It seems that quite a few Locks Heath homeowners and Locks Heath Landlords have become acclimatised to living with the uncertainty of Brexit throughout most of 2019, as figures show many of them decided to get on with living life, started reinvesting their money into Locks Heath property and buying and selling their Locks Heath homes and BTL investments. Land Registry stats confirm that. Current data shows that…

It seems that quite a few Locks Heath homeowners and Locks Heath Landlords have become acclimatised to living with the uncertainty of Brexit throughout most of 2019, as figures show many of them decided to get on with living life, started reinvesting their money into Locks Heath property and buying and selling their Locks Heath homes and BTL investments. Land Registry stats confirm that. Current data shows that…

Locks Heath property values are 1.6% lower than 12 months ago

Whilst the newspapers were stating prime central London property values were now 17% below the levels being achieved a couple of years ago, that message seems not to have been heard by certain sectors of the Locks Heath property market!

Speaking with other property professionals in Locks Heath, many weren’t expecting the usual autumn rebound after the summer holidays. Many were anticipating a dormant Locks Heath property market on the run up to Christmas believing many Locks Heath home-movers would put off the their home moving activities until the new year. Yet in many sectors of the local property market, I have seen (and the stats back this up) that those Locks Heath property buyers who are able to hold their nerve (whereas others were hesitant) have found themselves in a better negotiating position to get a great property deal. Putting aside the fluff of newspaper headlines, the real foundations of Locks Heath housing market remain sound with record low unemployment, ultra-low interest rates and low inflation.

Interestingly, there are 17% more homes for sale in Locks Heath (SO31) compared to two years ago, meaning more choice for buyers

However, there are still parts of the Locks Heath property market that remain stagnant, with some homeowners being slightly unrealistic with their marketing pricing. To them, the property market appears to be slow, as they stare at their ‘for sale’ board for months on end, yet nothing could be further from the truth.

The key to a balanced (and healthy) property market is realistic pricing by the homeowners when they place the property on the market, mortgage affordability for buyers and buy to let Landlord activity which creates and maintains forward momentum. One measure of momentum is how long a property remains on the market, and interestingly…

The current average length of time a Locks Heath (SO31) property remains on the market is 91 days, up slightly from 80 days two years ago

Now the number of properties sold locally is slightly down year on year (even though we had a burst of property sales in the summer locally) and interestingly, Rightmove reported recently that nationally, the number of properties sold in the UK was only just over 3% less year on year, so a similar picture nationally.

So, what does all this mean for Locks Heath homeowners and Locks Heath Landlords?

We have always had issues that were game changers for the housing market; for the last few years it’s been Brexit, 10 years ago the credit crunch, 18 years ago the dot com crash, the ERM and 15% interest rates issue 27 years ago, dual MIRAS 32 years ago, hyper-inflation 40 years ago, the 3 day week 45 years ago – the list goes on. Everyone needs a home to live in, the local authority just has not got the money to build council houses, so buy to let will continue to grow for the foreseeable future which in turn creates a stable foundation for all homeowners. Maybe you should use this time, like many are in Locks Heath to take advantage of the property deals to be had in Locks Heath.

Investing in a Locks Heath buy to let property has become a very different sport over the last few years.

Investing in a Locks Heath buy to let property has become a very different sport over the last few years.

Irrespective of the shenanigans and political goings on in Westminster recently, the housing market (for the time being anyway) shows a striking resilience, fostered by the on-going wide-ranging monetary policy by the Bank of England. With interest rates and unemployment low, UKplc is heading into 2020 in reasonable condition. Additionally, despite the UK’s new homes industry improving its year on year new build figures (building 173,660 new homes this year to date – notably 8% more new homes than at the same time last year), there has been an unequal increase in demand for housing, especially in the most thriving areas of the Country.

Irrespective of the shenanigans and political goings on in Westminster recently, the housing market (for the time being anyway) shows a striking resilience, fostered by the on-going wide-ranging monetary policy by the Bank of England. With interest rates and unemployment low, UKplc is heading into 2020 in reasonable condition. Additionally, despite the UK’s new homes industry improving its year on year new build figures (building 173,660 new homes this year to date – notably 8% more new homes than at the same time last year), there has been an unequal increase in demand for housing, especially in the most thriving areas of the Country. That number surprised you didn’t it? With the General Election done, I thought it time to reflect on renting in the manifestos and party-political broadcasts and ask why?

That number surprised you didn’t it? With the General Election done, I thought it time to reflect on renting in the manifestos and party-political broadcasts and ask why? In the late spring, the Government announced that they were planning to end no-fault evictions for tenants living in private rented accommodation.

In the late spring, the Government announced that they were planning to end no-fault evictions for tenants living in private rented accommodation. Many mature readers of this Locks Heath property market blog will remember buying their first home as 20 or 30 somethings, probably in Locks Heath many years ago, yet read the newspapers now and feel it is all doom and gloom for todays’ first-time buyers.

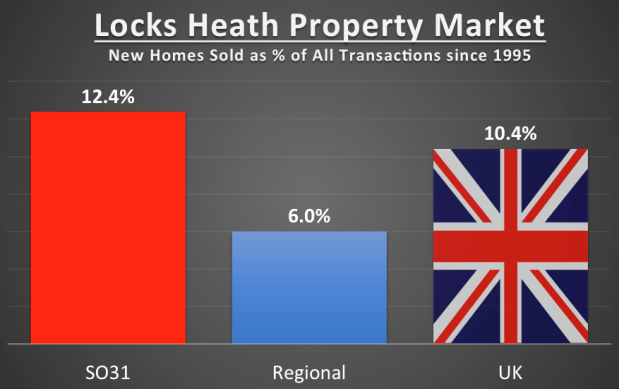

Many mature readers of this Locks Heath property market blog will remember buying their first home as 20 or 30 somethings, probably in Locks Heath many years ago, yet read the newspapers now and feel it is all doom and gloom for todays’ first-time buyers. Of the 23,500 houses and apartments sold in Locks Heath (SO31) since 1995, 2,700 of those have been new homes, representing 12.4% of property sold. So, I wondered how that compared to both the regional and the national picture… and from that, the pertinent questions are: are we building too many new homes or are we not building enough?

Of the 23,500 houses and apartments sold in Locks Heath (SO31) since 1995, 2,700 of those have been new homes, representing 12.4% of property sold. So, I wondered how that compared to both the regional and the national picture… and from that, the pertinent questions are: are we building too many new homes or are we not building enough?

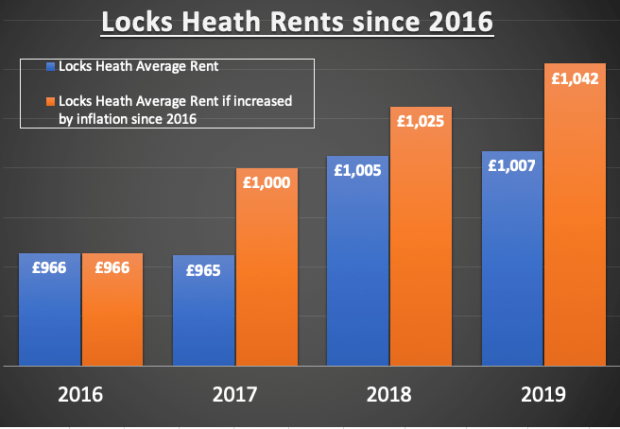

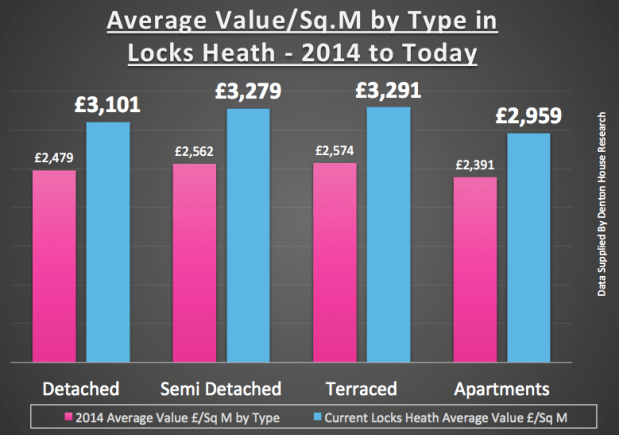

Over the last 5 years we have seen some interesting subtle changes to the Locks Heath property market as buying patterns of Landlords have changed ever so slightly.

Over the last 5 years we have seen some interesting subtle changes to the Locks Heath property market as buying patterns of Landlords have changed ever so slightly.

With the Government preparing to control Tenants’ deposits at five weeks rent, Locks Heath Landlords will soon only be protected in the event of a single month of unpaid rental-arrears, at a time when Universal Credit has seen some rent arrears quadrupling and that’s before you consider damage to the property or solicitor costs.

With the Government preparing to control Tenants’ deposits at five weeks rent, Locks Heath Landlords will soon only be protected in the event of a single month of unpaid rental-arrears, at a time when Universal Credit has seen some rent arrears quadrupling and that’s before you consider damage to the property or solicitor costs.