The most recent set of data from the Land Registry has stated that property values in Locks Heath and the surrounding area were 8.07% higher than 12 months ago and 19.8% higher than January 2015.

The most recent set of data from the Land Registry has stated that property values in Locks Heath and the surrounding area were 8.07% higher than 12 months ago and 19.8% higher than January 2015.

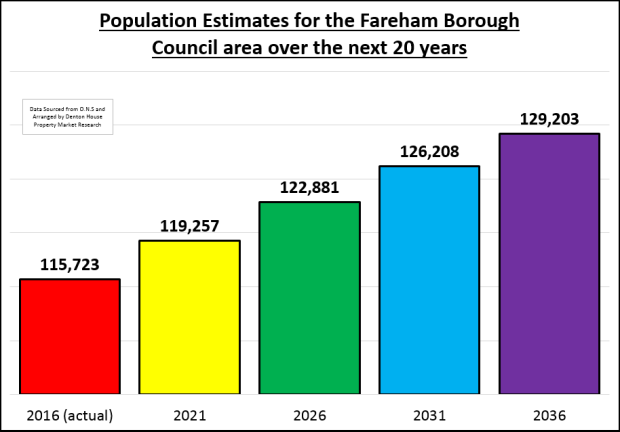

Despite the uncertainty over Brexit Locks Heath (and most of the UK’s) property values continue their medium and long-term upward trajectory. As economics is about supply and demand, the story behind the Locks Heath property market can also be seen from those two sides of the story.

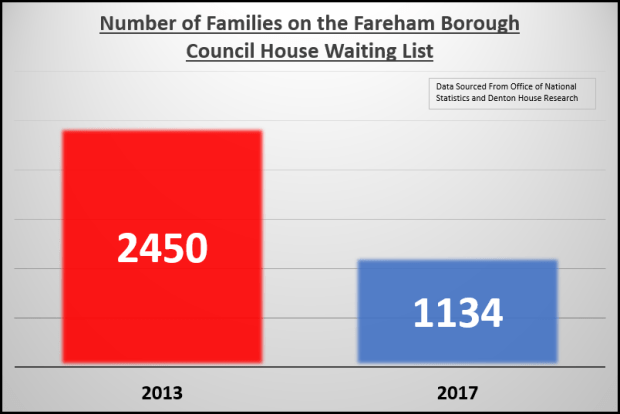

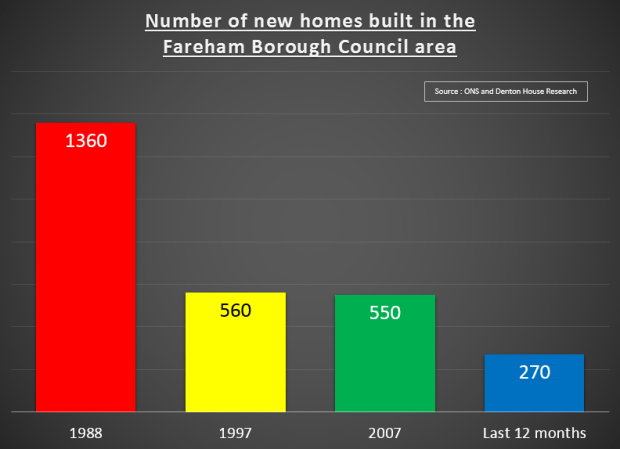

Looking at the supply issues of the Locks Heath property market, putting aside the short-term shortage of property on the market, one of the main reasons of this sustained house price growth has been down to of the lack of building new homes.

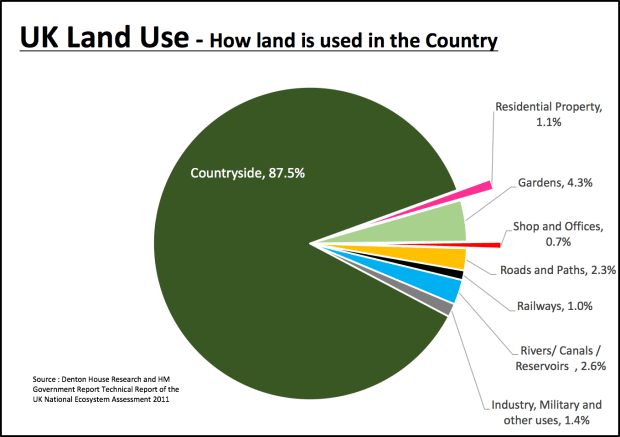

The draconian planning laws, that over the last 70 years (starting with The Town and Country Planning Act 1947) has meant the amount of land built on in the UK today, only stands at 1.8% (no, that’s not a typo – it is one point eight percent) and that is made up of 1.1% with residential property and 0.7% for commercial property. Now I am not advocating building modern ugly carbuncles and high-rise flats in the Cotswolds, nor blot the landscape with the building of massive out of place ugly 1,000 home housing estates around the beautiful countryside of such villages as Botley and Curdridge.

The facts are, with the restrictions on building homes for people to live in, because of these 70-year-old restrictive planning regulations, homes that the youngsters of Locks Heath badly need, aren’t being built.

Looking at the demand side of the equation, one might have thought property values would drop because of Brexit and buyers uncertainty. However, certain commenters now believe property values might rise because of Brexit. Many people are risk adverse, especially with their hard-earned savings. The stock market is at an all-time high (ready to pop again?) and many people don’t trust the money markets. The thing about property is it is tangible, bricks and mortar, you can touch it and you can easily understand it.

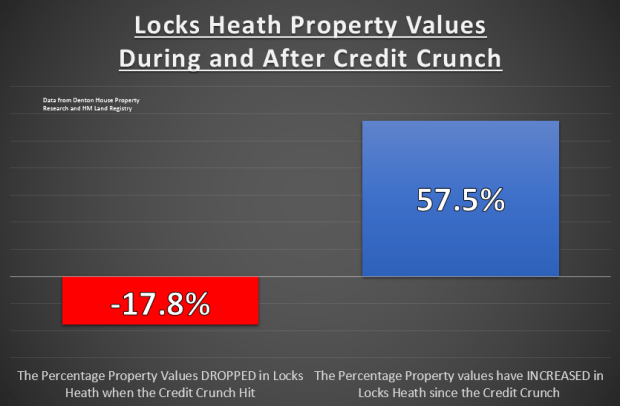

The Brits have historically put their faith in bricks and mortar, which they expect to rise in value, in numerical terms at least. Nationally, the value of property has risen by 635.4% since 1984 whilst the stock market has risen by a very similar 593.1%. However, the stock market has had a roller coaster of a ride to get to those figures. For example, in the dot com bubble of the early 2000’s, the FTSE100 dropped 126.3% in two years and it dropped again by 44.6% in 9 months in 2007… the worst drop Locks Heath saw in property values was just 17.88% in the 2008/9 credit crunch.

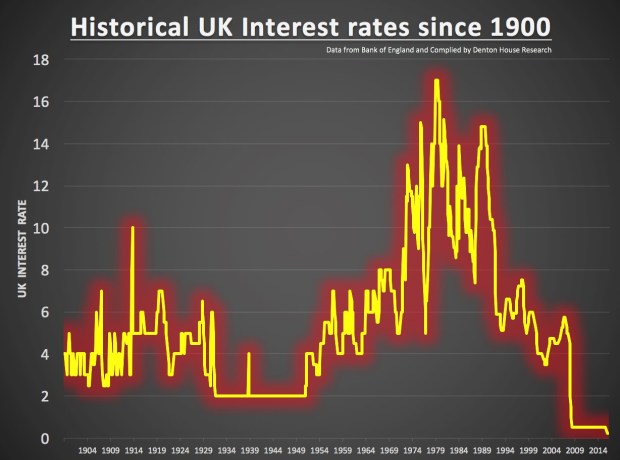

Despite the slowdown in the rate of annual property value growth in Locks Heath to the current 8.07%, from the heady days of 12.21% annual increases seen in mid 2010, it can be argued the headline rate of Locks Heath property price inflation is holding up well. Especially with the squeeze on real incomes, new taxation rules for landlords and the slight ambiguity around Brexit. With mortgage rates at an all-time low and tumbling unemployment, all these factors are largely continuing to help support property values in Locks Heath (and the UK).

For more thoughts on the Locks Heath Property Market, please visit The Locks Heath Property Blog.

Over the last 12 months, the UK has decided to leave the EU, have a General Election with a result that didn’t go to plan for Mrs May and to add insult to injury, our American cousins elected Donald Trump as the 45th President of the United States. It could be said this should have caused some unnecessary unpredictability into the UK property market.

Over the last 12 months, the UK has decided to leave the EU, have a General Election with a result that didn’t go to plan for Mrs May and to add insult to injury, our American cousins elected Donald Trump as the 45th President of the United States. It could be said this should have caused some unnecessary unpredictability into the UK property market.

As the dust starts to settle on the various unread General Election party manifestos, with their ‘bran-bucket’ made up numbers, life goes back to normal as political rhetoric on social media is replaced with pictures of cats and people’s lunch. Joking aside though, all the political parties promised so much on the housing front in their manifestos, should they have been elected at the General Election. In hindsight, irrespective of which party, they seldom deliver on those promises.

As the dust starts to settle on the various unread General Election party manifestos, with their ‘bran-bucket’ made up numbers, life goes back to normal as political rhetoric on social media is replaced with pictures of cats and people’s lunch. Joking aside though, all the political parties promised so much on the housing front in their manifestos, should they have been elected at the General Election. In hindsight, irrespective of which party, they seldom deliver on those promises.

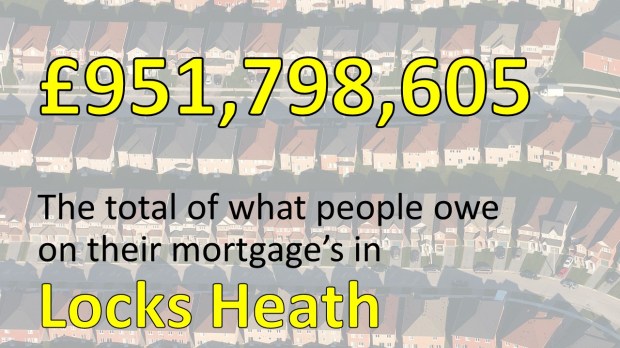

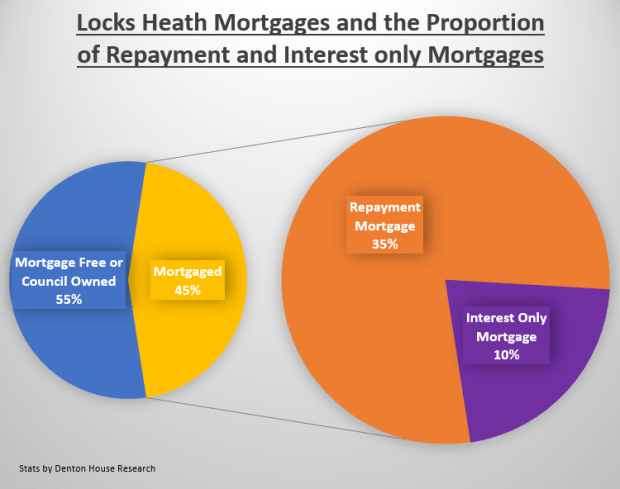

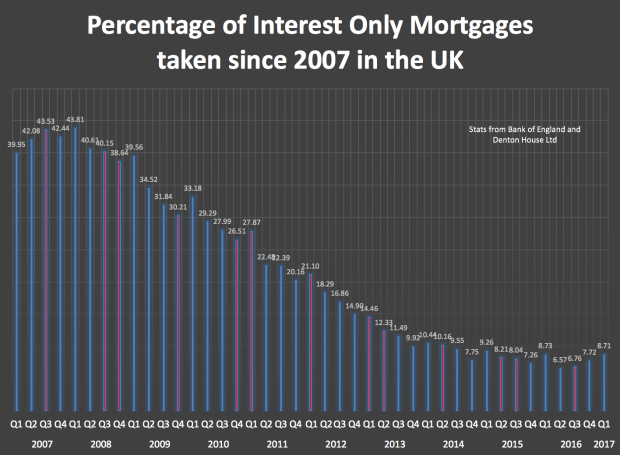

According to my research, of the 18,587 properties in Locks Heath, 8,378 of those properties have mortgages on them. 90.9% of those mortgaged properties are made up of owner-occupiers and the rest are buy to let landlords (with a mortgage).

According to my research, of the 18,587 properties in Locks Heath, 8,378 of those properties have mortgages on them. 90.9% of those mortgaged properties are made up of owner-occupiers and the rest are buy to let landlords (with a mortgage).

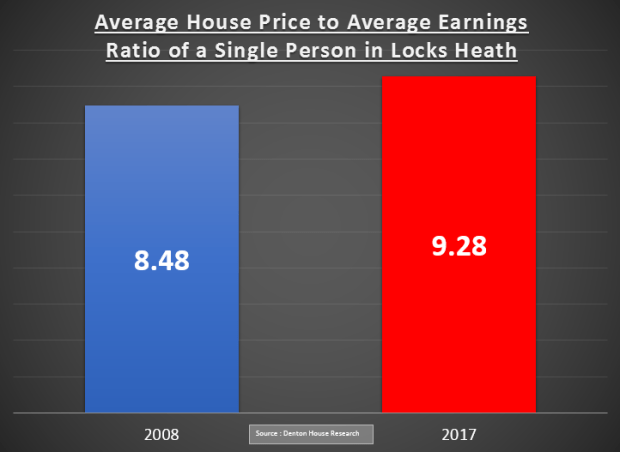

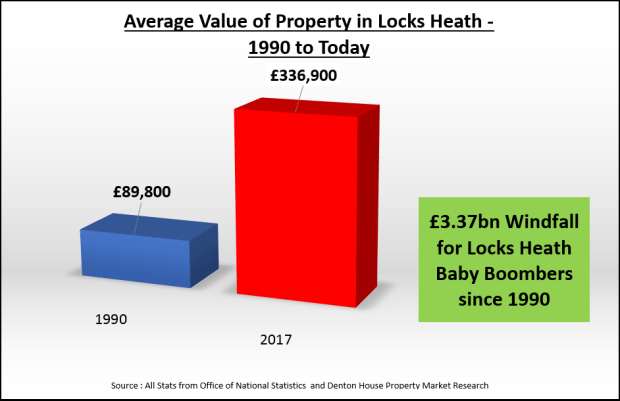

Well last week’s article “The Unfairness of the Locks Heath Baby Boomer’s £3,373,900,000 windfall?” caused a stir. In it we looked at a young family member of mine who was arguing the case that Millennials (those born after 1985) were suffering on the back of the older generation in Locks Heath. They claimed the older generation had seen the benefit of the cumulative value of Locks Heath properties significantly increasing over the last 25/30 years (which I calculated at £3.37bn since 1990). In addition many of the older generation (the baby boomers) had fantastic pensions, which meant the younger generation were priced out of the Locks Heath housing market.

Well last week’s article “The Unfairness of the Locks Heath Baby Boomer’s £3,373,900,000 windfall?” caused a stir. In it we looked at a young family member of mine who was arguing the case that Millennials (those born after 1985) were suffering on the back of the older generation in Locks Heath. They claimed the older generation had seen the benefit of the cumulative value of Locks Heath properties significantly increasing over the last 25/30 years (which I calculated at £3.37bn since 1990). In addition many of the older generation (the baby boomers) had fantastic pensions, which meant the younger generation were priced out of the Locks Heath housing market.

Recently I was having a chat with one of my older relatives at a big family get-together. We and a couple of their children got talking over a drink about the times of 15% interest rates and how the more mature members of our family had to endure the 3 day week, 20% inflation and the threat of nuclear annihilation in 4 minutes. So, foolishly, my older relative said what with all the opportunities youngsters had today, they had never had it so good!

Recently I was having a chat with one of my older relatives at a big family get-together. We and a couple of their children got talking over a drink about the times of 15% interest rates and how the more mature members of our family had to endure the 3 day week, 20% inflation and the threat of nuclear annihilation in 4 minutes. So, foolishly, my older relative said what with all the opportunities youngsters had today, they had never had it so good!

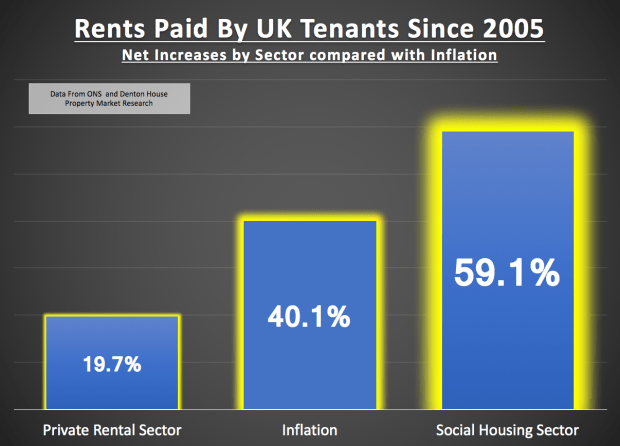

On several occasions over the last few months, in my Locks Heath Property Blog, I predicted that the rate of rental inflation (i.e. how much rents are rising by) had eased over the last year. At the same time I felt that in some parts of the UK rents had actually dropped for the first time in over eight years. Recent research backs up this prediction.

On several occasions over the last few months, in my Locks Heath Property Blog, I predicted that the rate of rental inflation (i.e. how much rents are rising by) had eased over the last year. At the same time I felt that in some parts of the UK rents had actually dropped for the first time in over eight years. Recent research backs up this prediction.

50 years ago, in 1967, the first human heart transplant was performed by Dr Christian Barnard in South Africa. In the same year Sweden switched from driving on the left-hand side to the right-hand side of the road. The average value of a Locks Heath property was £4,845, interest rates were at 5.5% and The Beatles released one of my favourite albums – their Sgt Pepper album… but what the hell has that to do with the Locks Heath property market today?? Quite a lot actually… so with my music turned up loud, let me explain my friends!

50 years ago, in 1967, the first human heart transplant was performed by Dr Christian Barnard in South Africa. In the same year Sweden switched from driving on the left-hand side to the right-hand side of the road. The average value of a Locks Heath property was £4,845, interest rates were at 5.5% and The Beatles released one of my favourite albums – their Sgt Pepper album… but what the hell has that to do with the Locks Heath property market today?? Quite a lot actually… so with my music turned up loud, let me explain my friends!

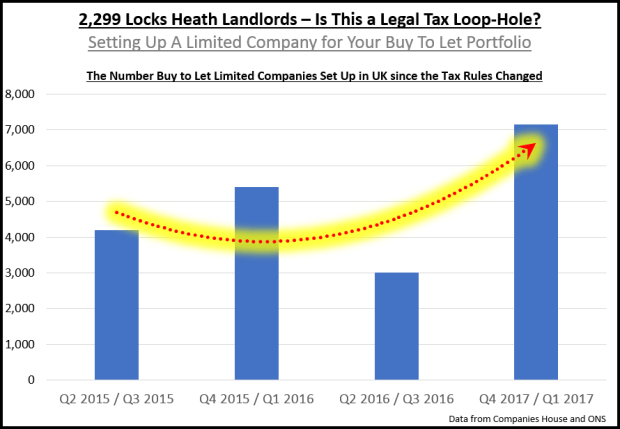

In November 2015 George Osborne disclosed plans to restrain the buy-to-let (BTL) market, implying its growing attractiveness was leaving aspiring first time buyers contesting with Landlords for the restricted number of properties on the market. One of things he brought in was that tax relief on BTL mortgages would be capped, starting in April 2017. Before April 2017, a private Landlord could claim tax relief from their interest on their BTL mortgage at the rate they paid income tax – (i.e. 20% basic /40% higher rate and 45% additional rate).

In November 2015 George Osborne disclosed plans to restrain the buy-to-let (BTL) market, implying its growing attractiveness was leaving aspiring first time buyers contesting with Landlords for the restricted number of properties on the market. One of things he brought in was that tax relief on BTL mortgages would be capped, starting in April 2017. Before April 2017, a private Landlord could claim tax relief from their interest on their BTL mortgage at the rate they paid income tax – (i.e. 20% basic /40% higher rate and 45% additional rate).

Should you buy or rent a house? Buying your own home can be expensive but could save you money over the years. Renting a property through a letting agent or private Landlord offers less autonomy to live by your own rules, with more flexibility if you need to move.

Should you buy or rent a house? Buying your own home can be expensive but could save you money over the years. Renting a property through a letting agent or private Landlord offers less autonomy to live by your own rules, with more flexibility if you need to move.