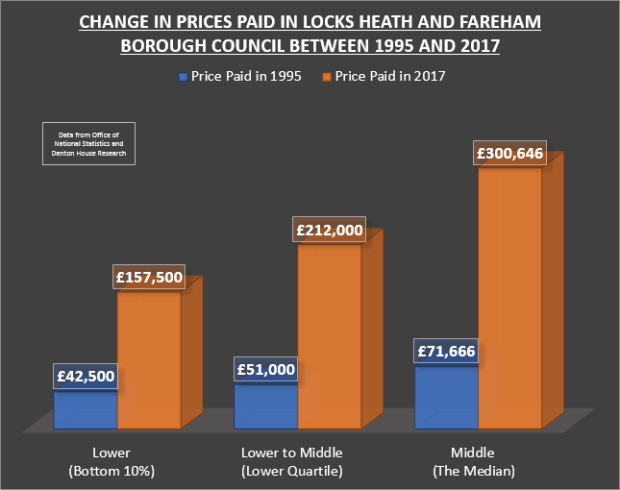

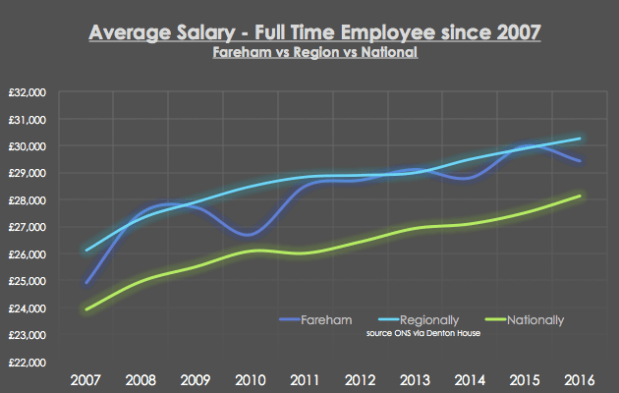

I recently read a report by the Yorkshire Building Society that 54% of the country has seen wages (salaries) rise faster than property prices in the last 10 years. The report said that in the Midlands and North salaries had outperformed property prices since 2007, whilst in other parts of the UK, especially in the South, the opposite has happened and property prices have outperformed salaries quite noticeably.

I recently read a report by the Yorkshire Building Society that 54% of the country has seen wages (salaries) rise faster than property prices in the last 10 years. The report said that in the Midlands and North salaries had outperformed property prices since 2007, whilst in other parts of the UK, especially in the South, the opposite has happened and property prices have outperformed salaries quite noticeably.

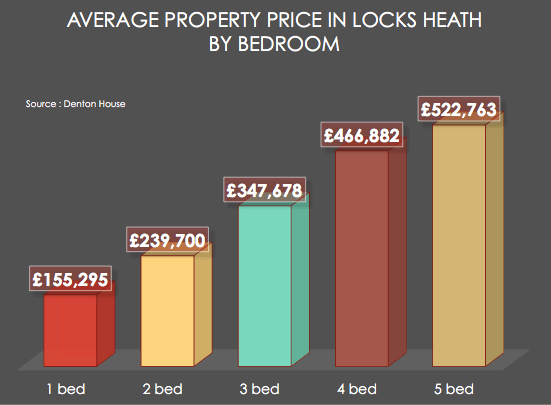

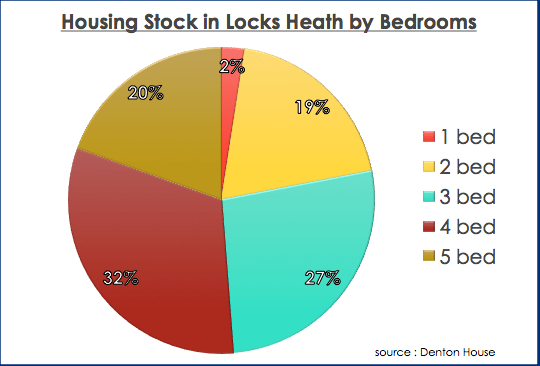

Moving to a bigger home is something Locks Heath people with growing young families aspire to. Many people in two bedroom homes move to a three bedroom home and some even make the jump to a four bed home. Bigger homes, especially three bed Locks Heath homes are much in demand and it can be a costly move.

Moving to a bigger home is something Locks Heath people with growing young families aspire to. Many people in two bedroom homes move to a three bedroom home and some even make the jump to a four bed home. Bigger homes, especially three bed Locks Heath homes are much in demand and it can be a costly move.

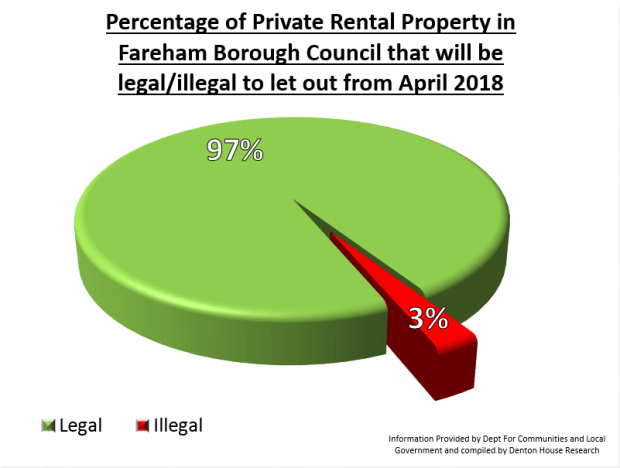

The mind-set and tactics you employ to buy your first Locks Heath buy to let property needs to be different to the tactics and methodology of buying a home for yourself to live in. The main difference is when purchasing your own property, you may well pay a little more to get the home you (and your family) want, and are less likely to compromise. When buying for your own use, it is only human nature you will want the best, so that quite often it is at the top end of your budget.

The mind-set and tactics you employ to buy your first Locks Heath buy to let property needs to be different to the tactics and methodology of buying a home for yourself to live in. The main difference is when purchasing your own property, you may well pay a little more to get the home you (and your family) want, and are less likely to compromise. When buying for your own use, it is only human nature you will want the best, so that quite often it is at the top end of your budget.

My thoughts to the Landlords and homeowners of Locks Heath…

My thoughts to the Landlords and homeowners of Locks Heath…

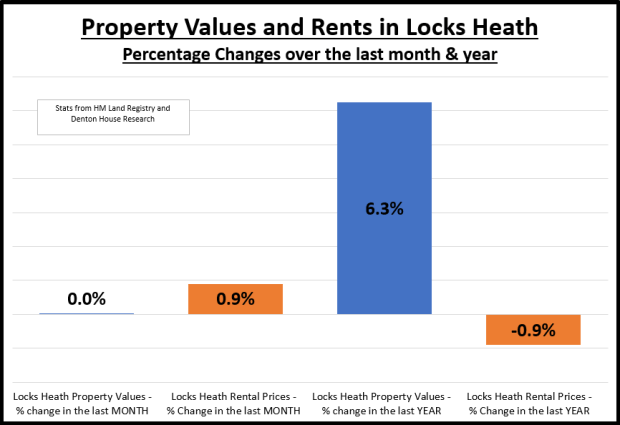

“What’s happening to the Locks Heath Property Market?” is a question I am asked repeatedly. Well, would it be a surprise to hear that my own research suggests that there isn’t just one big Locks Heath property market – but many small micro-property markets?

“What’s happening to the Locks Heath Property Market?” is a question I am asked repeatedly. Well, would it be a surprise to hear that my own research suggests that there isn’t just one big Locks Heath property market – but many small micro-property markets?