As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike.

As the memory of a glorious summer starts to dwindle some interesting statistics have come to light on the Locks Heath Property Market which will be thought provoking for both homeowners and buy to let Landlords alike.

Over the last 12 months 193 households have changed hands in Locks Heath, interesting when compared with the 10-year average of 199 households per year.

Yet, for the purpose of this week’s article, I want to discuss the pricing of the current crop of Locks Heath’s property sellers and the prices they are asking for their homes and the prices they are achieving (or not as at the case may be). It is so important for all property owners to know the real story, so they can judge for themselves where they stand in the current Locks Heath housing market, thus enabling them to make suitable and informed decisions… and that is why, in my blog about the Locks Heath Property Market, I pride myself in telling the people of Locks Heath the real answers, not just the ones they want to hear.

The national average of homes selling at or above the asking price currently stands at around 10%, so around 90% go below the asking price – but by how much? Well according to Rightmove, in the Locks Heath area, the average difference between the ‘FINAL asking price’ to the price agreed is 3.1%… yet note I highlighted the word FINAL in the last statement.

You see some Estate Agents will deliberately over inflate the suggested initial asking price to the house seller, because it gives them a greater chance to secure the property on that agent’s books, as opposed to a competitor. This practice is called overvaluing. Now of course, each homeowner wants to get the most for their property, it is quite often their biggest asset – yet some agents know this and prey on those house sellers. You might ask, what is the issue with that?

Well, you only get one chance of hitting the market as a new property. Everyone has access to the internet, Rightmove and Zoopla etc, and your potential buyers will know the market like the back of their hand. If you have a 3 bed semi that is on the market for a 3 bed detached house price those buyers will ignore you. Your Locks Heath property sticks on the market, potential buyers will keep seeing your Locks Heath property on Rightmove each week, then start to think there is something wrong with it, dismiss it even further, until you as the house seller have to reduce the asking price so much (to make it appear inexpensive) to get it away. According to our own research, the average house buyer only views between 4 and 5 houses before buying – so don’t assume viewers will come round to your optimistically priced (i.e. overvalued) property, thinking they will knock you down – no quite the opposite!

So how widespread is overvaluing in Locks Heath? The results might surprise you…

39.3% of properties in Locks Heath, currently on the market, have reduced their asking price by an average reduction of 5.2% (which equates to £18,700 each)

So, all I ask is this… be realistic and you will sell at a decent price to a decent buyer. First time, every time, enabling you to move on to the next chapter of your life.

I have been asked a number of times recently what a hard Brexit would mean to the Locks Heath property market. To be frank, I have been holding off giving my thoughts, as I did not want to add fuel to the stories being banded around in the national press. However, it’s obviously a topic that you as Locks Heath buy to let Landlords and Locks Heath homeowners are interested in… so I am going to try and give you what I consider a fair and unbiased piece on what would happen if a hard Brexit takes place in March 2019.

I have been asked a number of times recently what a hard Brexit would mean to the Locks Heath property market. To be frank, I have been holding off giving my thoughts, as I did not want to add fuel to the stories being banded around in the national press. However, it’s obviously a topic that you as Locks Heath buy to let Landlords and Locks Heath homeowners are interested in… so I am going to try and give you what I consider a fair and unbiased piece on what would happen if a hard Brexit takes place in March 2019.

I was recently reading a report by Rightmove that a North/South Divide has started to appear in the UK property market – so I wanted to see if Locks Heath was falling in line with those thoughts. In the North, there are 7.12% less properties on the market than 12 months ago, whilst in contrast, in the South, there are 14.7% more properties on the market than 12 months ago.

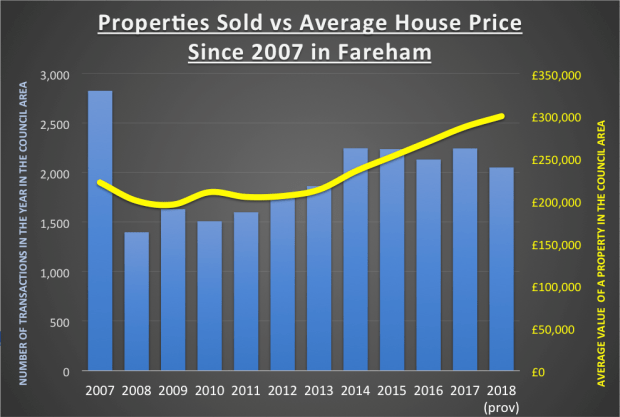

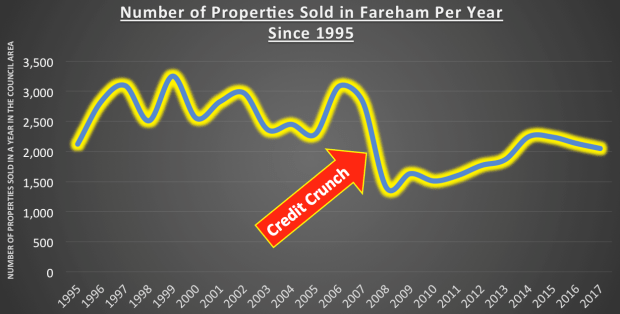

I was recently reading a report by Rightmove that a North/South Divide has started to appear in the UK property market – so I wanted to see if Locks Heath was falling in line with those thoughts. In the North, there are 7.12% less properties on the market than 12 months ago, whilst in contrast, in the South, there are 14.7% more properties on the market than 12 months ago. The number of residential property transactions in Fareham will be 1.7 per cent lower in 2018, compared to 2017.

The number of residential property transactions in Fareham will be 1.7 per cent lower in 2018, compared to 2017.

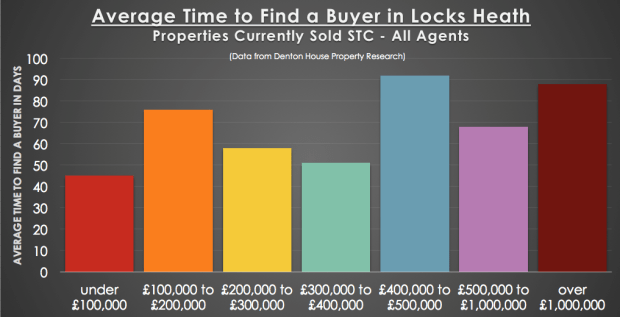

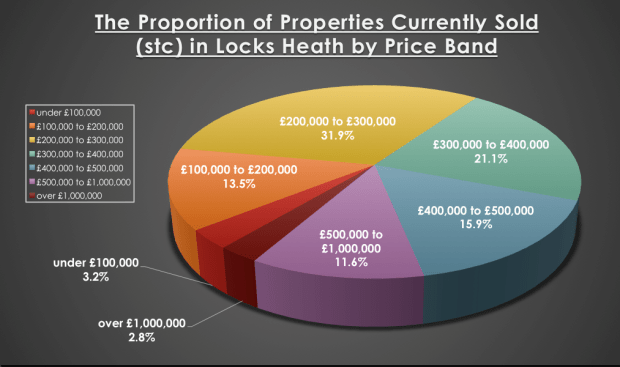

Whether you are a Locks Heath Landlord looking to liquidate your buy to let investment or a homeowner looking to sell your home, finding a buyer and selling your property can take an annoyingly long time. It is a step-by-step process that can take months and months. In fact, one of the worst parts of the house selling process is the not knowing how long you might be stuck at each step. At the moment, looking at every estate agent in Locks Heath, independent research shows it is taking on average 62 days from the property coming on the market for it to be sold subject to contract.

Whether you are a Locks Heath Landlord looking to liquidate your buy to let investment or a homeowner looking to sell your home, finding a buyer and selling your property can take an annoyingly long time. It is a step-by-step process that can take months and months. In fact, one of the worst parts of the house selling process is the not knowing how long you might be stuck at each step. At the moment, looking at every estate agent in Locks Heath, independent research shows it is taking on average 62 days from the property coming on the market for it to be sold subject to contract.

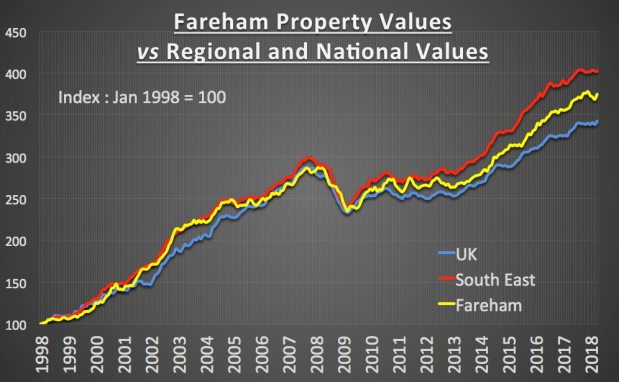

Living in our own homes or owning buy to let property in Locks Heath and the surrounding areas, it’s often easy to ignore the regional and national picture when it comes to property. As a homeowner or landlord in Locks Heath consideration must be given to these markets, as directly and indirectly, they do have a bearing on us in Locks Heath.

Living in our own homes or owning buy to let property in Locks Heath and the surrounding areas, it’s often easy to ignore the regional and national picture when it comes to property. As a homeowner or landlord in Locks Heath consideration must be given to these markets, as directly and indirectly, they do have a bearing on us in Locks Heath.

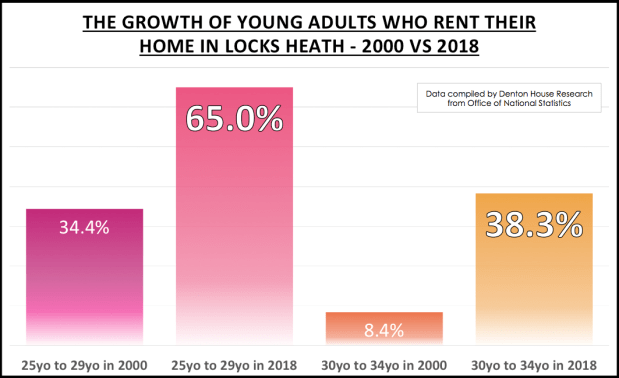

My analysis has shown that up to the end of the last quarter, Locks Heath first time buyers purchased 58 Locks Heath properties. With wages rising at 2.8%, unemployment at a low rate of 4.2% (down from 4.6% from a year earlier and the joint lowest since 1975), national GDP rising at 1.87% and inflation at 2.3%, tied in with indifferent house price growth (compared to a few years ago), this has given first time buyers a chance to get a foot hold on the Locks Heath property market.

My analysis has shown that up to the end of the last quarter, Locks Heath first time buyers purchased 58 Locks Heath properties. With wages rising at 2.8%, unemployment at a low rate of 4.2% (down from 4.6% from a year earlier and the joint lowest since 1975), national GDP rising at 1.87% and inflation at 2.3%, tied in with indifferent house price growth (compared to a few years ago), this has given first time buyers a chance to get a foot hold on the Locks Heath property market.